- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

March 11 Gasoline Market Analysis

International crude oil closes

|

date |

market |

specifications |

Closing (USD/barrel) |

rise and fall |

|

20240308 |

US |

WTI |

78.01 |

-0.92 |

|

20240308 |

British |

Brent |

82.08 |

-0.88 |

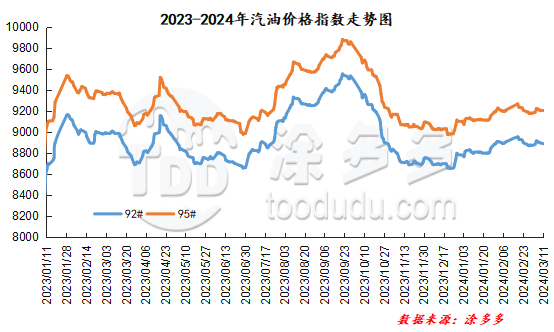

Gasoline price index

On March 11, China's 92 #gasoline price index was 8889.57, down 9.51, or 0.11%; China's 95 #gasoline price index was 9197.80, down 8.72, or 0.09%. Both the 92 #gasoline index and the 95 #gasoline index were lowered, and the price difference between the 92 #gasoline index and the 95 #gasoline index was 308.23.

Gasoline Market Analysis:

Today, the main wholesale price of gasoline in China is stable and weak. In some regions, the high-end gasoline prices have been slightly lowered by 20-50 yuan/ton; in most regions, gasoline prices are mostly narrow and minor in the region. The ex-factory prices of local refineries in all regions fell significantly compared with last Friday, with the reduction concentrated at 30-100 yuan/ton. At present, transactions in China's gasoline market are relatively flat, crude oil closed down, and there is no significant improvement in demand. The wait-and-see attitude in the gasoline market has not diminished, and refinery shipments have performed poorly.

|

Main wholesale price of gasoline on March 11 (yuan/ton) |

||||

|

areas |

Gasoline model |

Price 3.8 |

Price 3.11 |

rise and fall |

|

in North China |

92# |

8420-9581 |

8420-9581 |

0/0 |

|

95# |

8620-9942 |

8620-9942 |

0/0 |

|

|

South China |

92# |

8850-9650 |

8850-9630 |

0/-20 |

|

95# |

9050-9950 |

9050-9930 |

0/-20 |

|

|

central China |

92# |

8750-9400 |

8750-9350 |

0/-50 |

|

95# |

8900-9700 |

8900-9650 |

0/-50 |

|

|

East China |

92# |

8650-9100 |

8650-9100 |

0/0 |

|

95# |

8850-9300 |

8850-9300 |

0/0 |

|

|

northwestern region |

92# |

8600-10109 |

8600-10109 |

0/0 |

|

95# |

8800-10878 |

8800-10878 |

0/0 |

|

|

southwestern region |

92# |

8830-10146 |

8830-10146 |

0/0 |

|

95# |

9000-9950 |

9000-9950 |

0/0 |

|

|

Northeast China |

92# |

8520-8750 |

8520-8750 |

0/0 |

|

95# |

8650-9600 |

8650-9600 |

0/0 |

|

|

Ex-factory price of local gasoline refining on March 11 (yuan/ton) |

||||

|

areas |

Gasoline model |

Price 3.8 |

Price 3.11 |

rise and fall |

|

Shandong area |

92# |

8350-8800 |

8350-8700 |

0/-100 |

|

95# |

8440-9020 |

8440-8860 |

0/-160 |

|

|

in North China |

92# |

8530-8570 |

8500-8520 |

-30/-50 |

|

95# |

8580-8640 |

8550-8590 |

-30/-50 |

|

|

central China |

92# |

8830-8830 |

8730-8730 |

-100/-100 |

|

95# |

9030-9030 |

8930-8930 |

-100/-100 |

|

|

East China |

92# |

8470-8600 |

8430-8600 |

-40/0 |

|

95# |

8590-8710 |

8550-8710 |

-40/0 |

|

|

northwestern region |

92# |

8500-8600 |

8400-8600 |

-100/0 |

|

95# |

8650-8800 |

8550-8800 |

-100/0 |

|

|

Northeast China |

92# |

8400-8550 |

8400-8550 |

0/0 |

|

95# |

8750-8750 |

8750-8750 |

0/0 |

|

|

southwestern region |

92# |

9000-9000 |

8900-8900 |

-100/-100 |

|

95# |

9150-9150 |

9050-9050 |

-100/-100 |

|

market outlook

Multiple factors in international crude oil compete with each other. The benefits of OPEC+ extending production cuts are gradually exhausted. Support from the demand side and the global economy is insufficient, and there is still room for downward pressure in international oil prices. There is no holiday support on the demand side, and gasoline demand is relatively stable, making it difficult to support the upward trend of oil prices. Recently, the gasoline market has been generally light, with more pessimism in the market, and low enthusiasm among industry operators to enter the market. Overall, China's gasoline market is expected to decline slightly in the short term.