- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

March 15 Gasoline Market Analysis

International crude oil closes

|

date |

market |

specifications |

Closing (USD/barrel) |

rise and fall |

|

20240314 |

US |

WTI |

81.26 |

1.54 |

|

20240314 |

British |

Brent |

85.42 |

1.39 |

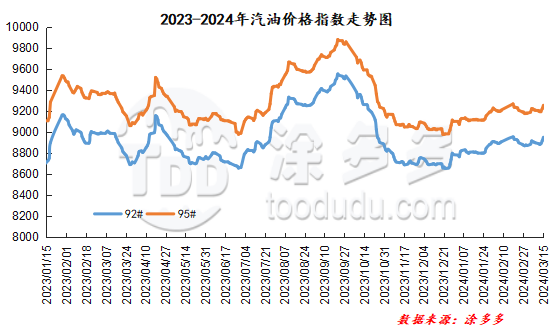

Gasoline price index

On March 15, China's 92 #gasoline price index was 8951.07, up 33.45, or 0.38%; China's 95 #gasoline price index was 9255.88, up 33.53, or 0.36%. Both the 92 #gasoline index and the 95 #gasoline index were raised, and the price difference between the 92 #gasoline index and the 95 #gasoline index was 304.81.

Gasoline Market Analysis:

Today, the main wholesale prices of gasoline in China have increased mainly, and most of them are concentrated at high-end prices, with the overall increase of 100-200 yuan/ton; the ex-factory price of local refineries has increased by 30-50 yuan/ton. Currently, transactions in China's gasoline market are active, and crude oil has closed overnight. Continue to rise, procurement operations in the middle and lower reaches have increased, refinery shipments are relatively smooth, and most of them have a high price mentality.

|

Main wholesale price of gasoline on March 15 (yuan/ton) |

||||

|

areas |

Gasoline model |

Price 3.14 |

Price 3.15 |

rise and fall |

|

in North China |

92# |

8650-9500 |

8580-9708 |

0/200 |

|

95# |

8850-10074 |

8780-10074 |

0/200 |

|

|

South China |

92# |

8850-9660 |

8850-9660 |

0/50 |

|

95# |

9150-9960 |

9150-9960 |

0/30 |

|

|

central China |

92# |

8950-9400 |

9150-10130 |

0/170 |

|

95# |

8950-9700 |

8980-9750 |

0/50 |

|

|

East China |

92# |

8750-9100 |

8790-9150 |

0/100 |

|

95# |

8860-9500 |

8890-9500 |

0/100 |

|

|

northwestern region |

92# |

8600-10109 |

8600-10109 |

-130/30 |

|

95# |

8800-10878 |

8830-10698 |

-130/0 |

|

|

southwestern region |

92# |

8950-10279 |

8920-10279 |

0/150 |

|

95# |

9100-10878 |

9250-10878 |

0/100 |

|

|

Northeast China |

92# |

8480-8750 |

8610-8900 |

-55/100 |

|

95# |

8650-9600 |

8950-9600 |

-5/0 |

|

|

Ex-factory price of local gasoline refining on March 15 (yuan/ton) |

||||

|

areas |

Gasoline model |

Price 3.14 |

Price 3.15 |

rise and fall |

|

Shandong area |

92# |

8370-8720 |

8430-8800 |

10/100 |

|

95# |

8530-8880 |

8580-8900 |

10/50 |

|

|

in North China |

92# |

8530-8540 |

8550-8590 |

20/50 |

|

95# |

8580-8610 |

8600-8660 |

20/50 |

|

|

central China |

92# |

8780-8780 |

8830-8830 |

50/50 |

|

95# |

8930-8930 |

9030-9030 |

50/50 |

|

|

East China |

92# |

8460-8630 |

8500-8650 |

20/40 |

|

95# |

8580-8740 |

876-8760 |

20/20 |

|

|

northwestern region |

92# |

8550-8600 |

8450-8650 |

0/50 |

|

95# |

8650-8800 |

8700-8800 |

0/50 |

|

|

Northeast China |

92# |

8400-8550 |

8450-8550 |

0/50 |

|

95# |

8750-8750 |

8750-8750 |

0/0 |

|

|

southwestern region |

92# |

8900-8900 |

8950-8950 |

50/50 |

|

95# |

9050-9050 |

9100-9100 |

50/50 |

|

market outlook

The continuous geopolitical events in international crude oil, coupled with a slight increase in demand for crude oil, may lead to a rise in international crude oil reserves. Affected by changes in international crude oil prices, the market situation in China's gasoline market continues to warm up. However, the phased replenishment of traders in some regions is coming to an end, and the pressure on main performance tasks may increase in the middle and late stages. Overall, China's gasoline market is expected to rise slightly in the short term.