- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC futures analysis: January 29th V2405 contract opening price: 5898, highest price: 5954, lowest price: 5886, position: 731778, settlement price: 5922, yesterday settlement: 5913, down: 9, daily trading volume: 602648 lots, precipitated capital: 3.043 billion, capital outflow: 8.62 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 1.26 |

Price 1.29 |

Rise and fall |

Remarks |

|

North China |

5500-5560 |

5510-5570 |

10/10 |

Send to cash remittance |

|

East China |

5640-5700 |

5650-5700 |

10/0 |

Cash out of the warehouse |

|

South China |

5620-5700 |

5650-5720 |

30/20 |

Cash out of the warehouse |

|

Northeast China |

5450-5650 |

5450-5650 |

0/0 |

Send to cash remittance |

|

Central China |

5560-5610 |

5560-5610 |

0/0 |

Send to cash remittance |

|

Southwest |

5510-5650 |

5510-5650 |

0/0 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction price range collation, a small flexible adjustment in various regions. Compared with the valuation, North China rose 10 yuan / ton, East China 10 yuan / ton, South China 20-30 yuan / ton, and Northeast, Central China and Southwest China were stable. The ex-factory price of upstream PVC production enterprises basically remained stable, and the price did not see a significant adjustment on Monday. The trend of futures is strong at first and then weak. the spot market offer in the morning part of the price is slightly higher than last Friday, but the transaction is not much, and then the point price increases after the price goes down, and the basis price does not change much as a whole. among them, East China basis offer 05 contract-(250-300), South China 05 contract-(200-250), North 05 contract-(550-600), Southwest 05 contract-(300). Although spot market point price and one-off price offer coexist, but the two spot sales models are not good, demand is weaker, and trading in the spot market is slightly light.

Futures perspective: PVC2405 contract night trading opened in a narrow range on Friday, followed by a slight rise in futures prices. Futures prices rose further after the start of morning trading on Monday, reaching a peak of 5954 again, but prices began to decline slightly after the high appeared and rose slightly in late afternoon trading. 2405 contracts range from 5886 to 5954 throughout the day, with a spread of 68,5005.The position of the contract has been reduced by 7927 hands, and the position has been held so far by 731778 lots. The 2409 contract closed at 6051, with 73864 positions.

PVC Future Forecast:

Futures: & the high point of nbsp; PVC2405 contract price retests the range of high range 5900-5950. First of all, positions continue to be reduced, and the trading period from the holiday this week will be gradually shortened, with the volume now reaching more than 730000 hands. The volume of trading is still open in short, of which 22.3% is open in blank compared with 21.7% more, especially under the high price, on the one hand, there are hedging policies, on the other hand, there are short-term empty orders. The technical level shows that the opening of the third rail of the Bolin belt (13,13,2) narrows obviously, the future price runs between the middle and upper tracks, and the recent narrow fluctuation range shortens the distance of the third rail. The KD line of the daily line level shows a dead fork. In the short term, the operation of the futures price may still test the position on the track, and observe the pressure performance in the direction of 5960.

Spot aspect: period the two cities show a slight deviation, first of all, futures trading is still relatively active, a total of 602648 main contracts in a single day, long and short parties still participate. However, after entering the spot market this week, the downstream demand side products enterprises have more holidays, and the spot demand is getting lower and lower, and under the current futures and current market prices, the spot transaction is light, mainly buying down without buying up, and low hanging orders with rigid demand for replenishment. Coupled with the previous low prices under some merchants and middlemen hoarding goods, leading to the current spot market gradually has no market, another part of the production enterprises this week before the festival or the last bid, but in view of the current futures price changes, it is expected that the spot factory price will not be too low. Therefore, the current operation of the two cities may be gradually dispersed. PVC fundamentals calcium carbide prices began to fall by 50 yuan / ton. On the whole, the spot market will continue to sort out in a small range in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 1.26 |

Price 1.27 |

Rate of change |

|

V2405 collection |

5893 |

5940 |

47 |

|

|

Average spot price in East China |

5670 |

5675 |

5 |

|

|

Average spot price in South China |

5660 |

5685 |

25 |

|

|

PVC2405 basis difference |

-223 |

-265 |

-42 |

|

|

V2409 collection |

6001 |

6051 |

50 |

|

|

V2405-2409 close |

-108 |

-111 |

-3 |

|

|

PP2405 collection |

7443 |

7519 |

76 |

|

|

Plastic L2405 collection |

8238 |

8314 |

76 |

|

|

V--PP basis difference |

-1550 |

-1579 |

-29 |

|

|

Vmure-L basis difference of plastics |

-2345 |

-2374 |

-29 |

|

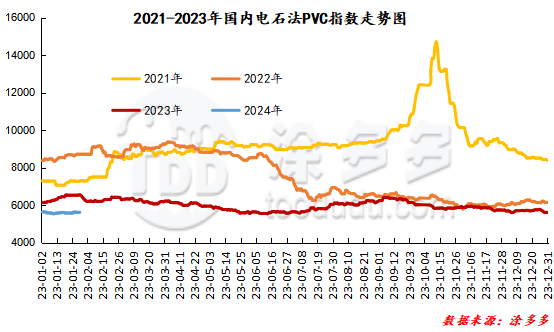

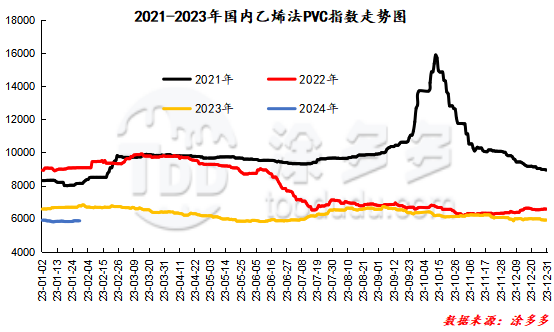

China PVC Index: according to Tudor data, the spot index of China's calcium carbide PVC rose 5622, or 0.162%, to 5622 on January 29th. The ethylene method PVC spot index is 5895.46, up 18.02, the range is 0.307%, the calcium carbide method index rises, the ethylene method index rises, the ethylene method-calcium carbide method index price difference is 273.46.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

1.26 warehouse orders |

1.29 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

2,645 |

2,645 |

0 |

|

|

Guangzhou materials |

943 |

943 |

0 |

|

|

China Central Reserve Nanjing |

1,702 |

1,702 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

2,425 |

2,425 |

0 |

|

|

Zhenjiang Middle and far Sea |

1,522 |

1,522 |

0 |

|

|

Middle and far sea in Jiangyin |

903 |

903 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

5,546 |

5,546 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

2,723 |

2,723 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

4,658 |

4,658 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

21,266 |

21,266 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

3,678 |

3,678 |

0 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

639 |

639 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,682 |

3,682 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,494 |

1,494 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

1,387 |

1,387 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

57,525 |

57,525 |

0 |

|

Total |

|

57,525 |

57,525 |

0 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.