- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

Gasoline: The market remains weak and the market is not sufficiently driven upward

International crude oil closes

|

date |

market |

specifications |

Closing (USD/barrel) |

rise and fall |

|

20240116 |

US |

WTI |

72.4 |

-0.28 |

|

20240116 |

British |

Brent |

78.29 |

0.14 |

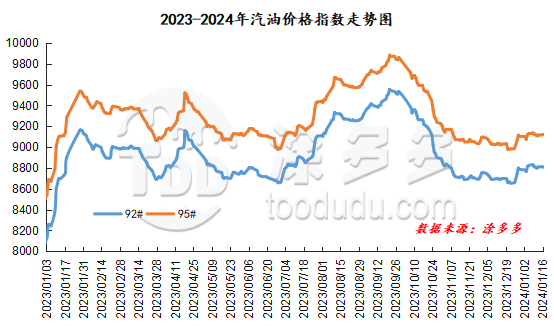

Gasoline price index

On January 17, China's 92 #gasoline price index was 8810.51, an increase of 2.70, or 0.03%; China's 95 #gasoline price index was 9121.95, an increase of 5.30, or 0.06%. Both the 92 #gasoline index and the 95 #gasoline index were raised, and the price difference between the 92 #gasoline index and the 95 #gasoline index was 311.44.

Gasoline Market Analysis:

Today, most of the main wholesale prices of gasoline in China have been consolidated in the region. High-end gasoline prices have fallen in some areas, and gasoline prices in East China have increased in a narrow range. Ex-factory prices of local refineries remain weak, with gasoline prices in Shandong, North China, Central China and East China lowered, with the reduction range concentrated at 30-60 yuan/ton. Gasoline prices in the northwest, northeast and southwest regions are relatively stable. At present, transactions in China's gasoline market are light, crude oil is mixed overnight, retail price limits are about to be realized, the wait-and-see atmosphere in the middle and lower reaches is not good, and small orders are needed in addition to the elimination of warehouses; pressure on refinery performance is gradually emerging, and refineries are flexibly adjusted according to their own circumstances, and preferential transaction policies are still in place.

|

Main wholesale price of gasoline on January 17 (yuan/ton) |

||||

|

areas |

Gasoline model |

Price 1.16 |

Price 1.17 |

rise and fall |

|

in North China |

92# |

8450-9397 |

8450-9397 |

0/0 |

|

95# |

8650-9752 |

8650-9752 |

0/0 |

|

|

South China |

92# |

8750-9580 |

8750-9580 |

0/0 |

|

95# |

8950-9880 |

8950-9880 |

0/0 |

|

|

central China |

92# |

8750-9200 |

8730-9200 |

-20/0 |

|

95# |

8950-9500 |

8950-9500 |

0/0 |

|

|

East China |

92# |

8550-9100 |

8550-9100 |

0/0 |

|

95# |

8750-9500 |

8750-9500 |

0/0 |

|

|

northwestern region |

92# |

8750-9800 |

8750-9800 |

0/0 |

|

95# |

8950-10050 |

8950-10050 |

0/0 |

|

|

southwestern region |

92# |

8850-9280 |

8850-9250 |

0/-30 |

|

95# |

9000-9730 |

9000-9680 |

0/-50 |

|

|

Northeast China |

92# |

8470-9150 |

8470-9000 |

0/-150 |

|

95# |

8730-9600 |

8730-9600 |

0/0 |

|

|

Ex-factory price of local gasoline refining on January 17 (yuan/ton) |

||||

|

areas |

Gasoline model |

Price 1.16 |

Price 1.17 |

rise and fall |

|

Shandong area |

92# |

8230-8650 |

8170-8610 |

-60/-40 |

|

95# |

8400-8810 |

8340-8770 |

-60/-40 |

|

|

in North China |

92# |

8380-8420 |

8330-8390 |

-50/-30 |

|

95# |

8430-8520 |

8380-8490 |

-50/-30 |

|

|

central China |

92# |

8610-8610 |

8580-8580 |

-30/-30 |

|

95# |

8810-8810 |

8780-8780 |

-30/-30 |

|

|

East China |

92# |

8380-8500 |

8380-8470 |

0/-30 |

|

95# |

8500-8610 |

8500-8580 |

0/-30 |

|

|

northwestern region |

92# |

8450-8650 |

8450-8650 |

0/0 |

|

95# |

8600-8850 |

8600-8850 |

0/0 |

|

|

Northeast China |

92# |

8400-8430 |

8400-8430 |

0/0 |

|

95# |

8600-8600 |

8600-8600 |

0/0 |

|

|

southwestern region |

92# |

8850-8850 |

8850-8850 |

0/0 |

|

95# |

9000-9000 |

9000-9000 |

0/0 |

|

market outlook

China released GDP data for 2023: GDP for the whole year of 2023 will increase by 5.2% compared with 2022; GDP in the fourth quarter will increase by 1.0%. China's positive economic data boosts market mentality. In addition, the geopolitical instability in the Middle East is still continuing, and the OPEC monthly report is about to be released or bring new positive news. Overall, positive factors in the international crude oil market have increased, and international oil prices may be expected to rise. Most areas in northern China are facing rainy and snowy weather. The obstruction of logistics and transportation has also curbed demand, and refinery shipments have slowed down. The performance in terms of demand is average. The current performance of hoarding before the Spring Festival is insufficient, and there are no other positive results. Overall, China's gasoline market is expected to remain weak in the short term.