- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

Gasoline: Some traders are replenishing goods, and refinery prices are slightly higher

International crude oil closes

|

date |

market |

specifications |

Closing (USD/barrel) |

rise and fall |

|

20240205 |

US |

WTI |

72.78 |

0.5 |

|

20240205 |

British |

Brent |

77.99 |

0.66 |

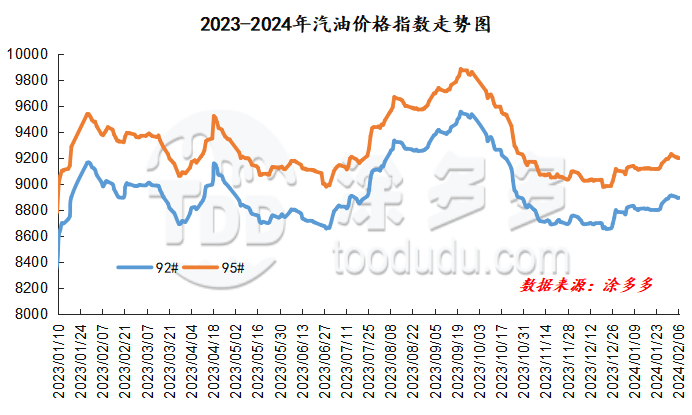

Gasoline price index

On February 6, China's 92 #gasoline price index was 8892.89, up 0.01, or 0.01%; China's 95 #gasoline price index was 9197.44, down 0.65, or 0.01%. The price difference between 92 #gasoline and 95 #gasoline index is 304.55.

Gasoline Market Analysis:

Today, the wholesale prices of China's main units are mainly adjusted within the region, with limited fluctuations. Ex-factory price of local refining gasoline prices increased slightly in some regions, with gasoline prices in Shandong, East China and North China increasing by 20-90 yuan/ton; gasoline prices in other regions remained stable. At present, the trading atmosphere in China's gasoline market is still good. Some traders have replenished stocks on dips, refinery shipments have improved, and orders have increased. Refinery prices in areas with better sales rose slightly.

|

Main wholesale price of gasoline on February 6 (yuan/ton) |

||||

|

areas |

Gasoline model |

Price 2.5 |

Price 2.6 |

rise and fall |

|

in North China |

92# |

8450-9581 |

8450-9581 |

0/0 |

|

95# |

8650-9942 |

8650-9942 |

0/0 |

|

|

South China |

92# |

8850-9850 |

8850-9850 |

0/0 |

|

95# |

9050-10150 |

9050-10150 |

0/0 |

|

|

central China |

92# |

8750-9400 |

8750-9400 |

0/0 |

|

95# |

8900-9700 |

8900-9700 |

0/0 |

|

|

East China |

92# |

8600-9060 |

8600-9110 |

0/50 |

|

95# |

8800-9350 |

8800-9400 |

0/50 |

|

|

northwestern region |

92# |

8680-9977 |

8680-9977 |

0/0 |

|

95# |

8880-10558 |

8880-10558 |

0/0 |

|

|

southwestern region |

92# |

8950-9650 |

8950-9650 |

0/0 |

|

95# |

9200-9950 |

9200-9950 |

0/0 |

|

|

Northeast China |

92# |

8450-9000 |

8450-9000 |

0/0 |

|

95# |

8700-9600 |

8700-9600 |

0/0 |

|

|

Ex-factory price of local gasoline refining on February 6 (yuan/ton) |

||||

|

areas |

Gasoline model |

Price 2.5 |

Price 2.6 |

rise and fall |

|

Shandong area |

92# |

8300-8730 |

8360-8770 |

60/40 |

|

95# |

8500-8890 |

8560-8920 |

60/40 |

|

|

in North China |

92# |

8480-8630 |

8500-8660 |

20/30 |

|

95# |

8530-8730 |

8550-8760 |

20/30 |

|

|

central China |

92# |

8700-8700 |

8700-8700 |

0/0 |

|

95# |

8900-8900 |

8900-8900 |

0/0 |

|

|

East China |

92# |

8410-8480 |

8460-8570 |

50/90 |

|

95# |

8530-8590 |

8580-8680 |

50/90 |

|

|

northwestern region |

92# |

8350-8600 |

8350-8600 |

0/0 |

|

95# |

8500-8800 |

8500-8800 |

0/0 |

|

|

Northeast China |

92# |

8400-8430 |

8400-8430 |

0/0 |

|

95# |

8600-8600 |

8600-8600 |

0/0 |

|

|

southwestern region |

92# |

8950-8950 |

8950-8950 |

0/0 |

|

95# |

9100-9100 |

9100-9100 |

0/0 |

|

market outlook

In terms of international crude oil, OPEC's geopolitical uncertainty continues, lacking guidance on important events, and there is a good game in the game. The market has been on holiday one after another, centralized stocking in the middle and lower reaches has ended, and some of them just need replenishment. The market has limited fluctuations and has become calm. Overall, China's gasoline market is expected to stabilize in the short term.