- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

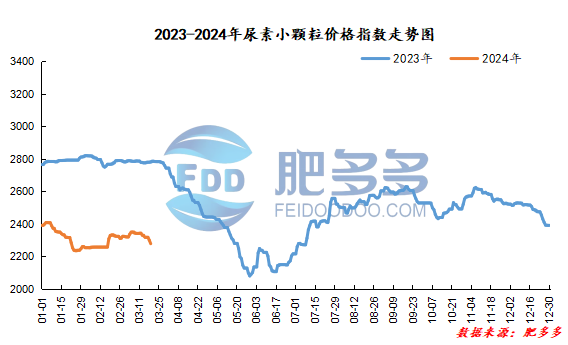

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on March 19 was 2,278.18, a decrease of 21.50 from yesterday, a month-on-month decrease of 0.93% and a year-on-year decrease of 18.14%.

Urea futures market:

Today, the opening price of the urea UR405 contract is 2043, the highest price is 2055, the lowest price is 2002, the settlement price is 2035, and the closing price is 2004. The closing price is 45 lower than the settlement price of the previous trading day, down 2.20% month-on-month. The fluctuation range of the whole day is 2002-2055; the basis of the 05 contract in Shandong is 216; the 05 contract has increased its position by 3005 lots today, and the position is 187501 lots so far.

Spot market analysis:

Today, China's urea market prices continue to decline, the market supply and demand relationship is weak, and company quotations are mostly sorted downward.

Specifically, prices in Northeast China fell to 2,220 - 2,280 yuan/ton. Prices in North China fell to 2,090 - 2,330 yuan/ton. Prices in East China fell to 2,210 - 2,280 yuan/ton. Prices in South China fell to 2,330 - 2,370 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,190 - 2,380 yuan/ton, and the price of large particles fell to 2,260 - 2,350 yuan/ton. Prices in Northwest China fell to 2,210 - 2,220 yuan/ton. Prices in Southwest China fell to 2,230 - 2,600 yuan/ton.

Market outlook forecast:

In terms of factories, factories have implemented more and more orders, followed up a small number of new orders, and the transaction is poor. The current factory quotation continues to decline and adjust. In terms of the market, the market is stable and weak, and prices continue to fall. In the later period, with the emergence of low-end prices in the market, low-price transactions may increase, and the current market price is weak and downward. On the supply side, individual companies have repaired equipment, and the industry's daily output has dropped, but the overall supply is still at a high level during the same period, and supply pressure will still exist for a short period of time. On the demand side, agricultural demand is advancing slowly, and green fertilizers are entering the final stage; most downstream factories just need to follow up, have a cautious purchasing mentality, and demand-side support is relatively weak.

On the whole, the current urea factory quotation continues to be consolidated downward, the market trading atmosphere is flat, and the demand side is difficult to support. It is expected that the urea market price will continue to fall in the short term.