- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

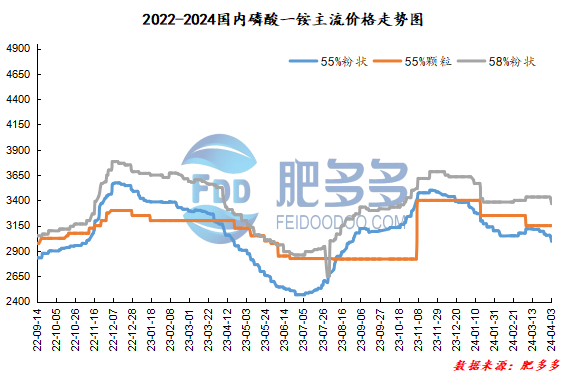

Monoammonium phosphate price index:

According to Feiduo data, on April 3, the 55% powder index of China's monoammonium phosphate was 2,995.00, down; the 55% particle index was 3,150.00, stable; and the 58% powder index was 3,366.67, down.

Monoammonium phosphate market analysis and forecast:

Today, the market price of monoammonium phosphate in China continues to be weak and lowered. In terms of enterprises, business owners have implemented pre-received orders, but there is insufficient follow-up on new orders, sales are under pressure, corporate inventories are gradually increasing, some prices are reduced to receive orders, low market prices continue to emerge, corporate maintenance plans have increased, and industry capacity utilization has declined. In terms of the market, the market remained weak, demand was sluggish, new orders were weak, and the focus of transactions continued to fall. On the demand side, agricultural demand is temporarily short and the goods are generally received; downstream industrial factories are less enthusiastic about purchasing raw materials, and they use them at will, and the demand side continues to be weak. In terms of raw materials, the prices of raw materials sulfur and phosphate rock remained generally stable, the price of synthetic ammonia continued to decline, and raw materials supported weak operations. On the whole, the current market demand for monoammonium is weak, and there is no good support. It is expected that the market price of monoammonium phosphate will continue to consolidate downward in the short term.

Specific market prices in each region are as follows:

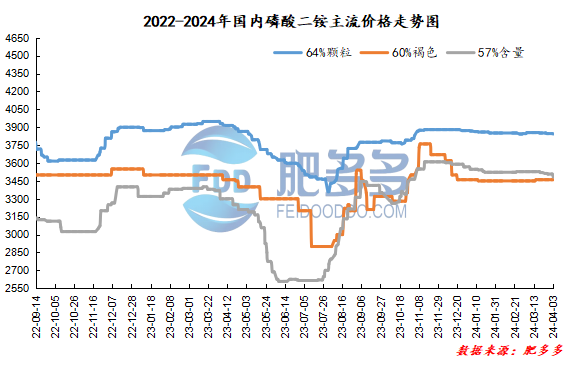

Diammonium phosphate price index:

According to Feiduo data, on April 3, the 64% particle index of China's mainstream diammonium phosphate was 3,843.33, down; the 60% brown index was 3,460.00, stable; and the 57% content index was 3,482.50, down.

Diammonium phosphate market analysis and forecast:

The market price of diammonium phosphate in China continues to decline today. In terms of enterprises, enterprises continue to implement advance receipts and export orders from China. Currently, they are mainly actively shipping goods. Some enterprises export goods in ports. The supply of 64% of the pellet supply is tight, and the price decline is limited. In terms of the market, market operations continue to be weak, the space for transaction negotiations expands, and actual transactions continue to be dominated by negotiations. On the demand side, downstream demand has not followed up sufficiently, and the mentality has become more and more wait-and-see, and the market continues to be tired. In terms of raw materials, the prices of raw materials sulfur and phosphate rock have remained stable, the prices of synthetic ammonia have continued to weaken downward, and the prices of raw materials have weakened downward. On the whole, currently, diammonium companies mainly issue advance orders from China, with strong quotations, insufficient follow-up from downstream demand, and a wait-and-see attitude. It is expected that the market price of diammonium phosphate will continue to be weakened and consolidated in the short term.

Specific market prices in each region are as follows: