- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

Sinopec inventory: two-oil polyolefin inventory of 835000 tons, down 25000 tons from yesterday.

PP futures analysis: March 20 PP2405 opening price: 7618, the highest price: 7649, the lowest price: 7601, position: 450110 hands, settlement price: 7626, yesterday settlement: 7616, up: 10, daily trading volume: 272564 lots.

Mainstream quotation for wire drawing in PP market: yuan / ton

|

Region |

March nineteenth |

March 20th |

Rise and fall |

|

North China |

7400-7550 |

7400-7550 |

0/0 |

|

East China |

7480-7600 |

7500-7650 |

20/50 |

|

South China |

7550-7650 |

7550-7650 |

0/0 |

PP China spot market analysis: today, China's PP market still maintains a regional make-up trend, the mainstream prices of wire drawing in China range from 7400 to 7650 yuan / ton, only up 20 to 50 yuan / ton in East China, and prices in North and South China are stable. In terms of petrochemical industry, the two oil depots were 835000 tons early this morning, and the speed of removing them upstream was accelerated. In terms of ex-factory prices, CNPC Northeast, Sinopec North China, Sinopec East China and so on have raised factory prices ranging from 50 to 100 yuan / ton. Coal enterprises only extended the refinery to increase 50 yuan / ton, other factory temporarily stable, on-site supply costs moved up. PP futures high shock rose, traders wait-and-see shipments, downstream rigid demand to enter the market, slightly lower prices are OK, high prices are more difficult to close.

PP spot trend forecast: for the future market, we still need to pay attention to the game from the cost side and the supply side, as well as the sentiment of capital on the disk. From the raw material side, geographically, the situation in the Middle East is still unstable, and the situation in Russia and Ukraine is also worthy of attention; fundamentals have positive expectations on both sides of supply and demand, supply-side OPEC+ will continue to control output, and demand-side gasoline demand will pick up seasonally; at the macro level, the risk appetite of financial markets is generally strong. International oil prices remain in a state that is easy to rise and difficult to fall. From the supply side, according to the current petrochemical maintenance plan, the overall supply contraction is expected to remain unchanged, so the positive effect on the market really exists. But at the same time, the new capacity expansion has gradually become a heavy pressure: on March 7th, the polypropylene plant of Huizhou Lituo New Materials Co., Ltd. (150000 tons / year) has produced qualified products and is currently producing wire drawing. Anhui Tianda PP plant (150000 tons / year PP powder, 150000 tons / year PP granule) has trial produced PP material qualified products, and plans to start up in March. Jinneng Science and Technology Phase II 450000 t / a polypropylene plant is scheduled to be put into trial operation in April. At the futures level, the current intention to push up funds is obvious, and there is still room for upward growth under the support of fundamentals. However, under the condition that many advantages are fully traded or even there may be over-trading in the future, there is still heavy pressure on capacity expansion and weak rigid demand, so the wave market can be more defined as a rebound than a reversal.

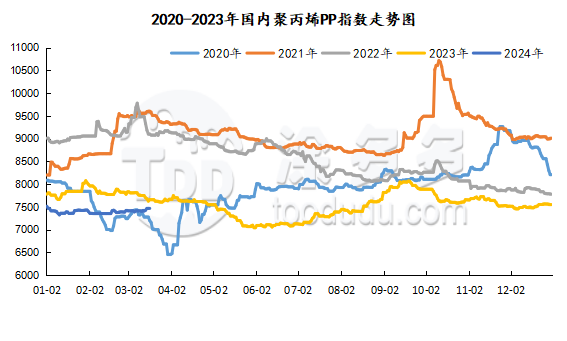

China's PP index: according to Tudor data, China's PP spot index rose 12, or 0.16%, to 7550 on March 20.

China installation parking Summary:

|

Enterprise name |

product line |

Production capacity |

Parking Duration |

departure time |

|

Dalian Petrochemical Corporation |

Third line |

5 |

August 2, 2006 |

To be determined |

|

Wuhan Petrochemical Corporation |

Old equipment |

12 |

November 12, 2021 |

To be determined |

|

Haiguolong oil |

First line |

20 |

February 8, 2022 |

To be determined |

|

Haiguolong oil |

Second line |

35 |

April 3, 2022 |

To be determined |

|

Tianjin Petrochemical Company |

First line |

6 |

August 1, 2022 |

To be determined |

|

Jinxi Petrochemical |

Single line |

15 |

February 16, 2023 |

To be determined |

|

Yanshan Petrochemical |

Second line |

7 |

September 18, 2023 |

To be determined |

|

Shaoxing Sanyuan |

New line |

30 |

September 20, 2023 |

To be determined |

|

Qinghai Salt Lake |

Single line |

16 |

October 27, 2023 |

To be determined |

|

Changzhou Fude |

Single line |

30 |

November 1, 2023 |

To be determined |

|

Jingbo polyolefin |

First line |

20 |

November 1, 2023 |

To be determined |

|

Luoyang Petrochemical |

First line |

8 |

November 3, 2023 |

To be determined |

|

Zhongjing Petrochemical |

The first phase and the first line |

50 |

December 5, 2023 |

To be determined |

|

Hongrun Petrochemical |

Single line |

45 |

December 6, 2023 |

To be determined |

|

Qilu Petrochemical |

Single line |

7 |

December 23, 2023 |

To be determined |

|

Lianhong Xinke |

Second line |

8 |

December 30, 2023 |

To be determined |

|

Fujian Union |

Old line |

12 |

January 3, 2024 |

To be determined |

|

Maoming Petrochemical |

First line |

17 |

February 24, 2024 |

March 19, 2024 |

|

Gold energy chemistry |

First line |

45 |

March 8, 2024 |

To be determined |

|

North China brocade |

Old line |

6 |

March 8, 2024 |

To be determined |

|

Hongji Petrochemical |

Single line |

20 |

March 13, 2024 |

March 19, 2024 |

|

China-Angola alliance |

Single line |

35 |

March 14, 2024 |

March 21, 2024 |

|

Haitian petrochemical |

Single line |

20 |

March 15, 2024 |

To be determined |

|

Jiutai Group |

Single line |

32 |

March 15, 2024 |

April 15, 2024 |

|

Donghua Energy (Ningbo) |

The first line of Phase II |

40 |

March 18, 2024 |

To be determined |

Shenhua auction turnover: Shenhua Coal Chemical's auction volume today was 2801 tons, down 17.33% from yesterday; the turnover was 2765 tons, down 4.19% from yesterday, and the turnover rate was 98.71%, up 13.53% from yesterday.