- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC futures analysis: March 13th V2405 contract opening price: 5923, highest price: 5938, lowest price: 5863, position: 859872, settlement price: 5909, yesterday settlement: 5903, up: 6, daily trading volume: 803113 lots, precipitated capital: 3.539 billion, capital inflow: 34.75 million.

List of comprehensive prices by region: yuan / ton

|

Area |

March 12th |

March 13th |

Rise and fall |

Remarks |

|

North China |

5580-5630 |

5560-5620 |

-20/-10 |

Send to cash remittance |

|

East China |

5640-5710 |

5610-5700 |

-30/-10 |

Cash out of the warehouse |

|

South China |

5640-5680 |

5630-5700 |

-10/20 |

Cash out of the warehouse |

|

Northeast China |

5510-5660 |

5450-5660 |

-60/0 |

Send to cash remittance |

|

Central China |

5580-5630 |

5580-5640 |

0/10 |

Send to cash remittance |

|

Southwest |

5480-5620 |

5480-5620 |

0/0 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction price trend is obvious, morning and afternoon quotation is different. Compared with the valuation, the price of North China fell by 10-20 yuan / ton, East China fell by 10-30 yuan / ton, low-end prices in South China fell by 10 yuan / ton, high-end prices rose by 20 yuan / ton, and low-end prices in Northeast China fell by 60 yuan / ton. high-end prices in Central China rose 10 yuan / ton, and the southwest region was stable. Most of the factory prices of upstream PVC production enterprises remained stable, and individual enterprises raised 30 yuan / ton slightly. Futures prices fell again in the afternoon after a narrow shock, leading to a divergence in the spot market. In the morning, the price offered by traders in all regions of the spot market was slightly higher than that of yesterday, but the price rise or even continued to decline slightly after the afternoon price decline. Spot market price and spot price appear alternately, including East China basis offer 05 contract-(250), South China 05 contract-(150-200), North 05 contract-(500-550), Southwest 05 contract-(300). On the whole, it is difficult to close a deal with high-priced goods in today's spot market, and the current purchasing enthusiasm in the lower reaches is low and the wait-and-see intention is strong.

Futures point of view: PVC2405 contract night price opening small-range shock finishing, to the end of the price trend has not seen an obvious direction. Futures prices weakened slightly after the start of morning trading and showed a further downward trend in late afternoon trading. 2405 contracts range from 5863 to 5938 throughout the day, with a spread of 75. 05 and an increase of 15198 positions in contracts, with 859872 positions so far. The 2409 contract closed at 6036, with 186106 positions.

PVC Future Forecast:

Futures: & the futures price of nbsp; PVC2405 contract showed a downward trend of increasing positions at the end of the day, in which in terms of transactions, the short opening of 25.2% was higher than that of 21.9%, and the downside short opening of increased positions was relatively obvious, and the futures price was pushed back below 5900. The technical level shows that the opening of the three tracks of the Bollinger belt (13, 13, 2) narrows obviously, and the trend of KD line and MACD line at the daily level is unstable, because the short-term price is basically within the horizontal range, resulting in the trend line losing certain reference significance. Futures prices show a different direction to do yesterday, candle chart shows a negative column cross star, short-term price operation or continue to take the postgraduate entrance examination under the support of the range, observe the performance in the range of 5850-5900.

Spot aspect: period the two cities once again showed a small adjustment trend, and throughout the trading day morning and afternoon session trend differentiation, although the time has arrived in mid-March, but the current two cities still lack a clear fuse to break the situation. First of all, the trend of narrow fluctuations in the futures market, although it also shows a higher position, but regardless of the long and short operating profit space is reduced. Secondly, the spot market is still faced with the pressure of supply digestion, and the spot price can not show a better sustained upward situation. Although there are certain expectations on the supply and demand side, the current market is more difficult to break. Oil prices fell in the outer disk as the US Energy Information Administration (EIA) raised its forecast for US oil production growth in 2024. Us crude oil production is expected to increase by 260000 b / d this year to 13.19 million b / d, up 90, 000 b / d from previous forecasts, EIA said in its short-term Energy Outlook report. On the whole, PVC spot prices will continue to adjust in a small range in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

March 12th |

March 13th |

Rate of change |

|

V2405 collection |

5926 |

5879 |

-47 |

|

|

Average spot price in East China |

5675 |

5655 |

-20 |

|

|

Average spot price in South China |

5660 |

5665 |

5 |

|

|

PVC2405 basis difference |

-251 |

-224 |

27 |

|

|

V2409 collection |

6071 |

6036 |

-35 |

|

|

V2405-2409 close |

-145 |

-157 |

-12 |

|

|

PP2405 collection |

7436 |

7426 |

-10 |

|

|

Plastic L2405 collection |

8166 |

8132 |

-34 |

|

|

V--PP basis difference |

-1510 |

-1547 |

-37 |

|

|

Vmure-L basis difference of plastics |

-2240 |

-2253 |

-13 |

|

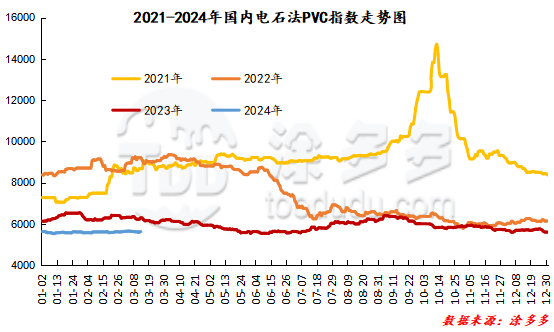

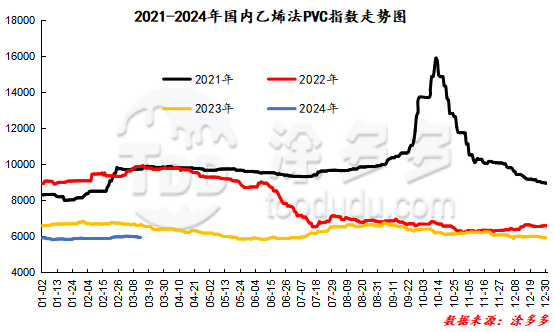

China PVC Index: according to Tuduoduo data, the Chinese calcium carbide PVC spot index fell 9.2% to 5622.67, or 0.163% on March 13. The ethylene method PVC spot index was 5934.69, down 7.46, or 0.126%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 312.02.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

3.12 warehouse orders |

3.13 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

1,702 |

1,702 |

0 |

|

|

China Central Reserve Nanjing |

1,702 |

1,702 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

1,786 |

1,786 |

0 |

|

|

Zhenjiang Middle and far Sea |

1,372 |

1,372 |

0 |

|

|

Middle and far sea in Jiangyin |

414 |

414 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

2,062 |

2,062 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,983 |

1,983 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

18,482 |

18,482 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

3,080 |

3,080 |

0 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

329 |

329 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

1,911 |

1,839 |

-72 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

1 |

1 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

120 |

120 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

686 |

686 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

165 |

165 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

1,599 |

1,599 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

440 |

440 |

0 |

|

PVC subtotal |

|

40,097 |

40,025 |

-72 |

|

Total |

|

40,097 |

40,025 |

-72 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.