- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

Gasoline: Lack of good news guidance, the gasoline market continues to be weak

International crude oil closes

|

date |

market |

specifications |

Closing (USD/barrel) |

rise and fall |

|

20240115 |

US |

WTI |

- |

- |

|

20240115 |

British |

Brent |

78.15 |

-0.14 |

Note: WTI crude oil futures are closed for one day on Martin Luther King's Day and have no settlement price

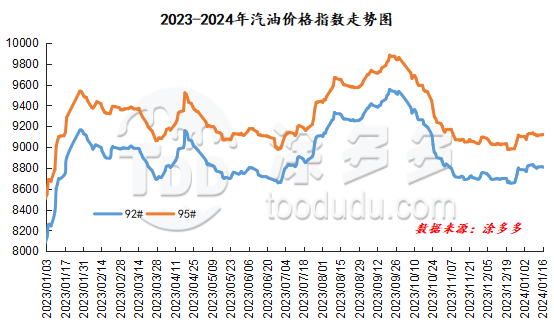

Gasoline price index

On January 16, China's 92 #gasoline price index was 8807.82, down 3.18, or 0.04%; China's 95 #gasoline price index was 9116.65, down 4.05, or 0.04%. Both the 92 #gasoline index and the 95 #gasoline index were lowered, and the price difference between the 92 #gasoline index and the 95 #gasoline index was 308.83.

Gasoline Market Analysis:

Today, the main wholesale price of gasoline in China is generally stable, with only the low-end gasoline price in the northwest region being lowered by 50 yuan/ton. The ex-factory prices of local refineries fell mostly. Among them, gasoline prices in Shandong, Central China and East China were slightly lowered, with the adjustment range of 20-50 yuan/ton; high-end gasoline prices in Northwest China dropped significantly, with a reduction of 150 yuan/ton. At present, transactions in China's gasoline market are light, and crude oil closed down overnight. The market mentality is cautious, but expectations of hoarding before the Spring Festival support oil prices, and the main units are not willing to take the initiative to lower prices. Independent refineries flexibly adjust their quotations according to their own circumstances, with shipments mainly flowing.

|

Main wholesale price of gasoline on January 16 (yuan/ton) |

||||

|

areas |

Gasoline model |

Price 1.15 |

Price 1.16 |

rise and fall |

|

in North China |

92# |

8450-9397 |

8450-9397 |

0/0 |

|

95# |

8650-9752 |

8650-9752 |

0/0 |

|

|

South China |

92# |

8750-9580 |

8750-9580 |

0/0 |

|

95# |

8950-9880 |

8950-9880 |

0/0 |

|

|

central China |

92# |

8750-9200 |

8750-9200 |

0/0 |

|

95# |

8950-9500 |

8950-9500 |

0/0 |

|

|

East China |

92# |

8550-9100 |

8550-9100 |

0/0 |

|

95# |

8750-9500 |

8750-9500 |

0/0 |

|

|

northwestern region |

92# |

8800-9800 |

8750-9800 |

-50/0 |

|

95# |

9000-10050 |

8950-10050 |

-50/0 |

|

|

southwestern region |

92# |

8850-9280 |

8850-9280 |

0/0 |

|

95# |

9000-9730 |

9000-9730 |

0/0 |

|

|

Northeast China |

92# |

8470-9150 |

8470-9150 |

0/0 |

|

95# |

8730-9600 |

8730-9600 |

0/0 |

|

|

Ex-factory price of local gasoline refining on January 16 (yuan/ton) |

||||

|

areas |

Gasoline model |

Price 1.15 |

Price 1.16 |

rise and fall |

|

Shandong area |

92# |

8250-8700 |

8230-8650 |

-20/-50 |

|

95# |

8420-8860 |

8400-8810 |

-20/-50 |

|

|

in North China |

92# |

8380-8420 |

8380-8420 |

0/0 |

|

95# |

8430-8520 |

8430-8520 |

0/0 |

|

|

central China |

92# |

8660-8660 |

8610-8610 |

-50/-50 |

|

95# |

8860-8860 |

8810-8810 |

-50/-50 |

|

|

East China |

92# |

8410-8500 |

8380-8500 |

-30/0 |

|

95# |

8530-8610 |

8500-8610 |

-30/0 |

|

|

northwestern region |

92# |

8450-8800 |

8450-8650 |

0/-150 |

|

95# |

8600-9000 |

8600-8850 |

0/-150 |

|

|

Northeast China |

92# |

8380-8400 |

8400-8430 |

20/30 |

|

95# |

8600-8600 |

8600-8600 |

0/0 |

|

|

southwestern region |

92# |

8850-8850 |

8850-8850 |

0/0 |

|

95# |

9000-9000 |

9000-9000 |

0/0 |

|

market outlook

From the perspective of international crude oil, geopolitical events continue to be unstable, and the risks brought to the supply level remain undiminished. International oil prices are more uncertain and the trend is not clear enough. In China's gasoline market, judging from the refined oil price adjustment mechanism, there are certain stranded expectations that the retail price limit is expected to be lowered. It is also necessary to pay attention to the crude oil fluctuation data for the next working day. The news is negative for guidance. In addition, the current market demand for gasoline is generally performing, and there is no good support. And as we enter the middle and late months of the month, the pressure on some refineries may increase and their willingness to support prices may decrease. Overall, it is expected that China's gasoline market will remain weak in the short term.