- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

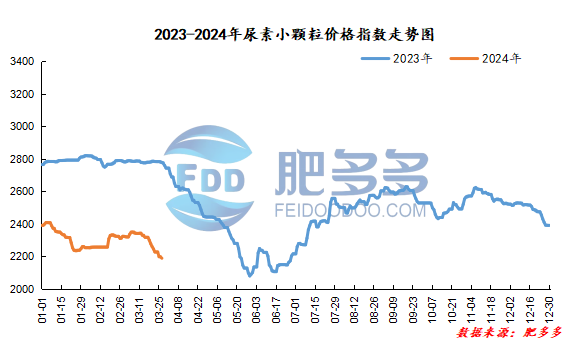

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on March 27 was 2,188.64, a decrease of 8.32 from yesterday, a month-on-month decrease of 0.38% and a year-on-year decrease of 21.18%.

Urea futures market:

Today, the opening price of urea UR405 contract is 2020, the highest price is 2026, the lowest price is 1964, the settlement price is 1992, and the closing price is 1966. The closing price is 56 lower than the settlement price of the previous trading day, down 2.77% month-on-month. The fluctuation range of the whole day is 1964-2026; the basis of the 05 contract in Shandong is 174; the 05 contract has reduced its position by 8721 lots today, and so far, it has held 157901 lots.

Spot market analysis:

Today, China's urea market prices continued to decline, and corporate price adjustments were mixed. Some companies with sufficient acquisitions increased their quotations to a small extent; companies with insufficient acquisitions continued to reduce their acquisitions.

Specifically, prices in Northeast China fell to 2,150 - 2,210 yuan/ton. Prices in North China rose to 2,000 - 2,180 yuan/ton. Prices in East China rose to 2,130 - 2,180 yuan/ton. Prices in South China rose to 2,240 - 2,340 yuan/ton. The price of small and medium-sized particles in Central China rose to 2,130 - 2,320 yuan/ton, and the price of large particles rose to 2,190 - 2,250 yuan/ton. Prices in the northwest region are stable at 2,140 - 2,150 yuan/ton. Prices in Southwest China are stable at 2,100 - 2,450 yuan/ton.

Market outlook forecast:

In terms of factories, the number of new orders received has improved after manufacturers cut prices recently, and they have increased the control of orders received. Some manufacturers with sufficient advance receipts still have room for upward adjustment. In the short term, shipping pressure has dropped and their mentality has improved. In terms of the market, transactions at the low-end market have increased recently, and transactions of new orders by mainstream regional companies have increased significantly. The trading atmosphere on the floor has warmed up, boosting the confidence of operators in trading. The sentiment has improved compared with the previous period, and the focus of market negotiations has begun to move upwards slightly. In terms of supply, the industry's capacity utilization rate continues to remain at a high level of more than 80%. There has been no change in the short period of construction, and the market supply is abundant. On the demand side, demand is followed up in stages, downstream purchases are replenished on dips, and the overall sentiment continues to wait and see. On the export side, today's bidding opening has affected the market trading atmosphere. The mood of operators has been disturbed by export news, and the market has fluctuated and changed.

On the whole, the current low-price transactions in the urea market are improving, and the increase in manufacturers 'orders has simultaneously driven the market trading atmosphere. It is expected that the urea market price will be stable and adjusted in a short period of time.