- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC futures analysis: February 6 V2405 contract opening price: 5780, highest price: 5850, lowest price: 5740, position: 767784, settlement price: 5787, yesterday settlement: 5813, down: 26, daily trading volume: 793383 lots, precipitated capital: 3.14 billion, capital outflow: 69.09 million.

List of comprehensive prices by region: yuan / ton

|

Area |

February fifth |

February sixth |

Rise and fall |

Remarks |

|

North China |

5470-5550 |

5470-5550 |

0/0 |

Send to cash remittance |

|

East China |

5550-5630 |

5530-5630 |

-20/0 |

Cash out of the warehouse |

|

South China |

5620-5680 |

5600-5680 |

-20/0 |

Cash out of the warehouse |

|

Northeast China |

5450-5600 |

5450-5600 |

0/0 |

Send to cash remittance |

|

Central China |

5560-5600 |

5560-5600 |

0/0 |

Send to cash remittance |

|

Southwest |

5490-5600 |

5490-5600 |

0/0 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction price trend is slightly differentiated, weakening in the morning and rising in the afternoon. The comparison of valuation shows that North China is stable, East China is down 20 yuan / ton, South China is down 20 yuan / ton, and Northeast, Central China and Southwest China are stable. The ex-factory prices of upstream PVC production enterprises are still mostly stable and there is no obvious adjustment. Although the fluctuation of the futures price shows an expanding trend, and the fluctuation is relatively intense, the production enterprises have not followed the price adjustment. The price of traders in all regions weakened slightly in early trading, and the price fell slightly. Some of the basis offers have price advantages, and the basis offers do not change much, including East China basis offer 05 contract-(180-270), South China 05 contract-(150-210), North 05 contract-(520-570), Southwest 05 contract-(250). But the decline was recovered in the afternoon and prices rebounded. The spot market part of the non-holiday downstream bargain order replenishment, the procurement of spot enthusiasm is low, the spot market trading atmosphere is light.

From the perspective of futures: & the opening price of the nbsp; PVC2405 contract showed an obvious downward trend, and the night market fell below the pre-low low of 5740. After the start of morning trading, the futures price fluctuated slightly, rose slightly, and the afternoon price rose obviously, returning to above 5800 and the increase was OK. 2405 contracts range from 5740 to 5850 throughout the day, with a spread of 1105.05 and a reduction of 23669 of the current position of 767784 hands. The 2409 contract closed at 5947, with 80325 positions.

PVC Future Forecast:

Futures: & the operation of the nbsp; PVC2405 contract futures disk price fluctuates at first, and then the position changes greatly, from night trading to daytime market increase of more than 36000 hands to the final reduction of 24000 hands, the entry and exit of short-term hot money is very obvious. In the process of the overall futures price decline, the short-term short order increased, the operating low of the futures price fell below the previous low of 5754, and a new low of 5740 appeared, further aggravating the pre-holiday short-term atmosphere, but the price rebounded in the afternoon with the reduction of positions. The technical level shows that the opening of the third track of the Bollinger belt (13, 13, 2) is open, the low point of the futures price is slightly lower than the lower rail support level, the corresponding lower shadow line is poor, and some of the low level interval is more open. We believe that in the short term, with the shortening of the trading day, the market will participate cautiously.

Spot: futures market volatility has expanded today, first of all in the downward phase of the low point before the successful refresh before the low, once a substantial increase in positions, short-term hot money entry is obvious. However, for the spot market, the time limit is separated, although the futures price goes down, there are also some spot price offers in the spot market, but some businesses have begun to have a holiday, so the spot market is relatively inactive, only some merchants bid. After the afternoon price rebounded, the spot market atmosphere has picked up somewhat, but in the market with price but no market, the price changes are not frequent, so on the whole, although the futures market is active, the spot market gradually stagnates. In the outer disk, the price of the international crude oil futures market closed higher as traders continued to pay attention to tensions in areas such as the Red Sea and worried about oil supply disruptions caused by geopolitical tensions, but comments by Fed officials in no hurry to cut interest rates pushed up the dollar and limit the rise in oil prices. On the whole, we still think that the spot market enters the rhythm of price but no market.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 2.5 |

Price 2.6 |

Rate of change |

|

V2405 collection |

5792 |

5842 |

50 |

|

|

Average spot price in East China |

5585 |

5580 |

-5 |

|

|

Average spot price in South China |

5650 |

5640 |

-10 |

|

|

PVC2405 basis difference |

-207 |

-262 |

-55 |

|

|

V2409 collection |

5902 |

5947 |

45 |

|

|

V2405-2409 close |

-110 |

-105 |

5 |

|

|

PP2405 collection |

7316 |

7383 |

67 |

|

|

Plastic L2405 collection |

8095 |

8142 |

47 |

|

|

V--PP basis difference |

-1524 |

-1541 |

-17 |

|

|

Vmure-L basis difference of plastics |

-2303 |

-2300 |

3 |

|

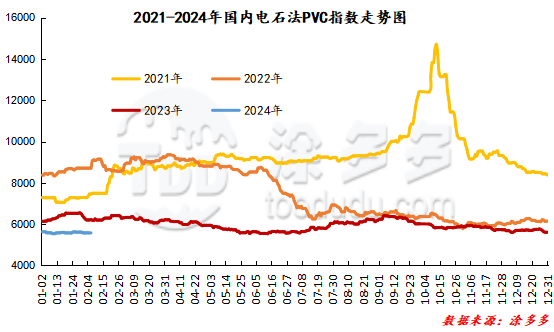

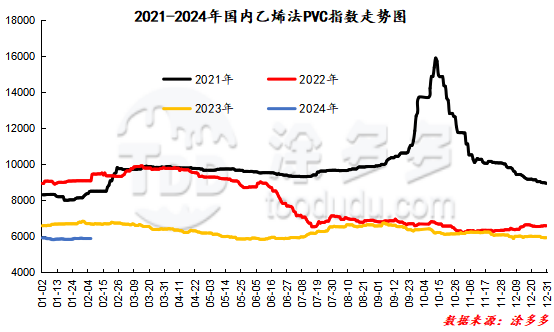

China PVC Index: according to Tuduoduo data, the China calcium Carbide PVC spot Index fell 3.69 or 0.066 per cent to 5572.23 on February 6th. The PVC spot index of ethylene method is 5877.54, down 0%, the range is 0%, the index of calcium carbide method is down, the index of ethylene method is stable, and the price difference between ethylene method and calcium carbide method is 305.31.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

2.5 warehouse orders |

2.6 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

2,645 |

2,645 |

0 |

|

|

Guangzhou materials |

943 |

943 |

0 |

|

|

China Central Reserve Nanjing |

1,702 |

1,702 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

2,425 |

2,425 |

0 |

|

|

Zhenjiang Middle and far Sea |

1,522 |

1,522 |

0 |

|

|

Middle and far sea in Jiangyin |

903 |

903 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

5,326 |

5,326 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

2,723 |

2,723 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

4,790 |

4,790 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

21,402 |

21,402 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

3,678 |

3,678 |

0 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

639 |

639 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,682 |

3,682 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,494 |

1,494 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

1,387 |

1,387 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

57,573 |

57,573 |

0 |

|

Total |

|

57,573 |

57,573 |

0 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.