- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

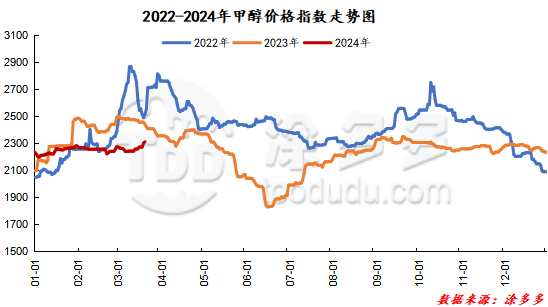

On March 19, the methanol market price index was 2310.69, up 9.61 from yesterday and 0.42 per cent higher than yesterday.

Outer disk dynamics:

Methanol closed on March 18:

China CFR 312-316USD / t, Ping

Us FOB 104-105 cents per gallon, flat

Southeast Asia CFR US $344-345 per ton, Ping

European FOB 302.5-303.5 euros / ton, up 2.75 euros / ton.

Summary of today's prices:

Guanzhong: 2200-2280 (0), North Route: 2040-2080 (20), Lunan: 2430 (10), Henan: 2350-2385 (0), Shanxi: 2200-2300 (0), Port: 2695-2715 (- 5)

Freight:

North Route-North Shandong 270-330 (10Universe Mur30), Northern Route-Southern Shandong 370-400 (- 10Maple 10), Southern Route-Northern Shandong 270-310 (10max 0), Guanzhong-Southwest Shandong 230-260 (0max 0)

Spot market: today, methanol market prices rose in a narrow range, futures continued to rise, the mentality of operators in the market was supported, coupled with the gradual encashment of spring inspection in the Chinese market, the supply in the region was reduced, and the mentality of methanol manufacturers was gradually rising under the good support of the supply side. Under the mentality of buying and rising, some operators were in a good mood to enter the market. Today, some methanol enterprises are bidding well, and more premiums are traded. Specifically, the market price in the main producing areas has been raised narrowly, with the quotation on the southern route around 2100 yuan / ton, the price on the northern line around 2040-2080 yuan / ton, the low end up by 20 yuan / ton, and the temporary parking of the 1 million-ton plant in Jiutai, which has significantly reduced the supply side and boosted the market atmosphere. coupled with the recent strong futures market trend, the trading center of support for China's methanol market has been raised. Market prices in Shandong, the main consumer area, rose narrowly, with 2430 yuan / ton in southern Shandong, 10 yuan / ton in the low end and 2370-2380 yuan / ton in northern Shandong. The futures market rose sharply, giving a certain boost to the market mentality. The market quotation in North China is adjusted in a narrow range. Hebei quotation is 2300-2330 yuan / ton today. Methanol enterprises currently have no inventory pressure, the mentality of manufacturers is relatively strong, and the downstream replenishment enthusiasm is OK. Shanxi quotes 2200-2300 yuan / ton today, and the overall trading atmosphere in the market is OK.

Port market: methanol futures fell after rising today. Most paper goods are quoted at high prices in the morning, with rigid demand within a month, and long-term arbitrage is dominant, with a slightly weaker basis; afternoon negotiations are reduced and the basis is stable. The overall transaction throughout the day is mediocre. Taicang main port transaction price: 3, transaction price: 2750-2760, base difference 05: 145cm, basis difference: 05x150, basis difference: 2715-2745, basis difference: 05x130, market price: 2690, basis difference: 05x100, transaction price: 2635-2665, basis difference: 05x48amp, 55tranc5, transaction: 2615-2640, basis difference: 05x20. 25.

|

Area |

2024/3/19 |

2024/3/18 |

Rise and fall |

|

The whole country |

2310.69 |

2301.08 |

9.61 |

|

Northwest |

2040-2280 |

2020-2280 |

20/0 |

|

North China |

2200-2330 |

2200-2330 |

0/0 |

|

East China |

2695-2780 |

2700-2790 |

-5/-10 |

|

South China |

2685-2810 |

2645-2770 |

40/40 |

|

Southwest |

2350-2650 |

2290-2650 |

60/0 |

|

Northeast China |

2350-2450 |

2350-2450 |

0/0 |

|

Shandong |

2370-2430 |

2340-2430 |

30/0 |

|

Central China |

2350-2600 |

2350-2600 |

0/0 |

The future forecast: recently, some devices in the Chinese market have entered the state of spring inspection, coupled with the short stop of Jiutai 1 million-ton methanol plant, the local market supply has been reduced, the new prices of manufacturers in the supporting region have been raised, and the futures market has fluctuated upwards. the mentality of the operators in the market is supported, the overall trading atmosphere of the market is OK, and the quotations of manufacturers have been raised. The short-term supply pressure in the port market is still small, and the arrival of foreign ships is still at a low level, but in the later stage, the olefin plant in the region is expected to be stored and overhauled, and the market demand may be weakened, and the traditional downstream demand continues the rigid demand for spot Buy more. Support for the methanol market is limited. At present, it is expected that the short-term Chinese market price is high, and the port spot quotation is high, but in the later stage, we should pay attention to the coal price, the release of spring inspection by various manufacturers and the follow-up of downstream demand.