- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

Gasoline: Insufficient demand-side support, weak gasoline market

International crude oil closes

|

date |

market |

specifications |

Closing (USD/barrel) |

rise and fall |

|

20240112 |

US |

WTI |

72.68 |

0.66 |

|

20240112 |

British |

Brent |

78.29 |

0.88 |

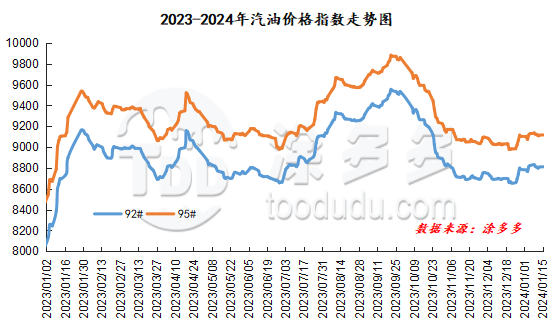

Gasoline price index

On January 15, China's 92 #gasoline price index was 8810.99, an increase of 2.68, or 0.03%; China's 95 #gasoline price index was 9120.70, an increase of 4.09, or 0.04%. Both the 92 #gasoline index and the 95 #gasoline index were raised, and the price difference between the 92 #gasoline index and the 95 #gasoline index was 309.70.

Gasoline Market Analysis:

Today, the main wholesale price of gasoline in China fluctuated within a narrow range, with gasoline prices in North China, Central China and Southwest China adjusted by 20-50 yuan/ton. Gasoline prices in other regions are relatively stable. The ex-factory price of local refineries was mainly lowered compared with last Friday, with gasoline prices in Shandong, North China, Central China and Southwest China being lowered by 30-130 yuan/ton; while gasoline prices in East China were increased by 30-40 yuan/ton. Gasoline prices remained unchanged in the Northwest and Northeast regions. At present, transactions in China's gasoline market are flat, market operations are relatively weak, procurement enthusiasm in the middle and lower reaches is not high, and demand support is insufficient. Transaction prices of refineries in areas with poor sales have dropped, and preferential policies exist for transactions. Overall, the wait-and-see atmosphere still exists, and the market is weak.

|

Main wholesale price of gasoline on January 15 (yuan/ton) |

||||

|

areas |

Gasoline model |

Price 1.12 |

Price 1.15 |

rise and fall |

|

in North China |

92# |

8430-9397 |

8450-9397 |

20/0 |

|

95# |

8630-9752 |

8650-9752 |

20/0 |

|

|

South China |

92# |

8750-9580 |

8750-9580 |

0/0 |

|

95# |

8950-9880 |

8950-9880 |

0/0 |

|

|

central China |

92# |

8750-9170 |

8750-9200 |

0/30 |

|

95# |

8950-9470 |

8950-9500 |

0/30 |

|

|

East China |

92# |

8550-9100 |

8550-9100 |

0/0 |

|

95# |

8750-9500 |

8750-9500 |

0/0 |

|

|

northwestern region |

92# |

8550-9800 |

8550-9800 |

0/0 |

|

95# |

9000-10050 |

9000-10050 |

0/0 |

|

|

southwestern region |

92# |

8880-9230 |

8850-9280 |

-30/50 |

|

95# |

9080-9680 |

9000-9730 |

-80/50 |

|

|

Northeast China |

92# |

8450-9150 |

8470-9150 |

20/0 |

|

95# |

8730-9600 |

8730-9600 |

0/0 |

|

|

Ex-factory price of local gasoline refining on January 15 (yuan/ton) |

||||

|

areas |

Gasoline model |

Price 1.12 |

Price 1.15 |

rise and fall |

|

Shandong area |

92# |

8250-8710 |

8250-8700 |

0/-10 |

|

95# |

8420-8900 |

8420-8860 |

0/-40 |

|

|

in North China |

92# |

8440-8450 |

8380-8420 |

-60/-30 |

|

95# |

8490-8550 |

8430-8520 |

-60/-30 |

|

|

central China |

92# |

8790-8790 |

8660-8660 |

-130/-130 |

|

95# |

8990-8990 |

8860-8860 |

-130/-130 |

|

|

East China |

92# |

8370-8470 |

8410-8500 |

40/30 |

|

95# |

8490-8580 |

8530-8610 |

40/30 |

|

|

northwestern region |

92# |

8450-8800 |

8450-8800 |

0/0 |

|

95# |

8600-9000 |

8600-9000 |

0/0 |

|

|

Northeast China |

92# |

8380-8400 |

8380-8400 |

0/0 |

|

95# |

8600-8600 |

8600-8600 |

0/0 |

|

|

southwestern region |

92# |

8900-8900 |

8850-8850 |

-50/-50 |

|

95# |

9050-9050 |

9000-9000 |

-50/-50 |

|

market outlook

From the perspective of international crude oil, the instability of geopolitical events continues and the risks posed to the supply level remain undiminished. The development of the Red Sea incident is still a focus of attention for traders in the crude oil market recently. At the same time, OPEC has a firm attitude towards production cuts. Whether the OPEC meeting will bring new guidance is also worthy of attention. In China's gasoline market, judging from the price adjustment mechanism of refined oil products, a new round of retail price limits is expected to be lowered, with negative news guidance. In addition, expectations for hoarding before the Spring Festival are still in place, but the current gasoline demand in the market is relatively stable and lacks good news. On the whole, China's gasoline market is expected to remain stable in the short term.