- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

1. Carbon black market analysis

Today, the price of carbon black in China has risen widely. As of now, the mainstream price of N330 in the carbon black market is 8,200 - 9,000 yuan/ton.

Cost: Today, China's high-temperature coal tar market prices are stable. The third round of price cuts for coke prices has been implemented. Coke companies are about to lose profits, resulting in a decline in operating rates. The supply of coal tar in the field is tight. Coupled with the fact that downstream companies have a significant increase in their enthusiasm to digest and replenish their inventories, the coal tar market is eager to increase prices. The cost support for carbon black is acceptable.

Supply: Due to the influence of rain and snow, the recent carbon black market shipments have been slow, and the inventory of some carbon black companies has increased.

On the demand side: Basically all downstream tire companies have resumed work, tire output has increased significantly, and semi-steel tire companies have performed reasonably.

2. Carbon black market price

|

Carbon black market price on February 21 |

|||||

|

specifications |

market |

on February 20 |

on February 21 |

rise and fall |

units |

|

N330 |

Shanxi |

7800-8100 |

8200-8500 |

400/400 |

Yuan/ton |

|

Hebei |

8700-9000 |

8700-9000 |

0 |

Yuan/ton |

|

|

Guangzhou |

8400-8600 |

8800-9000 |

400/400 |

Yuan/ton |

|

|

Shandong |

8000-8300 |

8400-8700 |

400/400 |

Yuan/ton |

|

|

Zhejiang |

8200-8400 |

8600-8800 |

400/400 |

Yuan/ton |

|

|

Henan |

8700-9000 |

8700-9000 |

0 |

Yuan/ton |

|

|

N220 |

Shanxi |

9100-9300 |

9500-9700 |

400/400 |

Yuan/ton |

|

Hebei |

10200-10500 |

10200-10500 |

0 |

Yuan/ton |

|

|

Guangzhou |

9300-9700 |

9700-10100 |

400/400 |

Yuan/ton |

|

|

Shandong |

9200-9400 |

9600-9800 |

400/400 |

Yuan/ton |

|

|

Zhejiang |

9300-9500 |

9700-9900 |

400/400 |

Yuan/ton |

|

|

Henan |

10200-10500 |

10200-10500 |

0 |

Yuan/ton |

|

|

N550 |

Shanxi |

8200-8500 |

8600-8900 |

400/400 |

Yuan/ton |

|

Hebei |

8900-9200 |

8900-9200 |

0 |

Yuan/ton |

|

|

Guangzhou |

8700-8900 |

9100-9300 |

400/400 |

Yuan/ton |

|

|

Shandong |

8300-8600 |

8700-9000 |

400/400 |

Yuan/ton |

|

|

Zhejiang |

8500-8700 |

8900-9100 |

400/400 |

Yuan/ton |

|

|

Henan |

8900-9200 |

8900-9200 |

0 |

Yuan/ton |

|

|

N660 |

Shanxi |

7800-8100 |

8200-8500 |

400/400 |

Yuan/ton |

|

Hebei |

8700-9000 |

8700-9000 |

0 |

Yuan/ton |

|

|

Guangzhou |

8400-8600 |

8800-9000 |

400/400 |

Yuan/ton |

|

|

Shandong |

8000-8300 |

8400-8700 |

400/400 |

Yuan/ton |

|

|

Zhejiang |

8200-8400 |

8600-8800 |

400/400 |

Yuan/ton |

|

|

Henan |

8700-9000 |

8700-9000 |

0 |

Yuan/ton |

|

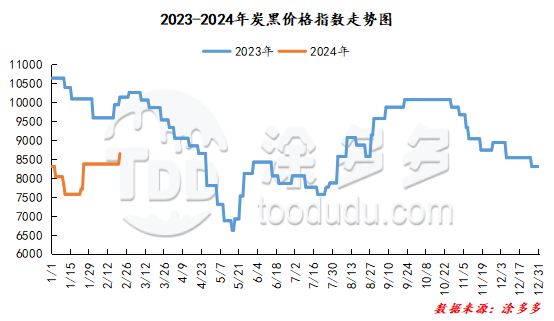

3. Carbon black index analysis

According to Tdd-global's data, the carbon black price index on February 21 was 8645, up 274 from yesterday, or 3.27%.

4. market outlook

In the short term, the high-temperature coal tar market trend may rise, which has strong support for carbon black costs; most companies in the downstream tire industry have resumed construction, and their enthusiasm for entering the market has increased significantly. There is a certain need for support on the demand side. New orders for carbon black companies are still in good condition, and it is expected that there will be some upside in the market price of carbon black in the short term.