- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

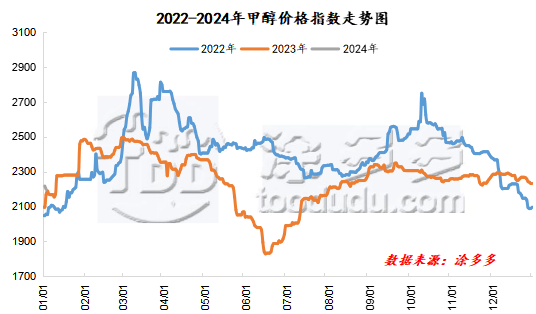

On January 8th, the methanol market price index was 2217.16, which was 5.93 higher than that of the previous working day and 0.27% higher than the previous working day.

Outer disk dynamics:

Methanol closed on January 5:

China CFR 280,284 US dollars / ton, down 1 US dollars / ton

Us FOB 95-96 cents per gallon, down 2 cents per gallon

Southeast Asia CFR 346.5-347.5 US dollars / ton, up 8 US dollars / ton

European FOB 284-285 euros / ton, stable.

Summary of today's prices:

Guanzhong: 2170-2220 (0), North Route: 1960-2000 (30), Lunan: 2380 (0), Henan: 2250-2260 (0), Shanxi: 2120-2200 (0), Port: 2385-2420 (- 20)

Freight:

North Route-Northern Shandong 200-300 (- 70 Universe Mueller 80), Southern Route-Northern Shandong 280-310 (30mp 30), Shanxi-Northern Shandong 150-200 (20 ppm 10), Guanzhong-Southwest Shandong 160-210 (- 20 amp 0)

Spot market: today, methanol market prices are adjusted in a narrow range, and the overall trading atmosphere in the market is different. with the continuous decline in prices last week, some manufacturers are looking for bargains, and some manufacturers are under the support of little inventory pressure, their quotations are pushed up by homeopathy. however, downstream demand follow-up is limited, there is not much room for price increases in the Chinese market. Specifically, the market prices in the main producing areas are adjusted in a narrow range, with the quotation on the southern route around 1950 yuan / ton and the northern line around 1960-2000 yuan / ton, the Jiutai plant is gradually restored, the market supply is still abundant, and the auction prices of some manufacturers are generally increased. After the new price in Guanzhong area is lowered, the deal is OK. The market prices in Shandong, the main consumer area, were adjusted narrowly, with 2380 yuan / ton in southern Shandong and 2300 yuan / ton in northern Shandong. At the beginning of the week, the wait-and-see mood of workers in the market was obvious, manufacturers shipped more small retail orders, and the overall trading atmosphere in the market was general. The market quotation in North China is adjusted in a narrow range. Hebei quotation is 2220-2300 yuan / ton today, while the lower end is reduced by 20 yuan / ton. manufacturers in the region still have a certain wait-and-see mood, and downstream rigid demand is mainly replenished. Shanxi region quotation stable operation, today's quotation stable to 2120-2200 yuan / ton, manufacturers do not have inventory pressure, business price mentality still exists, pay attention to tomorrow's market auction situation.

Port market: methanol futures fluctuated in a narrow range today. The spot covers the stock to cherish the sale, the rigid demand buys the plate to follow up, rises under the water month. Long-term arbitrage delivery, low point price to receive goods, the basis is strong. The overall transaction throughout the day is mediocre. Taicang main port transaction price: spot / small order: 2400-2415, base difference 05 "25cm" 40position 1 deal: 2390-2410, base difference 05x20 pound 25 position 1 deal: 2390-2410, base difference 0520pm 25position 2 transaction: 2395-2400, basis difference 05x25 position 2 : 2410-2420, with a base difference of 0540 and 45.

|

Area |

2024/1/8 |

2024/1/5 |

Rise and fall |

|

The whole country |

2217.16 |

2211.23 |

5.93 |

|

Northwest |

1960-2220 |

1930-2220 |

30/0 |

|

North China |

2120-2300 |

2120-2300 |

0/0 |

|

East China |

2385-2550 |

2405-2560 |

-20/-10 |

|

South China |

2395-2510 |

2390-2530 |

5/-20 |

|

Southwest |

2200-2600 |

2200-2600 |

0/0 |

|

Northeast China |

2250-2350 |

2200-2350 |

50/0 |

|

Shandong |

2270-2380 |

2300-2380 |

-30/0 |

|

Central China |

2250-2580 |

2250-2580 |

0/0 |

Future forecast: with the continuous downward adjustment of methanol prices in the early stage, there is a bargain-seeking replenishment operation in some of the lower reaches, and the inventory pressure of manufacturers in some areas is not great, but at present, the downstream of the terminal is limited, and some operators in the field still have a certain wait-and-see mood for the future. In addition, the 2 million-ton plant of Jiutai (Tuoxian) returned to normal, and Yanzhou Guohong's 640000 t / a coal-to-methanol plant was stopped and overhauled on January 4 and restarted today. The overall supply performance of the market is abundant, but the performance of the terminal downstream market is still poor, and it is difficult to alleviate the situation of oversupply in the short term. Overall, methanol market prices are expected to fluctuate in a narrow range in the short term. However, in the later stage, we need to pay close attention to the on-site transportation and downstream demand follow-up.