- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC futures analysis: January 10 V2405 contract opening price: 5815, highest price: 5824, lowest price: 5755, position: 960682, settlement price: 5779, yesterday settlement: 5802, down: 23, daily trading volume: 676797 lots, precipitated capital: 3.878 billion, capital inflow: 103 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 1.9 |

Price 1.10 |

Rise and fall |

Remarks |

|

North China |

5430-5470 |

5410-5460 |

-20/-10 |

Send to cash remittance |

|

East China |

5510-5600 |

5500-5600 |

-10/0 |

Cash out of the warehouse |

|

South China |

5600-5650 |

5570-5650 |

-30/0 |

Cash out of the warehouse |

|

Northeast China |

5470-5620 |

5470-5620 |

0/0 |

Send to cash remittance |

|

Central China |

5520-5590 |

5520-5570 |

0/-20 |

Send to cash remittance |

|

Southwest |

5440-5570 |

5440-5570 |

0/0 |

Kuti / send to |

PVC spot market: mainstream transaction prices in China's PVC market are mainly weak and prices continue to fall slightly in some areas. Compared with the valuation, it fell by 10-20 yuan / ton in North China, 10 yuan / ton in East China, 30 yuan / ton in South China, stable in Northeast China, 20 yuan / ton in Central China and stable in Southwest China. Upstream PVC production enterprises mostly maintain stable ex-factory prices, some enterprises negotiate, individual enterprises slightly reduce the ex-factory price of 50 yuan / ton. Futures are on the low side, the price offer by traders in various regions has little reference significance, and there is no advantage when it is difficult to close a deal. The spot market is mainly point price offer, and the basis is slightly stronger. Among them, the basis difference offer 05 contract in East China-(180-250), South China 05 contract-(130-220), North 05 contract-(500-550), Southwest 05 contract-(250) After the previous price decline, some products enterprises have a rigid demand for replenishment, so although prices continue to weaken slightly today, trading in the spot market is flat, and some spot prices are on the low side.

Futures point of view: PVC2405 contract night trading price down slightly, falling below the 5800 mark after a narrow concussion. At the beginning of early trading, the price fell for two times in late trading, but it fell little in early trading and then rebounded slightly, and the price fell again in the afternoon and closed at a low in late trading. 2405 contracts range from 5755 to 5824 throughout the day, with a spread of 69. 05 contracts with an increase of 30819 positions and 960682 positions so far. The 2409 contract closed at 5871, with 65967 positions.

PVC Future Forecast:

Futures: PVC2405 contract futures run a continuous test low range of 5750-5800, and the market continues to show a significant downward trend of increasing futures prices, in which short opening 26.8% versus opening more than 23.0% still dominates the market, with more than 960000 positions approaching 1 million. The technical level shows that the opening of the third rail of the Bolin belt (13,13,2) has an obvious downward trend, especially the lower rail of the middle rail. The daily KD line and MACD line continue the trend of dead cross, and the futures price shows a continuous downward trend from the previous high of 6153. In the current downside state of increasing positions, short-term futures may still face further pressure, so be on guard against the low position of the second target before the contract.

Spot: futures prices in the two markets continue to weaken, and there is no better deal today, but the sound of hoarding in the spot market is rising, including downstream products companies. First of all, from the perspective of futures, the continuous downward test of the low range, the current two cities may still face greater pressure, the corresponding price paid by the short positions may be greater, and the weak fundamentals are indeed the overall consensus. Therefore, there are still bargaining chips in the current short positions, but the risk of continuing to decline increases accordingly. On the other hand, for the spot, there is still a certain recovery expectation after the mid-term festival, so although the short-term demand constraints are obvious and seasonal accumulation, but the demand in the middle line to the warehouse or there is still hope. In the outer disk, the price of the international crude oil futures market rose due to geopolitical tensions in the Middle East and the disruption of oil supply in Libya. On the whole, PVC spot prices continue the low consolidation trend in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 1.9 |

Price 1.10 |

Rate of change |

|

V2405 collection |

5800 |

5767 |

-33 |

|

|

Average spot price in East China |

5555 |

5550 |

-5 |

|

|

Average spot price in South China |

5625 |

5610 |

-15 |

|

|

PVC2405 basis difference |

-245 |

-217 |

28 |

|

|

V2409 collection |

5904 |

5871 |

-33 |

|

|

V2405-2409 close |

-104 |

-104 |

0 |

|

|

PP2405 collection |

7317 |

7209 |

-108 |

|

|

Plastic L2405 collection |

8025 |

7961 |

-64 |

|

|

V--PP basis difference |

-1517 |

-1442 |

75 |

|

|

Vmure-L basis difference of plastics |

-2225 |

-2194 |

31 |

|

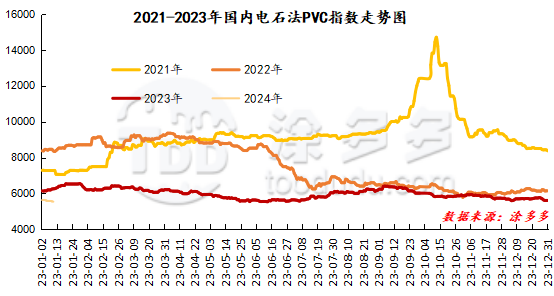

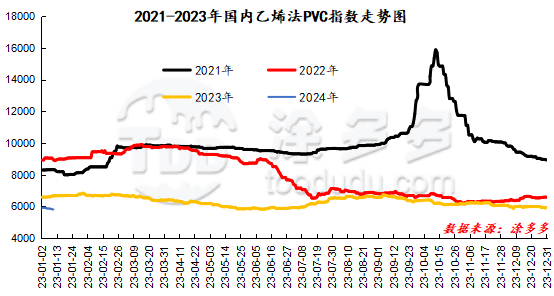

China PVC Index: according to Tuduoduo data, the spot index of China calcium Carbide PVC fell 9.13 or 0.165% to 5534.48 on January 10. The PVC spot index of ethylene method is 5816.61, down 0%, the range is 0%, the index of calcium carbide method is down, the index of ethylene method is stable, and the price difference between ethylene method and calcium carbide method is 282.13.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

1.9 warehouse orders |

1.10 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

2,245 |

2,245 |

0 |

|

|

Guangzhou materials |

963 |

963 |

0 |

|

|

China Central Reserve Nanjing |

1,282 |

1,282 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

1,315 |

1,315 |

0 |

|

|

Zhenjiang Middle and far Sea |

1,195 |

1,195 |

0 |

|

|

Middle and far sea in Jiangyin |

120 |

120 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

5,546 |

5,546 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

2,813 |

2,813 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

4,853 |

4,853 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

21,169 |

21,169 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

3,495 |

3,495 |

0 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

570 |

570 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,322 |

3,682 |

360 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

1,387 |

1,387 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

55,897 |

56,257 |

360 |

|

Total |

|

55,897 |

56,257 |

360 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.