- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

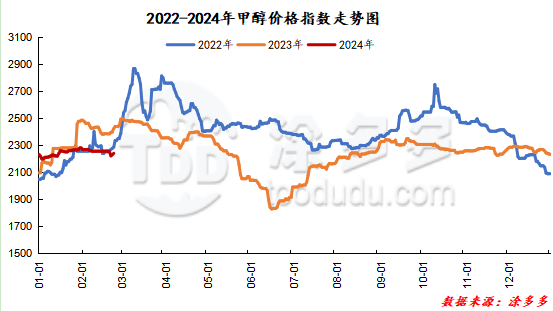

On March 18, the methanol market price index was 2301.08, up 29.67% from the previous working day and 1.31% higher than the previous working day.

Outer disk dynamics:

Methanol closed on March 15:

China CFR 312-316 USD / ton, up US $2 / tonne

Us FOB 104-105 cents per gallon, flat

Southeast Asia CFR US $344-345 per ton, Ping

European FOB 299.75-300.75 euros / ton, down 4.50 euros / ton.

Summary of today's prices:

Guanzhong: 2200-2280 (60), North Route: 2020-2050 (30), Lunan: 2020 (0), Henan: 2350-2385 (10), Shanxi: 2200-2300 (0), Port: 2700-2715 (0)

Freight:

North Route-Northern Shandong 260-360 (- 30 Universe Mueller 10), Northern Route-Southern Shandong 380-420 (- 20 Uniqure 30), Southern Route-Northern Shandong 260-310 (0amp 10), Guanzhong-Southwest Shandong 230-280 (0max 0)

Spot market: today, the price of methanol market fluctuates upward, the spring inspection of the Chinese market is gradually cashed, the supply in some areas has been reduced, the market quotation in the supporting region has been raised, and the recent futures market is strong and volatile, the mentality of operators is propped up, in addition, at present, the supply of spot negotiable goods in the port area is still tight, and spot prices still maintain a high operating state. Specifically, market prices in the main producing areas have been raised narrowly, with prices on the southern line around 2050 yuan / ton, and those on the northern line around 2020-2050 yuan / ton, with a low-end increase of 30 yuan / ton. Recently, some methanol plants have been overhauled and negative operations have been reduced, and local supply has been reduced. Today, the new prices of some manufacturers in the region continue to rise, and the overall trading atmosphere is general. Market prices in Shandong, the main consumer area, moved steadily, with 2420 yuan / ton in southern Shandong and 2340-2360 yuan / ton in northern Shandong yesterday. The main futures market trend was firm and upward, leading to a warming of trading sentiment in the market. The market quotation in North China is adjusted in a narrow range. Hebei quotation is 2300-2330 yuan / ton today. Methanol enterprises currently have no inventory pressure, and the mentality of manufacturers is relatively strong, but the performance of traditional downstream demand is general, and the favorable support for the market is limited. Shanxi quoted 2200-2300 yuan / ton today, the market wait-and-see mood at the beginning of the week is still strong, pay attention to tomorrow's market auction.

Port market: methanol futures fluctuated upwards today. In recent months, rigid demand trading, choose the opportunity to close the transaction; long-term unilateral high sell low suction, the current basis stabilized. The overall transaction throughout the day is not bad. Taicang main port transaction price: 3, transaction price: 2695-2715, basis difference 05: 150, transaction 3: 2680-2710, base difference 05: 135, transaction price: 2650-2675, basis difference 05: 100 shock, price: 2605-2630, basis difference: 05, 55: 55, 65: 5, transaction: 2570-2600, basis difference: 05: 25: 30.

|

Area |

2024/3/18 |

2024/3/15 |

Rise and fall |

|

The whole country |

2301.08 |

2271.42 |

29.66 |

|

Northwest |

2020-2280 |

1990-2200 |

30/80 |

|

North China |

2200-2330 |

2200-2330 |

0/0 |

|

East China |

2700-2790 |

2695-2790 |

5/0 |

|

South China |

2645-2770 |

2630-2790 |

15/-20 |

|

Southwest |

2290-2650 |

2290-2650 |

0/0 |

|

Northeast China |

2350-2450 |

2350-2450 |

0/0 |

|

Shandong |

2340-2430 |

2340-2430 |

0/0 |

|

Central China |

2350-2600 |

2340-2600 |

10/0 |

Future forecast: recently, some devices in the Chinese market have entered the state of spring inspection, the market supply in some areas has been reduced, the new prices of manufacturers in the supporting region have been raised, and the futures market has fluctuated upwards, and the mentality of the operators in the market has been support. however, at present, the performance of the downstream market is general, some operators hold a certain wait-and-see mood towards high prices, the enthusiasm to enter the market and replenish stock is limited, and the short-term supply pressure in the port market is still not great. Foreign ship arrival in Hong Kong is still low, short-term port spot quotation is still high. At present, the short-term market is still good and bad, and it is expected that the short-term Chinese market will fluctuate mainly under the influence of the game between supply and demand, and the port spot quotation will run at a high level, but in the later stage, we should pay attention to the coal price, the release of the spring inspection of various manufacturers and the follow-up of downstream demand.