- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

Gasoline Market Analysis on February 27

International crude oil closes

|

date |

market |

specifications |

Closing (USD/barrel) |

rise and fall |

|

20240226 |

US |

WTI |

77.58 |

1.09 |

|

20240226 |

British |

Brent |

82.53 |

0.91 |

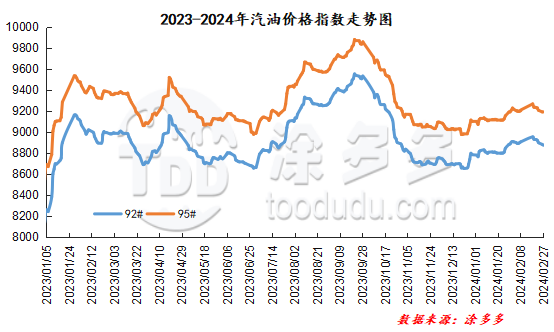

Gasoline price index

On February 27, China's 92 #gasoline price index was 8875.10, down 7.87, or 0.09%; China's 95 #gasoline price index was 9186.77, down 6.13, or 0.07%. Both the 92 #gasoline index and the 95 #gasoline index were lowered, and the price difference between the 92 #gasoline index and the 95 #gasoline index was 311.67.

Gasoline Market Analysis:

Today, the main wholesale price of gasoline in China has generally stabilized, with a downward adjustment in some regions. Specifically, gasoline prices in East China and Southwest China have been lowered by 50-100 yuan/ton. The ex-factory prices of local refineries have fluctuated and fluctuated, with gasoline prices in Shandong, North China and East China increasing by 20-50 yuan/ton. High-end gasoline prices in Northwest China will be lowered by 100 yuan/ton. Gasoline prices in other regions are relatively stable. At present, transactions in China's gasoline market are moderate, and replenishment in the middle and lower reaches is still at a low level, with purchases mainly needed; performance pressure on the main units at the end of the month is gradually increasing, and their willingness to support prices is relatively weak. International oil prices closed higher, with local refinery shipments showing mixed performance, with prices rising and falling.

|

Main wholesale price of gasoline on February 27 (yuan/ton) |

||||

|

areas |

Gasoline model |

Price 2.26 |

Price 2.27 |

rise and fall |

|

in North China |

92# |

8500-9581 |

8500-9581 |

0/0 |

|

95# |

8700-9942 |

8700-9942 |

0/0 |

|

|

South China |

92# |

8850-9600 |

8850-9600 |

0/0 |

|

95# |

9050-9900 |

9050-9900 |

0/0 |

|

|

central China |

92# |

8800-9350 |

8800-9350 |

0/0 |

|

95# |

9000-9650 |

9000-9650 |

0/0 |

|

|

East China |

92# |

8600-9060 |

8600-9010 |

0/-50 |

|

95# |

8800-9260 |

8800-9210 |

0/-50 |

|

|

northwestern region |

92# |

8800-9977 |

8800-9977 |

0/0 |

|

95# |

9000-10558 |

9000-10558 |

0/0 |

|

|

southwestern region |

92# |

9000-10146 |

8900-10146 |

-100/0 |

|

95# |

9200-9950 |

9100-9950 |

-100/0 |

|

|

Northeast China |

92# |

8500-8750 |

8500-8750 |

0/0 |

|

95# |

8750-9600 |

8750-9600 |

0/0 |

|

|

Ex-factory price of local gasoline refining on February 27 (yuan/ton) |

||||

|

areas |

Gasoline model |

Price 2.26 |

Price 2.27 |

rise and fall |

|

Shandong area |

92# |

8340-8930 |

8370-8930 |

30/0 |

|

95# |

8420-9090 |

8450-9090 |

30/0 |

|

|

in North China |

92# |

8540-8570 |

8540-8600 |

0/30 |

|

95# |

8590-8670 |

8640-8650 |

50/-20 |

|

|

central China |

92# |

8770-8770 |

8770-8770 |

0/0 |

|

95# |

8970-8970 |

8970-8970 |

0/0 |

|

|

East China |

92# |

8400-8600 |

8420-8600 |

20/0 |

|

95# |

8520-8710 |

8540-8710 |

20/0 |

|

|

northwestern region |

92# |

8550-8900 |

8550-8800 |

0/-100 |

|

95# |

8700-9100 |

8700-9000 |

0/-100 |

|

|

Northeast China |

92# |

8430-8550 |

8430-8550 |

0/0 |

|

95# |

8600-8750 |

8600-8750 |

0/0 |

|

|

southwestern region |

92# |

9150-9150 |

9150-9150 |

0/0 |

|

95# |

9300-9300 |

9300-9300 |

0/0 |

|

market outlook

In terms of international crude oil, Russia will ban gasoline exports for six months. Goldman Sachs expects OPEC + to extend production reduction measures. The supply level is expected to be tightening, and geopolitical uncertainty continues. It is expected that there will be room for growth in international oil prices. Demand for gasoline in the Chinese market lacks holiday support, and demand performance is relatively weak. Coupled with the increasing pressure on refinery performance at the end of the month, the gasoline market lacks upward momentum. On the whole, China's gasoline market is expected to remain stable in the short term.