- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

Gasoline Market Analysis on March 4

International crude oil closes

|

date |

market |

specifications |

Closing (USD/barrel) |

rise and fall |

|

20240301 |

US |

WTI |

79.97 |

1.71 |

|

20240301 |

British |

Brent |

83.55 |

-0.07 |

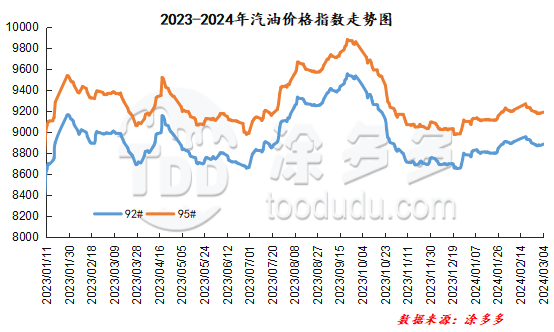

Gasoline price index

On March 4, China's 92 #gasoline price index was 885.88, up 13.43, or 0.15%; China's 95 #gasoline price index was 9190.56, up 12.58, or 0.14%. Both the 92 #gasoline index and the 95 #gasoline index were raised, and the price difference between the 92 #gasoline index and the 95 #gasoline index was 304.68.

Gasoline Market Analysis:

Today, China's gasoline market fluctuated within a narrow range. Among them, the main wholesale price of gasoline was increased by 30-50 yuan/ton in central and southern China, and the price of gasoline in southwest China was lowered by 50 yuan/ton. The ex-factory price of local refineries is increased by 10-60 yuan/ton, and the price of gasoline in Shandong, North China, and East China is reduced by 50 yuan/ton. At present, transactions in China's gasoline market are average, international oil prices are rising, and the retail price limit increase is approaching. The market's wait-and-see mentality has weakened. Mid-stream and downstream traders just need to replenish stocks, and refinery shipments are still acceptable, so they offer flexible quotations.

|

Main wholesale price of gasoline on March 4 (yuan/ton) |

||||

|

areas |

Gasoline model |

Price 3.1 |

Price 3.4 |

rise and fall |

|

in North China |

92# |

8500-9581 |

8500-9581 |

0/0 |

|

95# |

8700-9942 |

8700-9942 |

0/0 |

|

|

South China |

92# |

8850-9630 |

8900-9680 |

50/50 |

|

95# |

9050-9930 |

9100-9980 |

50/50 |

|

|

central China |

92# |

8750-9400 |

8780-9400 |

30/0 |

|

95# |

8950-9700 |

8980-9700 |

30/0 |

|

|

East China |

92# |

8600-9010 |

8600-9010 |

0/0 |

|

95# |

8800-9210 |

8800-9210 |

0/0 |

|

|

northwestern region |

92# |

8700-9977 |

8700-9977 |

0/0 |

|

95# |

8900-10558 |

8900-10558 |

0/0 |

|

|

southwestern region |

92# |

8900-10146 |

8850-10146 |

-50/0 |

|

95# |

9100-9950 |

9050-9950 |

-50/0 |

|

|

Northeast China |

92# |

8580-8750 |

8580-8750 |

0/0 |

|

95# |

8810-9600 |

8810-9600 |

0/0 |

|

|

Ex-factory price of local gasoline refining on March 4 (yuan/ton) |

||||

|

areas |

Gasoline model |

Price 3.1 |

Price 3.4 |

rise and fall |

|

Shandong area |

92# |

8410-8870 |

8420-8870 |

10/0 |

|

95# |

8440-9090 |

8450-9090 |

10/0 |

|

|

in North China |

92# |

8510-8600 |

8570-8630 |

60/30 |

|

95# |

8610-8650 |

8670-8680 |

60/30 |

|

|

central China |

92# |

8830-8830 |

8830-8830 |

0/0 |

|

95# |

9030-9030 |

9030-9030 |

0/0 |

|

|

East China |

92# |

8440-8580 |

8490-8630 |

50/50 |

|

95# |

8560-8690 |

8610-8740 |

50/50 |

|

|

northwestern region |

92# |

8500-8800 |

8500-8800 |

0/0 |

|

95# |

8650-9000 |

8650-9000 |

0/0 |

|

|

Northeast China |

92# |

8460-8550 |

8460-8550 |

0/0 |

|

95# |

8630-8750 |

8630-8750 |

0/0 |

|

|

southwestern region |

92# |

9150-9150 |

9100-9100 |

-50/-50 |

|

95# |

9250-9250 |

9200-9200 |

-50/-50 |

|

market outlook

Geopolitical instability in international crude oil continues. OPEC + production cuts have been extended to the end of the second quarter, basically facing increased support from the gasoline market. The gasoline market in China is approaching the opening date of the price adjustment window, and the adjustment of retail price limits is about to be realized. Coupled with the enhanced cost-side support, gasoline demand is insufficient and refinery shipments are performing generally. Overall, China's gasoline market is expected to fluctuate within a narrow range in the short term.