- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

Gasoline Market Analysis on March 1

International crude oil closes

|

date |

market |

specifications |

Closing (USD/barrel) |

rise and fall |

|

20240229 |

US |

WTI |

78.26 |

-0.28 |

|

20240229 |

British |

Brent |

83.62 |

-0.06 |

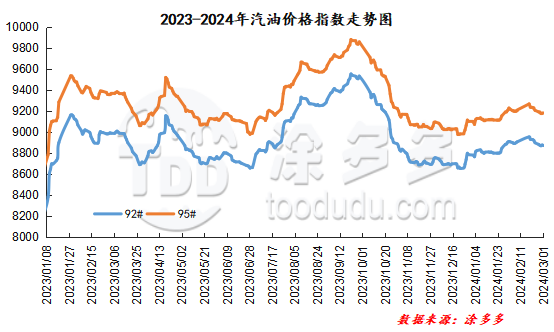

Gasoline price index

On March 1, China's 92 #gasoline price index was 8872.45, down 4.75, or 0.05%; China's 95 #gasoline price index was 9177.98, down 4.82, or 0.05%. Both the 92 #gasoline index and the 95 #gasoline index were lowered, and the price difference between the 92 #gasoline index and the 95 #gasoline index was 305.53.

Gasoline Market Analysis:

Today, the main wholesale price of gasoline in China is stable and weak. The high-end gasoline price in East China has been lowered by 50 yuan/ton, and gasoline prices in other regions have been mainly consolidated within the region. The ex-factory prices of local refineries have been mostly lowered, with gasoline prices in Shandong, North China, East China, Northwest China and Southwest China being lowered by 20-60 yuan/ton. Gasoline prices in Northeast China have been raised by 30 yuan/ton, and gasoline prices in Central China have been relatively stable. At present, the transaction atmosphere in China's gasoline market is mild, the wait-and-see atmosphere in the middle and lower reaches is strong, and refinery shipments are poor. Overall, the market lacks news guidance, and prices fluctuate with the market.

|

Main wholesale price of gasoline on March 1 (yuan/ton) |

||||

|

areas |

Gasoline model |

Price 2.29 |

Price 3.1 |

rise and fall |

|

in North China |

92# |

8500-9581 |

8500-9581 |

0/0 |

|

95# |

8700-9942 |

8700-9942 |

0/0 |

|

|

South China |

92# |

8850-9630 |

8850-9630 |

0/0 |

|

95# |

9050-9930 |

9050-9930 |

0/0 |

|

|

central China |

92# |

8750-9400 |

8750-9400 |

0/0 |

|

95# |

8950-9700 |

8950-9700 |

0/0 |

|

|

East China |

92# |

8600-9060 |

8600-9010 |

0/-50 |

|

95# |

8800-9260 |

8800-9210 |

0/-50 |

|

|

northwestern region |

92# |

8700-9977 |

8700-9977 |

0/0 |

|

95# |

8900-10558 |

8900-10558 |

0/0 |

|

|

southwestern region |

92# |

8900-10146 |

8900-10146 |

0/0 |

|

95# |

9100-9950 |

9100-9950 |

0/0 |

|

|

Northeast China |

92# |

8580-8750 |

8580-8750 |

0/0 |

|

95# |

8810-9600 |

8810-9600 |

0/0 |

|

|

Ex-factory price of local gasoline refining on March 1 (yuan/ton) |

||||

|

areas |

Gasoline model |

Price 2.29 |

Price 3.1 |

rise and fall |

|

Shandong area |

92# |

8410-8930 |

8410-8870 |

0/-60 |

|

95# |

8440-9090 |

8440-9090 |

0/-60 |

|

|

in North China |

92# |

8540-8650 |

8510-8600 |

-30/-50 |

|

95# |

8640-8700 |

8610-8650 |

-30/-50 |

|

|

central China |

92# |

8830-8830 |

8830-8830 |

0/0 |

|

95# |

9030-9030 |

9030-9030 |

0/0 |

|

|

East China |

92# |

8460-8620 |

8440-8580 |

-20/-40 |

|

95# |

8580-8730 |

8560-8690 |

-20/-40 |

|

|

northwestern region |

92# |

8550-8800 |

8500-8800 |

-50/0 |

|

95# |

8700-9000 |

8650-9000 |

-50/0 |

|

|

Northeast China |

92# |

8430-8550 |

8460-8550 |

30/0 |

|

95# |

8600-8750 |

8630-8750 |

30/0 |

|

|

southwestern region |

92# |

9150-9100 |

9150-9100 |

-50/-50 |

|

95# |

9300-9300 |

9250-9250 |

-50/-50 |

|

market outlook

Geopolitical instability in international crude oil continues, but the euro zone economic sentiment index and China's manufacturing data in February fell short of expectations. International oil prices are expected to be lowered. The gasoline market in China is approaching the opening date of the price adjustment window, and the retail price limit adjustment is expected to be raised. In addition, there is no task pressure on the main business at the beginning of the month, and the promotion level has weakened. However, there is still a lack of good news on the demand side. Overall, it is expected that downside risks to China's gasoline market will still exist in the short term.