- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC futures analysis: March 11 V2405 contract opening price: 5896, highest price: 5928, lowest price: 5833, position: 843826, settlement price: 5873, yesterday settlement: 5898, down: 25, daily trading volume: 898347 lots, precipitated capital: 3.461 billion, capital inflow: 490000.

List of comprehensive prices by region: yuan / ton

|

Area |

March 8th |

March eleventh |

Rise and fall |

Remarks |

|

North China |

5580-5620 |

5530-5590 |

-50/-30 |

Send to cash remittance |

|

East China |

5620-5690 |

5570-5670 |

-50/-20 |

Cash out of the warehouse |

|

South China |

5630-5680 |

5600-5660 |

-30/-20 |

Cash out of the warehouse |

|

Northeast China |

5510-5670 |

5510-5660 |

0/-10 |

Send to cash remittance |

|

Central China |

5570-5620 |

5530-5590 |

-40/-30 |

Send to cash remittance |

|

Southwest |

5480-5650 |

5480-5620 |

0/-30 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction prices fell slightly, market sentiment weakened. Compared with the valuation, it fell by 30-50 yuan / ton in North China, 20-50 yuan / ton in East China, 20-30 yuan / ton in South China, 10 yuan / ton in Northeast China, 30-40 yuan / ton in Central China and 30 yuan / ton in Southwest China. Upstream PVC production enterprises part of the factory price to maintain wait-and-see, some enterprises began to slightly reduce the price of 30-50 yuan / ton, a small number of contracts signed. The futures market has weakened obviously, with prices in various regions of the spot market falling slightly, with traders offering lower prices than last Friday, and it is difficult to make a deal without inquiries for the time being. As the futures price goes down, the price advantage increases, and the recent basis adjustment does not change much, including East China basis offer 05 contract-(230-250), South China 05 contract-(150-200), North 05 contract-(500-540), Southwest 05 contract-(300). With the downward trend of futures price, the transaction of point price advantage has increased, and the feedback of merchants in various regions has improved.

From a futures point of view: & the night price of the nbsp; PVC2405 contract rose slightly at the start of the day, but it did not rise much and returned to the downside at the end of the night. Futures prices fell further after the start of early trading on Monday, reaching a low of 5833 at one point, then began to fluctuate mainly at low levels, and settled in a narrow range of lows in late afternoon trading. 2405 contracts range from 5833 to 5928 throughout the day, with a spread of 95. 05. The contract increased its position by 6692 hands, and has held 843826 positions so far. The 2409 contract closed at 6011, with 176155 positions.

PVC Future Forecast:

Futures: The operation of the futures price of PVC2405 contract shows a trend of short opening, which increases the position and goes downwards. In terms of transaction, the short opening is 24.1% compared with 22.7% more. After the futures price continues to break through the middle rail from above the middle rail, the fluctuation range expands and approaches the position of the lower rail, and the technical level shows that the opening of the third rail of the Bollinger belt (13,13,2) narrows obviously. The distance between the three tracks is shortened because of the recent trend of finishing and operation. The deadcross trend of the KD line at the daily level continues to expand, and the futures price shows a continuous negative decline from the high point, and the daily level of MACD also begins to show two lines crossing. In the short term, the operation of futures prices or continue to test the low range to observe the support in the range of 5800-5850.

Spot: first of all the overall range of commodities, closed at noon, the decline of iron ore fell more than 5%, glass, red dates, coking coal, thread, soda ash, liquefied petroleum gas (LPG), coke, fuel oil fell more than 2%. Commodity sentiment has weakened, the PVC plate has a significant downward trend of expanding volatility, although the decline is relatively large, but the change in position is relatively small, from the current time node, although commodities and PVC have a weakening trend, but because of the existence of expectations, bears are not willing to take too much risk. On the other hand, the decline in the intermediate price in the corresponding spot market has improved the turnover. With the passage of time, spring maintenance at the supply and demand level may become an influencing factor, and demand is also expected to recover. Generally speaking, whether it is the futures market or the spot level, even if there is a weakening trend in the market, the range is not too large. In the short term, the PVC spot market still maintains a narrow adjustment.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

March 8th |

March eleventh |

Rate of change |

|

V2405 collection |

5906 |

5860 |

-46 |

|

|

Average spot price in East China |

5655 |

5620 |

-35 |

|

|

Average spot price in South China |

5655 |

5630 |

-25 |

|

|

PVC2405 basis difference |

-251 |

-240 |

11 |

|

|

V2409 collection |

6052 |

6011 |

-41 |

|

|

V2405-2409 close |

-146 |

-151 |

-5 |

|

|

PP2405 collection |

7448 |

7470 |

22 |

|

|

Plastic L2405 collection |

8170 |

8177 |

7 |

|

|

V--PP basis difference |

-1542 |

-1610 |

-68 |

|

|

Vmure-L basis difference of plastics |

-2264 |

-2317 |

-53 |

|

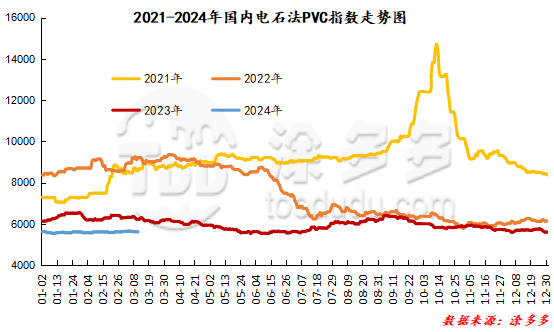

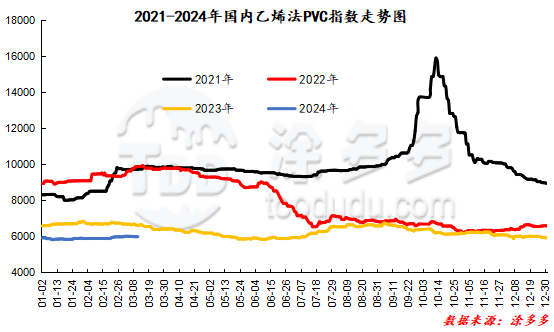

China PVC Index: according to Tuduo data, the Chinese calcium carbide PVC spot index fell 30.19 to 5593.99 on March 11, a range of 0.537%. The ethylene method PVC spot index was 5933.6, down 44.34, with a range of 0.742%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 339.61.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

3.8 warehouse receipt volume |

3.11 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

2,414 |

2,104 |

-310 |

|

|

Guangzhou materials |

712 |

402 |

-310 |

|

|

China Central Reserve Nanjing |

1,702 |

1,702 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

1,936 |

1,936 |

0 |

|

|

Zhenjiang Middle and far Sea |

1,522 |

1,522 |

0 |

|

|

Middle and far sea in Jiangyin |

414 |

414 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

719 |

121 |

-598 |

|

Polyvinyl chloride |

Peak supply chain |

2,673 |

2,413 |

-260 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

4,165 |

2,375 |

-1,790 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

19,242 |

18,882 |

-360 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

3,438 |

3,080 |

-358 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

639 |

639 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,642 |

3,602 |

-40 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

1 |

1 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

120 |

-29 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

686 |

686 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

165 |

165 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

1,599 |

1,599 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

440 |

440 |

0 |

|

PVC subtotal |

|

47,812 |

44,067 |

-3,745 |

|

Total |

|

47,812 |

44,067 |

-3,745 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.