- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

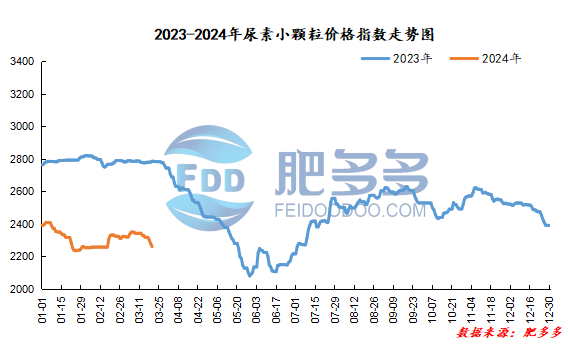

China Urea Price Index:

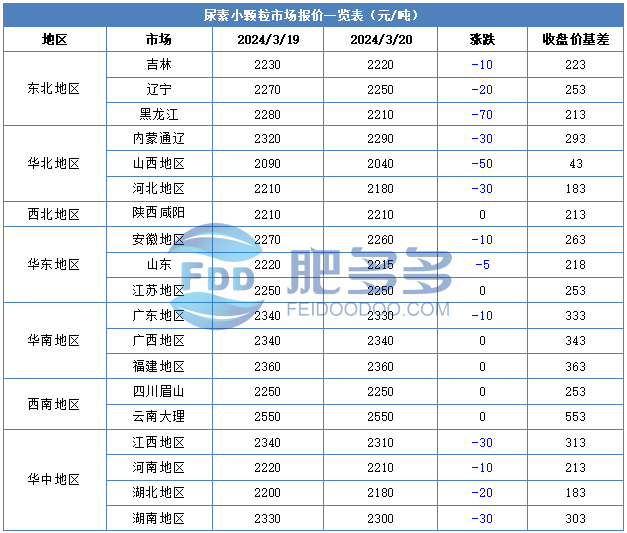

According to Feiduo data, the urea small pellet price index on March 20 was 2,260.36, a decrease of 17.82 from yesterday, a month-on-month decrease of 0.78% and a year-on-year decrease of 18.88%.

Urea futures market:

Today, the opening price of the Urea UR405 contract is 1991, the highest price is 2027, the lowest price is 1984, the settlement price is 2003, and the closing price is 1997. The closing price is 38 lower than the settlement price of the previous trading day, down 1.87% month-on-month. The fluctuation range of the whole day is 1984-2027; the basis of the 05 contract in Shandong is 218; the 05 contract has increased its position by 6654 lots today, and so far, the position is 194155 lots.

Spot market analysis:

Today, China's urea market prices continued to decline. After the factory quotation was lowered, transactions at the low-end market increased, but the overall market continued to be weak.

Specifically, prices in Northeast China fell to 2,210 - 2,260 yuan/ton. Prices in North China fell to 2,040 - 2,290 yuan/ton. Prices in East China fell to 2,200 - 2,280 yuan/ton. Prices in South China fell to 2,320 - 2,370 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,170 - 2,360 yuan/ton, and the price of large particles fell to 2,260 - 2,300 yuan/ton. Prices in the northwest region are stable at 2,210 - 2,220 yuan/ton. Prices in Southwest China are stable at 2,230 - 2,600 yuan/ton.

Market outlook forecast:

In terms of factories, manufacturers have gradually reduced their orders, while a small number of new orders have been followed up. Currently, shipments are blocked and inventories are under pressure. In order to receive new orders, quotations continue to fall. On the market side, low-price transactions increased, but the overall trading atmosphere remained deadlocked and light, and the mood continued to be weak and volatile. On the supply side, the industry's capacity utilization rate continues to remain at around 80%, and supply continues to be high. On the demand side, the overall demand side is generally followed up, procurement is relatively cautious, agricultural demand is in a gap period, and labor needs maintain replenishment on demand and purchase on demand, which provides weak price support.

On the whole, although transactions at the low-end of the urea market have increased, purchasing demand is more wait-and-see, which is difficult to support price increases. Therefore, it is expected that the urea market price will continue to have difficulty rising in the short term, and it will be weak and downward.