- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

March 8 gasoline market analysis

International crude oil closes

|

date |

market |

specifications |

Closing (USD/barrel) |

rise and fall |

|

20240307 |

US |

WTI |

78.93 |

-0.2 |

|

20240307 |

British |

Brent |

82.96 |

0 |

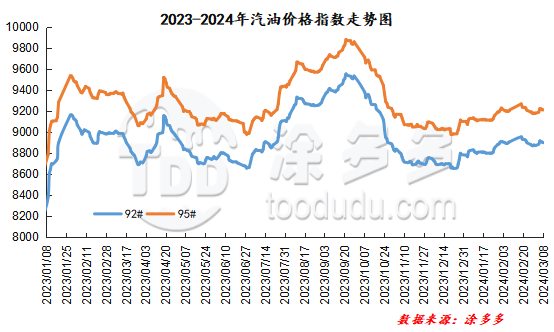

Gasoline price index

On March 8, China's 92 #gasoline price index was 8899.08, down 5.58, or 0.06%; China's 95 #gasoline price index was 9206.52, down 5.35, or 0.06%. Both the 92 #gasoline index and the 95 #gasoline index were lowered, and the price difference between the 92 #gasoline index and the 95 #gasoline index was 307.44.

Gasoline Market Analysis:

Today, the main wholesale price of gasoline in China is stable to weak, and the quotations of most companies are stable, but gasoline prices in South China and Northwest China have been lowered by 50-100 yuan/ton. The ex-factory price of local refineries remained mainly stable, with only the high-end gasoline price in the northwest region being lowered by 100 yuan/ton. At present, transactions in China's gasoline market are light, international crude oil is mostly volatile, and market guidance is limited. The demand side is relatively weak, and the middle and lower reaches have a wait-and-see mentality, mainly eliminating warehouses. Refineries appropriately adjust their quotations according to their own conditions to stimulate shipments.

|

Main wholesale price of gasoline on March 8 (yuan/ton) |

||||

|

areas |

Gasoline model |

Price 3.7 |

Price 3.8 |

rise and fall |

|

in North China |

92# |

8420-9581 |

8420-9581 |

0/0 |

|

95# |

8620-9942 |

8620-9942 |

0/0 |

|

|

South China |

92# |

8900-9650 |

8850-9650 |

-50/0 |

|

95# |

9100-9950 |

9050-9950 |

-50/0 |

|

|

central China |

92# |

8750-9400 |

8750-9400 |

0/0 |

|

95# |

8900-9700 |

8900-9700 |

0/0 |

|

|

East China |

92# |

8650-9100 |

8650-9100 |

0/0 |

|

95# |

8850-9300 |

8850-9300 |

0/0 |

|

|

northwestern region |

92# |

8700-10109 |

8600-10109 |

-100/0 |

|

95# |

8900-10878 |

8800-10878 |

-100/0 |

|

|

southwestern region |

92# |

8830-10146 |

8830-10146 |

0/0 |

|

95# |

9000-9950 |

9000-9950 |

0/0 |

|

|

Northeast China |

92# |

8520-8750 |

8520-8750 |

0/0 |

|

95# |

8650-9600 |

8650-9600 |

0/0 |

|

|

Ex-factory price of local gasoline refinery on March 8 (yuan/ton) |

||||

|

areas |

Gasoline model |

Price 3.7 |

Price 3.8 |

rise and fall |

|

Shandong area |

92# |

8350-8800 |

8350-8800 |

0/0 |

|

95# |

8380-9020 |

8380-9020 |

0/0 |

|

|

in North China |

92# |

8530-8570 |

8530-8570 |

0/0 |

|

95# |

8580-8640 |

8580-8640 |

0/0 |

|

|

central China |

92# |

8830-8830 |

8830-8830 |

0/0 |

|

95# |

9030-9030 |

9030-9030 |

0/0 |

|

|

East China |

92# |

8470-8600 |

8470-8600 |

0/0 |

|

95# |

8590-8710 |

8590-8710 |

0/0 |

|

|

northwestern region |

92# |

8500-8700 |

8500-8600 |

0/-100 |

|

95# |

8650-8900 |

8650-8800 |

0/-100 |

|

|

Northeast China |

92# |

8400-8550 |

8400-8550 |

0/0 |

|

95# |

8750-8750 |

8750-8750 |

0/0 |

|

|

southwestern region |

92# |

9000-9000 |

9000-9000 |

0/0 |

|

95# |

9150-9150 |

9150-9150 |

0/0 |

|

market outlook

In terms of international crude oil, OPEC + extended production cuts are expected to be consumed in advance, with limited boost; geopolitical uncertainty continues; coupled with the accumulation of U.S. commercial crude oil inventories, the market continues to weigh crude oil supply and demand. There is no holiday support on the demand side, and gasoline demand is relatively stable, making it difficult to support the upward trend of oil prices. On the supply side, there will be no new refineries to be overhauled next week. Coupled with the current increase in comprehensive refining profits, it is expected that the processing load may increase next week. On the whole, China's gasoline market is expected to remain mainly stable in the short term and fluctuate within a narrow range.