- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

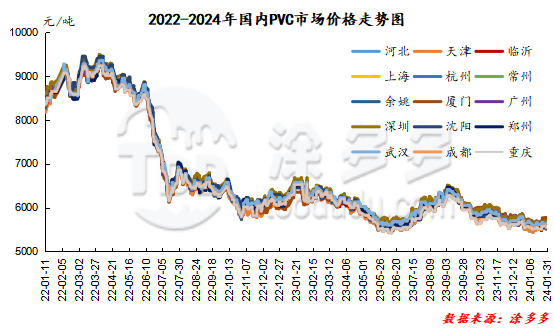

Weekend market analysis: the mainstream transaction prices in China's PVC market are temporarily stable, and the ex-factory prices of upstream manufacturers PVC have not been significantly adjusted, and most merchants have feedback that although there are quotations, the first-generation contracts have been suspended. PVC futures are closed on Sunday, so there is a lack of spot price offer in China's spot market, while the offer is not active. Some traders begin to have a holiday one after another, and some of the one-time offer continues on Friday, with few transactions and offers, and few spot supplies in the market. Downstream procurement spot enthusiasm is low, the spot market trading atmosphere is relatively light. Friday night trading time futures rose slightly, the overall fluctuation range of night trading between 5807-5848 points, but showed a certain reduction of more than 13000 hands of the situation, some funds left the market. And it is expected that in next week's trading day, the stock volume will continue to reduce positions and leave the market to avoid risk. On the whole, the weekend market presents a holiday pattern, especially in the spot market.

List of comprehensive prices by region: yuan / ton

|

Area |

February second |

February fourth |

Rise and fall |

Remarks |

|

North China |

5470-5550 |

5470-5550 |

0/0 |

Send to cash remittance |

|

East China |

5560-5640 |

5560-5640 |

0/0 |

Cash out of the warehouse |

|

South China |

5620-5680 |

5620-5680 |

0/0 |

Cash out of the warehouse |

|

Northeast China |

5450-5600 |

5450-5600 |

0/0 |

Send to cash remittance |

|

Central China |

5560-5600 |

5560-5600 |

0/0 |

Send to cash remittance |

|

Southwest |

5490-5600 |

5490-5600 |

0/0 |

Kuti / send to |

Market analysis of the two markets: with the passage of time, the Spring Festival is coming quietly, and the market performance of the two markets is weak in January and early February. First of all, the price adjustments of the two cities are relatively small every day, and continue to tentatively confirm the bottom space. Secondly, the spot market, especially the downstream demand-side products enterprises, began to enter the holiday mode one after another after mid-January, and the turnover in the spot market gradually lightened. The futures market has fluctuated between 5754 and 5970 points since January, and positions have been reduced continuously since late January, with funds leaving the market to wait and see, but after the futures price rose to a high range, there was a certain increase in positions in early February, with the entry of hedging policies on the one hand and short-term speculative positions on the other. Futures prices began to explore the range of low bottom space 5750-5800 on January 10, and some merchants in the spot market also carried out corresponding hoarding behavior in the corresponding spot prices, although the two cities have a consensus that there are weak fundamentals, but its downward space continues to narrow, so some merchants hoard goods during this period of time. However, in late January and early February, after the two cities weakened again, different psychology began to appear in the spot market, and some merchants thought that greater accumulation would be formed before the festival and during the Spring Festival. therefore, even after the festival will perform poorly in the corresponding period of time, the two cities do not have a good upside premise, so in this period of time, middlemen do not see more hoarding behavior.

Future market forecast: the current futures market performance is weak, pre-festival futures prices are even forced back to the low range, from a technical point of view, the Bollinger belt trend of all three tracks turn down, the daily line-level KD line and MACD line show a dead-fork trend, and there is an expanding trend, so if the outer disk is not unexpectedly stimulated during the holiday period after the festival, the trend of low finishing may be continued after the festival. If the outer disk fluctuates or appears on the first day after the festival. In view of the current high inventory and the continued accumulation of inventory during the holiday period, the spot market also needs some time to digest after the holiday, and the spot market may still show a trend of narrow adjustment.

The information provided in this report is for reference only.