- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

Gasoline: The main wholesale price has slightly increased, while the ex-factory price of local refineries has been relatively stable

International crude oil closes

|

date |

market |

specifications |

Closing (USD/barrel) |

rise and fall |

|

20240111 |

US |

WTI |

72.02 |

0.65 |

|

20240111 |

British |

Brent |

77.41 |

0.61 |

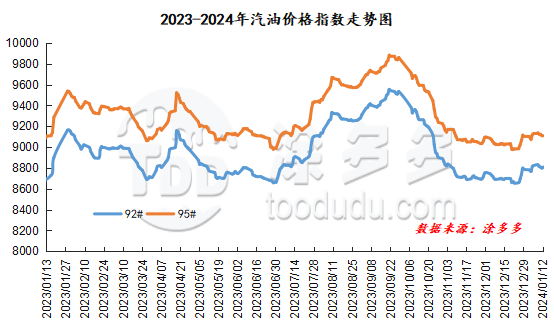

Gasoline price index

On January 12, China's 92 #gasoline price index was 8808.31, up 9.85, or 0.11%; China's 95 #gasoline price index was 9116.61, up 7.22, or 0.08%. Both the 92 #gasoline index and the 95 #gasoline index were raised, and the price difference between the 92 #gasoline index and the 95 #gasoline index was 308.30.

Gasoline Market Analysis:

Today, the main wholesale price of gasoline in China has increased slightly, with gasoline prices in North China, South China, Central China and Southwest China increasing by 20-50 yuan/ton. Gasoline prices in other regions have stabilized. The overall ex-factory price of local refineries is relatively stable, and the high-end gasoline price in East China has dropped significantly, down by 100 yuan/ton. At present, transactions in China's gasoline market are average. Crude oil closed up overnight. In the middle and lower reaches, we just need to purchase while eliminating warehouses. Refinery shipments performed well, and refinery quotations in areas with better sales have slightly increased.

|

Main wholesale price of gasoline on January 12 (yuan/ton) |

||||

|

areas |

Gasoline model |

Price 1.11 |

Price 1.12 |

rise and fall |

|

in North China |

92# |

8400-9397 |

8430-9397 |

30/0 |

|

95# |

8600-9752 |

8630-9752 |

30/0 |

|

|

South China |

92# |

8700-9550 |

8750-9580 |

50/30 |

|

95# |

8900-9850 |

8950-9880 |

50/30 |

|

|

central China |

92# |

8750-9150 |

8750-9170 |

0/20 |

|

95# |

8950-9450 |

8950-9470 |

0/20 |

|

|

East China |

92# |

8550-9100 |

8550-9100 |

0/0 |

|

95# |

8750-9500 |

8750-9500 |

0/0 |

|

|

northwestern region |

92# |

8550-9800 |

8550-9800 |

0/0 |

|

95# |

9000-10050 |

9000-10050 |

0/0 |

|

|

southwestern region |

92# |

8880-9200 |

8880-9230 |

0/30 |

|

95# |

9080-9650 |

9080-9680 |

0/30 |

|

|

Northeast China |

92# |

8580-9150 |

8580-9150 |

0/0 |

|

95# |

8730-9600 |

8730-9600 |

0/0 |

|

|

Ex-factory price of local gasoline refining on January 12 (yuan/ton) |

||||

|

areas |

Gasoline model |

Price 1.11 |

Price 1.12 |

rise and fall |

|

Shandong area |

92# |

8250-8700 |

8250-8700 |

0/0 |

|

95# |

8420-8900 |

8420-8900 |

0/0 |

|

|

in North China |

92# |

8440-8450 |

8440-8450 |

0/0 |

|

95# |

8490-8550 |

8490-8550 |

0/0 |

|

|

central China |

92# |

8790-8790 |

8790-8790 |

0/0 |

|

95# |

8990-8990 |

8990-8990 |

0/0 |

|

|

East China |

92# |

8370-8570 |

8370-8470 |

0/-100 |

|

95# |

8490-8680 |

8490-8580 |

0/-100 |

|

|

northwestern region |

92# |

8450-8800 |

8450-8800 |

0/0 |

|

95# |

8600-9000 |

8600-9000 |

0/0 |

|

|

Northeast China |

92# |

8380-8400 |

8380-8400 |

0/0 |

|

95# |

8600-8600 |

8600-8600 |

0/0 |

|

|

southwestern region |

92# |

8900-8900 |

8900-8900 |

0/0 |

|

95# |

9050-9050 |

9050-9050 |

0/0 |

|

market outlook

From the perspective of international crude oil, geopolitical events continue to disrupt the crude oil market and boost oil prices; U.S. December CPI data showed that U.S. inflation was higher than expected, and negative news such as the resumption of production of Libya oil fields still exists, but there is no obvious trend overall. China's gasoline market has been delayed during the Spring Festival, but combined with mid-term performance pressure, the market's positive and negative factors are intertwined, and we expect obvious factors to guide the market. The trend of international oil prices is unclear. From a mental point of view, the main market is not willing to actively lower prices. The wait-and-see mood in the Chinese gasoline market is surrounding. Overall, China's gasoline market is expected to stabilize in the short term.