- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

March 12 Gasoline Market Analysis

International crude oil closes

|

date |

market |

specifications |

Closing (USD/barrel) |

rise and fall |

|

20240311 |

US |

WTI |

77.93 |

-0.08 |

|

20240311 |

British |

Brent |

82.21 |

0.13 |

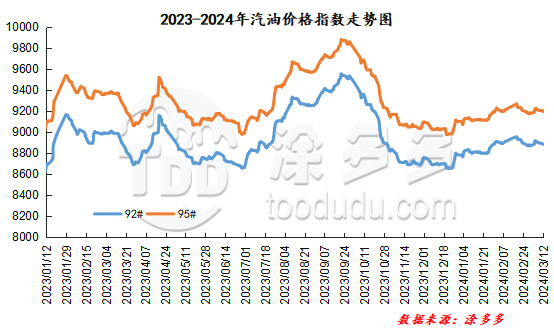

Gasoline price index

On March 12, China's 92 #gasoline price index was 883.13, down 6.44, or 0.07%; China's 95 #gasoline price index was 9194.14, down 3.66, or 0.04%. Both the 92 #gasoline index and the 95 #gasoline index were lowered, and the price difference between the 92 #gasoline index and the 95 #gasoline index was 311.01.

Gasoline Market Analysis:

Today, the main wholesale price of gasoline in China is stable and weak. Gasoline prices in most regions have been sorted out in the region. The low-end gasoline prices in South China have been lowered by 50 yuan/ton. The ex-factory prices of local refineries were mainly stable, with slight reductions in some regions, including a reduction in gasoline prices in North China by 10-30 yuan/ton. At present, transactions in China's gasoline market are flat, and the demand side has not improved significantly. Purchasing in the middle and lower reaches is cautious, focusing on just-needed needs, and refinery shipments are average.

|

Main wholesale price of gasoline on March 12 (yuan/ton) |

||||

|

areas |

Gasoline model |

Price 3.11 |

Price 3.12 |

rise and fall |

|

in North China |

92# |

8420-9581 |

8420-9581 |

0/0 |

|

95# |

8620-9942 |

8620-9942 |

0/0 |

|

|

South China |

92# |

8850-9630 |

8800-9630 |

-50/0 |

|

95# |

9050-9930 |

9000-9930 |

-50/0 |

|

|

central China |

92# |

8750-9350 |

8750-9350 |

0/0 |

|

95# |

8900-9650 |

8900-9650 |

0/0 |

|

|

East China |

92# |

8650-9100 |

8650-9100 |

0/0 |

|

95# |

8850-9300 |

8850-9300 |

0/0 |

|

|

northwestern region |

92# |

8600-10109 |

8600-10109 |

0/0 |

|

95# |

8800-10878 |

8800-10878 |

0/0 |

|

|

southwestern region |

92# |

8830-10146 |

8830-10146 |

0/0 |

|

95# |

9000-9950 |

9000-9950 |

0/0 |

|

|

Northeast China |

92# |

8520-8750 |

8520-8750 |

0/0 |

|

95# |

8650-9600 |

8650-9600 |

0/0 |

|

|

Ex-factory price of local gasoline refining on March 12 (yuan/ton) |

||||

|

areas |

Gasoline model |

Price 3.11 |

Price 3.12 |

rise and fall |

|

Shandong area |

92# |

8350-8700 |

8350-8700 |

0/0 |

|

95# |

8440-8860 |

8440-8860 |

0/0 |

|

|

in North China |

92# |

8500-8520 |

8490-8500 |

-10/-20 |

|

95# |

8550-8590 |

8550-8560 |

0/-30 |

|

|

central China |

92# |

8730-8730 |

8730-8730 |

0/0 |

|

95# |

8930-8930 |

8930-8930 |

0/0 |

|

|

East China |

92# |

8430-8600 |

8430-8600 |

0/0 |

|

95# |

8550-8710 |

8550-8710 |

0/0 |

|

|

northwestern region |

92# |

8400-8600 |

8400-8600 |

0/0 |

|

95# |

8550-8800 |

8550-8800 |

0/0 |

|

|

Northeast China |

92# |

8400-8550 |

8400-8550 |

0/0 |

|

95# |

8750-8750 |

8750-8750 |

0/0 |

|

|

southwestern region |

92# |

8900-8900 |

8900-8900 |

0/0 |

|

95# |

9050-9050 |

9050-9050 |

0/0 |

|

market outlook

International crude oil continues to weigh supply and demand, and various data will be released this week, which may bring new guidance. Gasoline demand performance is relatively stable, and the frequency of procurement in the middle and lower reaches is low. Recently, the gasoline market has been generally light, there is more pessimism in the market, and industry operators have low enthusiasm to enter the market. Overall, China's gasoline market is expected to be stable and weak in the short term.