- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

March 6 Gasoline Market Analysis

International crude oil closes

|

date |

market |

specifications |

Closing (USD/barrel) |

rise and fall |

|

20240305 |

US |

WTI |

78.15 |

-0.59 |

|

20240305 |

British |

Brent |

82.04 |

-0.76 |

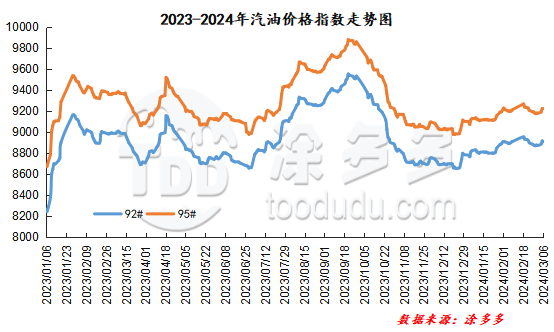

Gasoline price index

On March 6, China's 92 #gasoline price index was 8908.82, down 7.33, or 0.08%; China's 95 #gasoline price index was 9214.97, down 8.97, or 0.10%. Both the 92 #gasoline index and the 95 #gasoline index were lowered, and the price difference between the 92 #gasoline index and the 95 #gasoline index was 306.16.

Gasoline Market Analysis:

Today, the main wholesale price of gasoline in China has declined mostly. Among them, gasoline prices in North China, South China, Central China, Southwest and Northeast China have been lowered by 30-160 yuan/ton; gasoline prices in East China and Northwest China have been consolidated within the region. The ex-factory prices of local refineries are mainly minor. Among them, gasoline prices in Shandong, North China, East China, Northeast and Southwest regions have been lowered by 20-100 yuan/ton, and gasoline prices in other regions have been relatively stable. At present, transactions in China's gasoline market are light, international crude oil has closed down, and cost support is insufficient. In addition, demand continues to be weak. The phased replenishment in the middle and lower reaches has ended early. There are no favorable factors in the market to stimulate, refinery shipments have performed poorly, and price reduction promotions have increased.

|

Main wholesale price of gasoline on March 6 (yuan/ton) |

||||

|

areas |

Gasoline model |

Price 3.5 |

Price 3.6 |

rise and fall |

|

in North China |

92# |

8500-9581 |

8420-9581 |

-80/0 |

|

95# |

8700-9942 |

8620-9942 |

-80/0 |

|

|

South China |

92# |

8900-9680 |

8900-9650 |

0/-30 |

|

95# |

9100-9980 |

9100-9950 |

0/-30 |

|

|

central China |

92# |

8780-9400 |

8750-9400 |

-30/0 |

|

95# |

8980-9700 |

8900-9700 |

-80/0 |

|

|

East China |

92# |

8600-9100 |

8600-9100 |

0/0 |

|

95# |

8800-9300 |

8800-9300 |

0/0 |

|

|

northwestern region |

92# |

8700-10109 |

8700-10109 |

0/0 |

|

95# |

8900-10878 |

8900-10878 |

0/0 |

|

|

southwestern region |

92# |

8850-10146 |

8830-10146 |

-20/0 |

|

95# |

9050-9950 |

9000-9950 |

-50/0 |

|

|

Northeast China |

92# |

8580-8750 |

8520-8750 |

-60/0 |

|

95# |

8810-9600 |

8650-9600 |

-160/0 |

|

|

Ex-factory price of local gasoline refining on March 6 (yuan/ton) |

||||

|

areas |

Gasoline model |

Price 3.5 |

Price 3.6 |

rise and fall |

|

Shandong area |

92# |

8370-8870 |

8350-8800 |

-20/-70 |

|

95# |

8400-9090 |

8380-9020 |

-20/-70 |

|

|

in North China |

92# |

8540-8630 |

8520-8530 |

-20/-100 |

|

95# |

8640-8680 |

8620-8580 |

-20/-100 |

|

|

central China |

92# |

8830-8830 |

8830-8830 |

0/0 |

|

95# |

9030-9030 |

9030-9030 |

0/0 |

|

|

East China |

92# |

8490-8630 |

8470-8600 |

-20/-30 |

|

95# |

8610-8740 |

8590-8710 |

-20/-30 |

|

|

northwestern region |

92# |

8500-8800 |

8500-8800 |

0/0 |

|

95# |

8650-9000 |

8650-9000 |

0/0 |

|

|

Northeast China |

92# |

8460-8550 |

8400-8550 |

-60/0 |

|

95# |

8750-8750 |

8750-8750 |

0/0 |

|

|

southwestern region |

92# |

9100-9100 |

9000-9000 |

-100/-100 |

|

95# |

9200-9200 |

9100-9100 |

-100/-100 |

|

market outlook

In terms of international crude oil, the Palestinian-Israeli conflict and support for OPEC + production cuts still exist, so we should pay attention to the signals brought by the release of EIA inventory data. Demand in China's gasoline market is weak and has no holiday support. The lack of positive factors has boosted the gasoline market. There is a strong wait-and-see attitude in the middle and lower reaches, and small orders just need to be purchased. Overall, it is expected that downside risks to China's gasoline market will still exist in the short term.