- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

Gasoline: Crude oil opened higher in intraday trading today, and gasoline prices fluctuated with the market

International crude oil closes

|

date |

market |

specifications |

Closing (USD/barrel) |

rise and fall |

|

20240101 |

US |

WTI |

- |

- |

|

20240101 |

British |

Brent |

- |

- |

Note: Due to the global New Year holiday, the international crude oil market is closed for one day and there is no settlement price

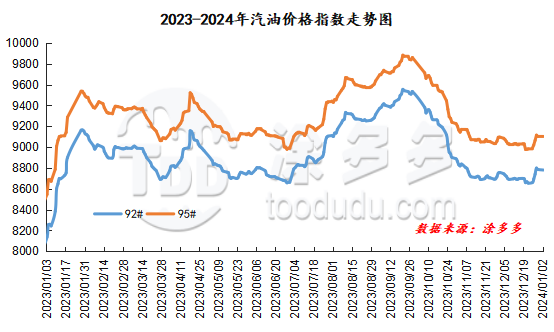

Gasoline price index

On January 2, China's 92 #gasoline price index was 8779.92, down 6.13, or 0.07%; China's 95 #gasoline price index was 9093.69, down 8.78, or 0.10%. Both the 92 #gasoline index and the 95 #gasoline index were lowered, and the price difference between the 92 #gasoline index and the 95 #gasoline index was 313.77.

Gasoline Market Analysis:

Today, the main wholesale prices of gasoline in China are mostly sorted out in the region. However, the low-end gasoline prices in Northeast China and the high-end gasoline prices in East China have been increased by 80-100 yuan/ton; the low-end gasoline prices in Southwest China have been lowered by 50 yuan/ton. The ex-factory prices of local refineries have fluctuated and fluctuated, with gasoline prices in North China and Central China increasing by 50-80 yuan/ton. Gasoline prices in East China have been lowered by 30 yuan/ton. The low-end price of gasoline in Shandong has been raised by 70 yuan/ton. High-end prices will be lowered by 30 yuan/ton. At present, the transaction atmosphere in China's gasoline market is mild. After the holiday, there is just a need to purchase after the elimination of warehouses in the middle and lower reaches. The main units have increased preferential policies for large volumes at the beginning of the year, and the shipment situation is better; crude oil opened higher in intraday trading today, and independent refineries 'prices are relatively stable.

|

Main wholesale price of gasoline on January 2 (yuan/ton) |

||||

|

areas |

Gasoline model |

Price 12.29 |

Price 1.2 |

rise and fall |

|

in North China |

92# |

8430-9600 |

8430-9600 |

0/0 |

|

95# |

8630-9900 |

8630-9900 |

0/0 |

|

|

South China |

92# |

8700-9450 |

8700-9450 |

0/0 |

|

95# |

8900-9750 |

8900-9750 |

0/0 |

|

|

central China |

92# |

8650-9050 |

8650-9050 |

0/0 |

|

95# |

8850-9350 |

8850-9350 |

0/0 |

|

|

East China |

92# |

8500-8890 |

8500-8990 |

0/100 |

|

95# |

8570-9100 |

8570-9200 |

0/100 |

|

|

northwestern region |

92# |

8550-9600 |

8550-9600 |

0/0 |

|

95# |

8750-9860 |

8750-9860 |

0/0 |

|

|

southwestern region |

92# |

8850-9200 |

8800-9200 |

-50/0 |

|

95# |

9050-9650 |

9000-9650 |

-50/0 |

|

|

Northeast China |

92# |

8400-8950 |

8480-8950 |

80/0 |

|

95# |

8650-9600 |

8650-9600 |

0/0 |

|

|

Ex-factory price of local gasoline refining on January 2 (yuan/ton) |

||||

|

areas |

Gasoline model |

Price 12.29 |

Price 1.2 |

rise and fall |

|

Shandong area |

92# |

8230-8650 |

8300-8620 |

70/-30 |

|

95# |

8330-8810 |

8400-8780 |

70/-30 |

|

|

in North China |

92# |

8340-8400 |

8420-8450 |

80/50 |

|

95# |

8440-8450 |

8500-8520 |

50/70 |

|

|

central China |

92# |

8700-8700 |

8750-8750 |

50/50 |

|

95# |

8900-8900 |

8950-8950 |

50/50 |

|

|

East China |

92# |

8300-8570 |

8300-8540 |

0/-30 |

|

95# |

8420-8700 |

8420-8670 |

0/-30 |

|

|

northwestern region |

92# |

8250-8650 |

8250-8650 |

0/0 |

|

95# |

8500-8850 |

8500-8850 |

0/0 |

|

|

Northeast China |

92# |

8300-8380 |

8300-8380 |

0/0 |

|

95# |

8500-8500 |

8500-8500 |

0/0 |

|

|

southwestern region |

92# |

8800-8800 |

8800-8800 |

0/0 |

|

95# |

8950-8950 |

8950-8950 |

0/0 |

|

market outlook

From the perspective of international crude oil, the international crude oil market is closed overnight and there is no settlement price. At present, geopolitical tensions continue to attract undiminished attention. Coupled with the increase in production in some industrial countries, the market supply side is relatively loose. In the future, we will pay more attention to changes in the crude oil side. From the perspective of the Chinese market, there is a need for replenishment operations in the market after the holiday, and the demand for gasoline is still supported. In addition, a new round of retail price increases is about to begin, and the news is good for guidance. At the same time, the main units are highly willing to bid. Overall, it is expected that there will be upward expectations in the Chinese gasoline market in the short term.