- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

Gasoline Market Analysis on February 26

International crude oil closes

|

date |

market |

specifications |

Closing (USD/barrel) |

rise and fall |

|

20240223 |

US |

WTI |

76.49 |

-2.12 |

|

20240223 |

British |

Brent |

81.62 |

-2.05 |

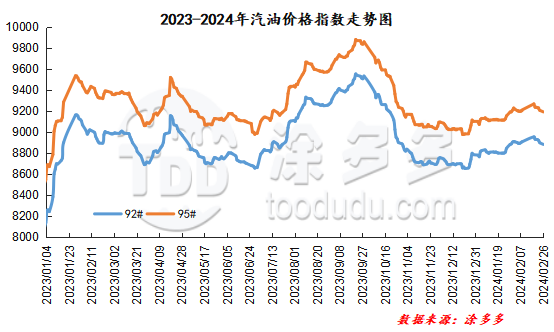

Gasoline price index

On February 26, China's 92 #gasoline price index was 882.98, down 16.40, or 0.18%; China's 95 #gasoline price index was 9192.90, down 14.58, or 0.16%. Both the 92 #gasoline index and the 95 #gasoline index were lowered, and the price difference between the 92 #gasoline index and the 95 #gasoline index was 309.92.

Gasoline Market Analysis:

China's gasoline market continued to decline today. Among them, wholesale prices of main units fell within a narrow range, and gasoline prices in Central, East, Southwest and Northeast China were lowered by 30-50 yuan/ton. Gasoline price quotes in other regions are relatively stable. The ex-factory prices of local refineries have been mostly lowered, with gasoline prices in Shandong, North China, Central China, Northwest China and East China falling by 50-110 yuan/ton. At present, transactions in China's gasoline market are flat. In terms of demand, there are many low-level replenishment in the middle and lower reaches. The wait-and-see atmosphere of owners remains unabated. Refinery shipments perform generally. Transaction policies are relatively flexible. Prices have been lowered in areas with poor sales to stimulate shipments.

|

Main wholesale price of gasoline on February 26 (yuan/ton) |

||||

|

areas |

Gasoline model |

Price 2.23 |

Price 2.26 |

rise and fall |

|

in North China |

92# |

8500-9581 |

8500-9581 |

0/0 |

|

95# |

8700-9942 |

8700-9942 |

0/0 |

|

|

South China |

92# |

8850-9600 |

8850-9600 |

0/0 |

|

95# |

9050-9900 |

9050-9900 |

0/0 |

|

|

central China |

92# |

8800-9400 |

8800-9350 |

0/-50 |

|

95# |

9000-9700 |

9000-9650 |

0/-50 |

|

|

East China |

92# |

8600-9110 |

8600-9060 |

0/-50 |

|

95# |

8800-9310 |

8800-9260 |

0/-50 |

|

|

northwestern region |

92# |

8800-9977 |

8800-9977 |

0/0 |

|

95# |

9000-10558 |

9000-10558 |

0/0 |

|

|

southwestern region |

92# |

9050-10146 |

9000-10146 |

-50/0 |

|

95# |

9250-9950 |

9200-9950 |

-50/0 |

|

|

Northeast China |

92# |

8530-8750 |

8500-8750 |

-30/0 |

|

95# |

8790-9600 |

8750-9600 |

-40/0 |

|

|

Ex-factory price of local gasoline refining on February 26 (yuan/ton) |

||||

|

areas |

Gasoline model |

Price 2.23 |

Price 2.26 |

rise and fall |

|

Shandong area |

92# |

8400-9000 |

8340-8930 |

-60/-70 |

|

95# |

8540-9200 |

8420-9090 |

-120/-110 |

|

|

in North China |

92# |

8620-8620 |

8540-8570 |

-80/-50 |

|

95# |

8670-8720 |

8590-8670 |

-80/-50 |

|

|

central China |

92# |

8870-8870 |

8770-8770 |

-100/-100 |

|

95# |

9070-9070 |

8970-8970 |

-100/-100 |

|

|

East China |

92# |

8450-8670 |

8400-8600 |

-50/-70 |

|

95# |

8570-8780 |

8520-8710 |

-50/-70 |

|

|

northwestern region |

92# |

8650-8900 |

8550-8900 |

-100/0 |

|

95# |

8800-9100 |

8700-9100 |

-100/0 |

|

|

Northeast China |

92# |

8430-8550 |

8430-8550 |

0/0 |

|

95# |

8600-8750 |

8600-8750 |

0/0 |

|

|

southwestern region |

92# |

9150-9150 |

9150-9150 |

0/0 |

|

95# |

9300-9300 |

9300-9300 |

0/0 |

|

market outlook

In terms of international crude oil, the Palestinian-Israeli conflict has shown signs of improving, and the impact of geopolitical events has weakened. The number of U.S. oil wells increases. Pressure on the demand side still exists. Overall, the negative factors for international crude oil have not diminished, and oil prices have difficulty rising, and there is room for decline. Consumer demand for gasoline in the Chinese market has decreased significantly after the Spring Festival, and there is a lack of holiday support, so demand performance is relatively weak. In addition, the performance pressure of some refineries at the end of the month is increasing, and the willingness to support prices is weak. Overall, it is expected that there will still be room for downside in China's gasoline market in the short term.