- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

March 13 Gasoline Market Analysis

International crude oil closes

|

date |

market |

specifications |

Closing (USD/barrel) |

rise and fall |

|

20240312 |

US |

WTI |

77.56 |

-0.37 |

|

20240312 |

British |

Brent |

81.92 |

-0.29 |

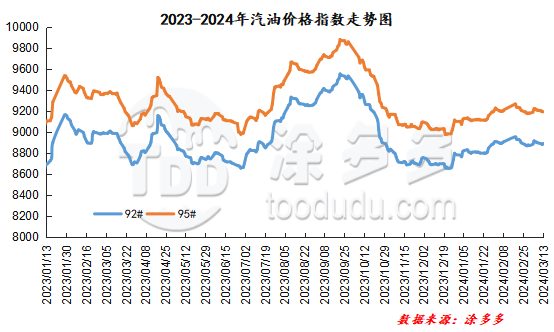

Gasoline price index

On March 13, China's 92 #gasoline price index was 8891.73, up 8.61, or 0.10%; China's 95 #gasoline price index was 9201.59, up 7.46, or 0.08%. Both the 92 #gasoline index and the 95 #gasoline index were raised, and the price difference between the 92 #gasoline index and the 95 #gasoline index was 309.86.

Gasoline Market Analysis:

Today, the main wholesale price of gasoline in China remained stable, and gasoline prices in some regions increased slightly. High-end gasoline prices in South China will be raised by 50 yuan/ton. The overall ex-factory price of local refining is stable, the quotations in various regions are stable, and the Shandong region is slightly consolidated. At present, transactions in China's gasoline market are moderate. Crude oil closed down overnight. In the middle and lower reaches of the warehouse, purchases are just needed. Market quotations are relatively stable, and gasoline prices have increased in some areas.

|

Main wholesale price of gasoline on March 13 (yuan/ton) |

||||

|

areas |

Gasoline model |

Price 3.12 |

Price 3.13 |

rise and fall |

|

in North China |

92# |

8420-9581 |

8420-9581 |

0/0 |

|

95# |

8620-9942 |

8620-9942 |

0/0 |

|

|

South China |

92# |

8800-9630 |

8800-9660 |

0/30 |

|

95# |

9000-9930 |

9000-9960 |

0/30 |

|

|

central China |

92# |

8750-9350 |

8750-9350 |

0/0 |

|

95# |

8900-9650 |

8900-9650 |

0/0 |

|

|

East China |

92# |

8650-9100 |

8650-9100 |

0/0 |

|

95# |

8850-9300 |

8850-9300 |

0/0 |

|

|

northwestern region |

92# |

8600-10109 |

8600-10109 |

0/0 |

|

95# |

8800-10878 |

8800-10878 |

0/0 |

|

|

southwestern region |

92# |

8830-10146 |

8830-10146 |

0/0 |

|

95# |

9000-9950 |

9000-9950 |

0/0 |

|

|

Northeast China |

92# |

8520-8750 |

8520-8750 |

0/0 |

|

95# |

8650-9600 |

8650-9600 |

0/0 |

|

|

Ex-factory price of local gasoline refining on March 13 (yuan/ton) |

||||

|

areas |

Gasoline model |

Price 3.12 |

Price 3.13 |

rise and fall |

|

Shandong area |

92# |

8350-8700 |

8350-8700 |

0/0 |

|

95# |

8440-8860 |

8440-8860 |

0/0 |

|

|

in North China |

92# |

8490-8500 |

8490-8500 |

0/0 |

|

95# |

8550-8560 |

8550-8560 |

0/0 |

|

|

central China |

92# |

8730-8730 |

8730-8730 |

0/0 |

|

95# |

8930-8930 |

8930-8930 |

0/0 |

|

|

East China |

92# |

8430-8600 |

8430-8600 |

0/0 |

|

95# |

8550-8710 |

8550-8710 |

0/0 |

|

|

northwestern region |

92# |

8400-8600 |

8400-8600 |

0/0 |

|

95# |

8550-8800 |

8550-8800 |

0/0 |

|

|

Northeast China |

92# |

8400-8550 |

8400-8550 |

0/0 |

|

95# |

8750-8750 |

8750-8750 |

0/0 |

|

|

southwestern region |

92# |

8900-8900 |

8900-8900 |

0/0 |

|

95# |

9050-9050 |

9050-9050 |

0/0 |

|

market outlook

International crude oil is operating within a narrow range, negative and positive factors in the market are competing with each other, and there is a lack of guidance for directional events. Gasoline demand performance is relatively stable, and the frequency of procurement in the middle and lower reaches is low. Recently, the gasoline market has been generally light, and there is a lot of pessimism in the market. In addition to the elimination of warehouses in the middle and lower reaches, small orders just need to be purchased. Overall, China's gasoline market is expected to fluctuate within a narrow range in the short term.