- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

Gasoline: The market buying and selling atmosphere has weakened, and refinery transaction policies have been flexible

International crude oil closes

|

date |

market |

specifications |

Closing (USD/barrel) |

rise and fall |

|

20240202 |

US |

WTI |

72.28 |

-1.54 |

|

20240202 |

British |

Brent |

77.33 |

-1.37 |

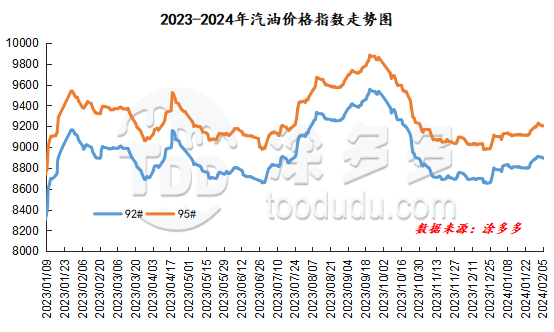

Gasoline price index

On February 5, China's 92 #gasoline price index was 8892.88, down 7.70, or 0.09%; China's 95 #gasoline price index was 9198.08, down 6.87, or 0.07%. Both the 92 #gasoline index and the 95 #gasoline index were lowered, and the price difference between the 92 #gasoline index and the 95 #gasoline index was 305.20.

Gasoline Market Analysis:

Today, the wholesale prices of China's main units have been mostly adjusted within the region. High-end gasoline prices in some regions have been reduced within a narrow range, with the reduction range concentrated at 30-50 yuan/ton; the ex-factory price of local refineries has been increased in some regions, including gasoline prices in Shandong and North China. Prices increased by 20-100 yuan/ton; gasoline prices in other regions have remained stable. At present, the trading atmosphere in China's gasoline market is generally general. Rain and snow weather in the northern region has increased, and logistics and transportation have been blocked, which suppresses gasoline shipments. In addition, as the end of the year is approaching, companies have gradually delisted, the overall market purchasing and sales atmosphere has weakened, and refinery transaction policies have been relatively flexible.

|

Main wholesale price of gasoline on February 5 (yuan/ton) |

||||

|

areas |

Gasoline model |

Price 2.4 |

Price 2.5 |

rise and fall |

|

in North China |

92# |

8450-9581 |

8450-9581 |

0/0 |

|

95# |

8650-9942 |

8650-9942 |

0/0 |

|

|

South China |

92# |

8850-9880 |

8850-9850 |

0/-30 |

|

95# |

9050-10180 |

9050-10150 |

0/-30 |

|

|

central China |

92# |

8750-9400 |

8750-9400 |

0/0 |

|

95# |

8900-9700 |

8900-9700 |

0/0 |

|

|

East China |

92# |

8600-9010 |

8600-9060 |

0/50 |

|

95# |

8800-9350 |

8800-9350 |

0/0 |

|

|

northwestern region |

92# |

8680-9977 |

8680-9977 |

0/0 |

|

95# |

8880-10558 |

8880-10558 |

0/0 |

|

|

southwestern region |

92# |

8950-9650 |

8950-9650 |

0/0 |

|

95# |

9200-9950 |

9200-9950 |

0/0 |

|

|

Northeast China |

92# |

8450-9000 |

8450-9000 |

0/0 |

|

95# |

8700-9600 |

8700-9600 |

0/0 |

|

|

Ex-factory price of local gasoline refining on February 5 (yuan/ton) |

||||

|

areas |

Gasoline model |

Price 2.4 |

Price 2.5 |

rise and fall |

|

Shandong area |

92# |

8300-8710 |

8300-8730 |

0/20 |

|

95# |

8500-8870 |

8500-8890 |

0/20 |

|

|

in North China |

92# |

8460-8530 |

8480-8630 |

20/100 |

|

95# |

8510-8630 |

8530-8730 |

20/100 |

|

|

central China |

92# |

8700-8700 |

8700-8700 |

0/0 |

|

95# |

8900-8900 |

8900-8900 |

0/0 |

|

|

East China |

92# |

8410-8480 |

8410-8480 |

0/0 |

|

95# |

8530-8610 |

8530-8590 |

0/0 |

|

|

northwestern region |

92# |

8350-8600 |

8350-8600 |

0/0 |

|

95# |

8500-8800 |

8500-8800 |

0/0 |

|

|

Northeast China |

92# |

8400-8430 |

8400-8430 |

0/0 |

|

95# |

8600-8600 |

8600-8600 |

0/0 |

|

|

southwestern region |

92# |

8950-8950 |

8950-8950 |

0/0 |

|

95# |

9100-9100 |

9100-9100 |

0/0 |

|

market outlook

In terms of international crude oil, the atmosphere of OPEC production cuts still exists. On the geopolitical front, Palestine and Israel have not formally reached an agreement. It is expected that there may be room for oil prices to rise next week. The market has been on holiday one after another, coupled with rainy and snowy weather in some areas in the north, the number of logistics and transportation vehicles has been reduced, and operators have been delisted one after another, and the demand for gasoline has been significantly reduced. Overall, China's gasoline market is expected to remain weak in the short term.