- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

China Urea Price Index:

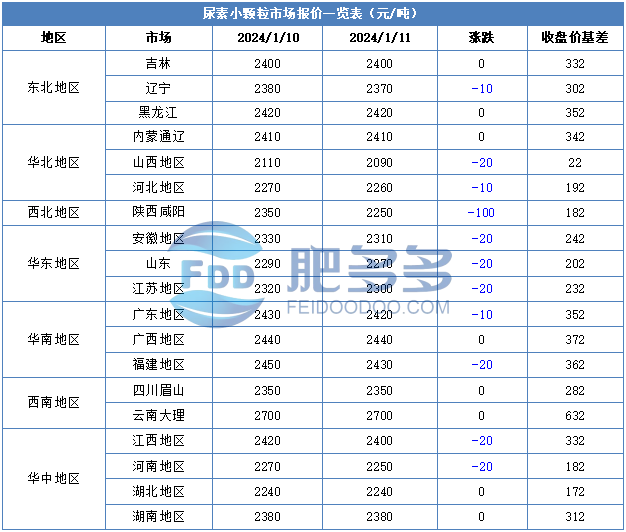

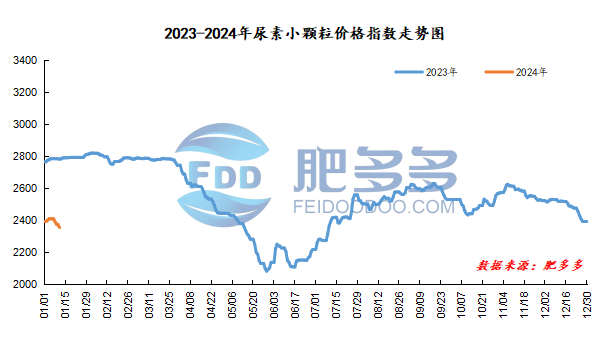

According to Feiduo data, the urea small pellet price index on January 11 was 2,353.00, a decrease of 13.82 from yesterday, a month-on-month decrease of 0.58%, and a year-on-year decrease of 15.40%.

Urea futures market:

Today, the opening price of the Urea UR405 contract is 2054, the highest price is 2083, the lowest price is 2025, the settlement price is 2055, and the closing price is 2068. The closing price is 1.1 lower than the settlement price of the previous trading day, down 0.05% month-on-month. The fluctuation range of the whole day is 2025-2083; the basis of the 05 contract in Shandong is 202; the 05 contract has increased its position by 6059 lots today, and so far, it has held 169,200 lots.

Spot market analysis:

Today, China's urea market prices continue to be weak and downward. Recently, agricultural cover positions have slowed down, market prices have continued to test, and the atmosphere continues to wait and see.

Specifically, prices in Northeast China fell to 2,360 - 2,420 yuan/ton. Prices in North China fell to 2,090 - 2,420 yuan/ton. Prices in East China fell to 2,260 - 2,320 yuan/ton. Prices in South China fell to 2,410 - 2,460 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,240 - 2,450 yuan/ton, and the price of large particles fell to 2,390 - 2,480 yuan/ton. Prices in Northwest China fell to 2,250 - 2,260 yuan/ton. Prices in Southwest China are stable at 2,300 - 2,800 yuan/ton.

Market outlook forecast:

In terms of factories, urea factories have successively started to collect orders before the Spring Festival. Most of the current ex-factory quotations have been lowered and sorted out, and new orders have been followed up in a small amount. Although the company's inventory has dropped, the market price has continued to drop. In terms of the market, although low-end prices in the urea market continue to emerge, the overall trading atmosphere is still short, and transactions continue to remain deadlocked. In terms of supply, the current industry supply is still low, the operating rate continues to fall, and Nissan is operating at a low level. Gas head maintenance equipment will be restarted in the middle and late stages of this month. Nissan will gradually recover, and urea prices will be under upward pressure. On the demand side, agricultural demand continues to require phased replenishment, which is limited in sustainability, which is difficult to benefit the market; downstream factories are cautious in filling up positions and just need to follow up appropriately, and the mood is mainly wait-and-see.

On the whole, the urea market is currently operating in a weak position and the overall atmosphere is deadlocked. With the continuous restart of maintenance equipment, it is expected that the urea market price will continue to maintain a large stability and a small decline in the short term.