- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

Gasoline: Limited replenishment after the holiday, and light market transactions

International crude oil closes

|

date |

market |

specifications |

Closing (USD/barrel) |

rise and fall |

|

20240219 |

US |

WTI |

- |

- |

|

20240219 |

British |

Brent |

83.56 |

0.09 |

Note: WTI crude oil futures will be closed on February 19

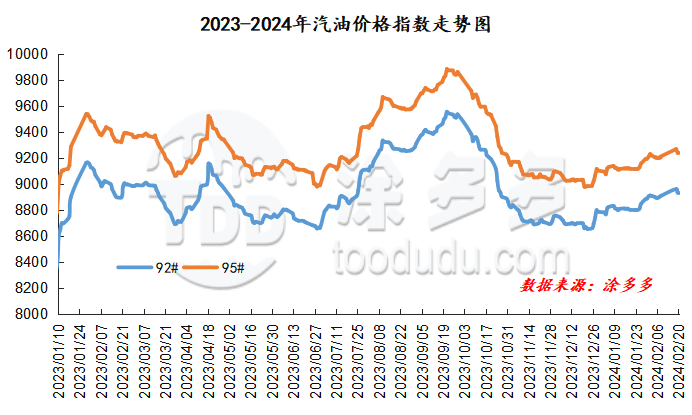

Gasoline price index

On February 20, China's 92 #gasoline price index was 8930.11, down 2.42, or 0.03%; China's 95 #gasoline price index was 9235.38, down 2.29, or 0.02%. Both the 92 #gasoline index and the 95 #gasoline index were lowered, and the price difference between the 92 #gasoline index and the 95 #gasoline index was 305.28.

Gasoline Market Analysis:

Today, China's gasoline market continues to be weak, with the wholesale prices of main units being mainly consolidated within the region, and the low-end gasoline prices in central and southwest regions being lowered by 50-100 yuan/ton. Ex-factory prices of local refineries were mixed, with East China lowering the price by 40 yuan/ton. Gasoline in the northwest and southwest regions will be increased by 50-100 yuan/ton. At present, transactions in China's gasoline market are average. After the Spring Festival, the replenishment efforts in the gasoline market fell short of expectations. Some middle and lower reaches traders replenished at low levels. Refiners often flexibly adjust their quotations according to their own conditions, and there are hidden benefits in transactions.

|

Main wholesale price of gasoline on February 20 (yuan/ton) |

||||

|

areas |

Gasoline model |

Price 2.19 |

Price 2.20 |

rise and fall |

|

in North China |

92# |

8580-9581 |

8580-9581 |

0/0 |

|

95# |

8780-9942 |

8780-9942 |

0/0 |

|

|

South China |

92# |

8850-9650 |

8850-9650 |

0/0 |

|

95# |

9050-9950 |

9050-9950 |

0/0 |

|

|

central China |

92# |

8900-9400 |

8850-9400 |

-50/0 |

|

95# |

9050-9700 |

9000-9700 |

-50/0 |

|

|

East China |

92# |

8650-9210 |

8650-9210 |

0/0 |

|

95# |

8850-9360 |

8850-9360 |

0/0 |

|

|

northwestern region |

92# |

8800-9977 |

8800-9977 |

0/0 |

|

95# |

9000-10558 |

9000-10558 |

0/0 |

|

|

southwestern region |

92# |

9150-10146 |

9050-10146 |

-100/0 |

|

95# |

9350-9950 |

9250-9950 |

-100/0 |

|

|

Northeast China |

92# |

8550-8800 |

8550-8800 |

0/0 |

|

95# |

8900-9600 |

8900-9600 |

0/0 |

|

|

Ex-factory price of local gasoline refining on February 20 (yuan/ton) |

||||

|

areas |

Gasoline model |

Price 2.19 |

Price 2.20 |

rise and fall |

|

Shandong area |

92# |

8440-9040 |

8440-9040 |

0/0 |

|

95# |

8620-9200 |

8620-9200 |

0/0 |

|

|

in North China |

92# |

8750-8850 |

8750-8850 |

0/0 |

|

95# |

8800-8950 |

8800-8950 |

0/0 |

|

|

central China |

92# |

9070-8780 |

9070-8780 |

0/0 |

|

95# |

9270-9270 |

9270-9270 |

0/0 |

|

|

East China |

92# |

8570-8720 |

8530-8720 |

-40/0 |

|

95# |

8690-8830 |

8650-8830 |

-40/0 |

|

|

northwestern region |

92# |

8650-8800 |

8650-8900 |

0/100 |

|

95# |

8800-9000 |

8800-9100 |

0/100 |

|

|

Northeast China |

92# |

8430-8550 |

8430-8550 |

0/0 |

|

95# |

8600-8750 |

8600-8750 |

0/0 |

|

|

southwestern region |

92# |

9100-9100 |

9150-9150 |

50/50 |

|

95# |

9250-9250 |

9300-9300 |

50/50 |

|

market outlook

The positive and negative game still exists in terms of international crude oil. Currently, there are no guiding factors affecting it. Narrow-range fluctuations are dominant, and international oil price guidance is relatively weak. After returning from the holiday, the market's post-holiday replenishment efforts fell short of expectations, and demand performance was flat. In addition, the pressure on some refineries is gradually increasing in the middle and late months, and the mentality of supporting prices has weakened. The gasoline market lacks upward momentum and has more than a downward trend. Overall, China's gasoline market is expected to remain weak in the short term.