- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC futures analysis: December 25th V2405 contract opening price: 6084, highest price: 6140, lowest price: 6064, position: 669030, settlement price: 6105, yesterday settlement: 6077, up: 28, daily trading volume: 866917 lots, precipitated capital: 2.938 billion, capital inflow: 84.06 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 12.22 |

Price 12.25 |

Rise and fall |

Remarks |

|

North China |

5630-5670 |

5640-5680 |

10/10 |

Send to cash remittance |

|

East China |

5750-5850 |

5800-5860 |

50/10 |

Cash out of the warehouse |

|

South China |

5780-5880 |

5810-5900 |

30/20 |

Cash out of the warehouse |

|

Northeast China |

5550-5800 |

5600-5800 |

50/0 |

Send to cash remittance |

|

Central China |

5720-5750 |

5730-5770 |

10/20 |

Send to cash remittance |

|

Southwest |

5600-5740 |

5640-5740 |

40/0 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction price atmosphere is good, the price shows a small upward trend at the beginning of the week. Valuation comparison: 10 yuan / ton in North China, 10-50 yuan / ton in East China, 20-30 yuan / ton in South China, 50 yuan / ton in Northeast China, 10-20 yuan / ton in Central China, and 40 yuan / ton in Southwest China. Most of the ex-factory prices of upstream PVC production enterprises remain stable, and there is no obvious adjustment today. The operating high point of the futures price is too strong to continue to break through, and the price offer of traders in the spot market in the morning is higher than that of last Friday, and the high price has no great reference significance. After the futures price went up, the supply advantage of the point price disappeared, and the basis changed little. Among them, East China basis offer 05 contract-(220-280-320), South China 05 contract-(150-220), North 05 contract-(620) Southwest 05 contract-(300). Although the two quotations coexist, the transaction atmosphere in the spot market is light, and the actual transaction is dominated by negotiation. The downstream procurement is not positive and the wait-and-see intention is obvious.

Futures point of view: & the nbsp; PVC2405 contract opened slightly volatile on Friday night and rose slightly in late trading. After the start of morning trading, futures prices rose slightly in a straight line, with a new high of 6153 at one point, but then prices fell and gave up some of the gains in late afternoon trading. 2405 contracts range from 6074 to 6153 throughout the day, with a price spread of 79. 05 contracts with an increase of 17452 positions and 686482 positions so far. The 2401 contract closed at 5893, with 102872 positions.

PVC Future Forecast:

Futures: PVC2405 contract futures operating high point showed a slight breakthrough on the track, and refreshed last week's operating high, the disk price effectively stabilized the 6100 position, the afternoon futures price did not fall below this position. At the close of midday, the main contracts of Chinese futures were up and down, but the overall performance of the plasticizing plate was strong, and PVC also followed an upward trend. During the weekend, the cracking workshop of an olefin plant in Zibo, Shandong Province caught fire, and the market may be more inclined to ferment with the help of this event. The current fundamentals and macro level of PVC have not changed much, but the operation of the current futures price is slightly stronger. As a whole, the operation of futures prices in the short term continues to observe the performance of the high range of 6100-6150.

Spot: spot prices in the two markets showed a slight upward trend at the beginning of the week, although prices rose, but the spot market transaction was not good, there were not many contracts signed on Monday, and all parties in the market had a heavy wait-and-see mentality, especially downstream products enterprises relatively resistant to high prices, mainly in the early days of bargain replenishment. At present, the fundamentals of PVC are impressive, although there is a small breakthrough in the disk with the help of unexpected events, considering that there is no obvious positive support for its own PVC, so the performance in the high range may still need to be observed. However, according to past experience, the changes in the two markets caused by emotion go far beyond the fundamentals. Therefore, if the futures price continues to effectively step on the 6100 mark, the medium-term market may be worth looking forward to. On the outer disk, oil prices fell before the Christmas holiday, as Angola's oil production is expected to increase after its withdrawal from OPEC. On the whole, the PVC spot market may continue the trend of small consolidation in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 12.22 |

Price 12.25 |

Rate of change |

|

V2401 collection |

6094 |

6114 |

20 |

|

|

Average spot price in East China |

5800 |

5830 |

30 |

|

|

Average spot price in South China |

5830 |

5855 |

25 |

|

|

PVC2401 basis difference |

-294 |

-284 |

10 |

|

|

V2405 collection |

6181 |

6214 |

33 |

|

|

V2401-2405 closed |

-87 |

-100 |

-13 |

|

|

PP2401 collection |

7624 |

7627 |

3 |

|

|

Plastic L2401 collection |

8240 |

8288 |

48 |

|

|

V--PP basis difference |

-1530 |

-1513 |

17 |

|

|

Vmure-L basis difference of plastics |

-2146 |

-2174 |

-28 |

|

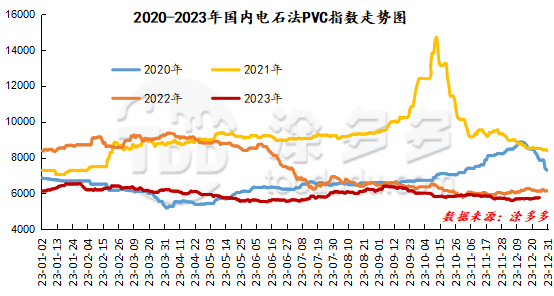

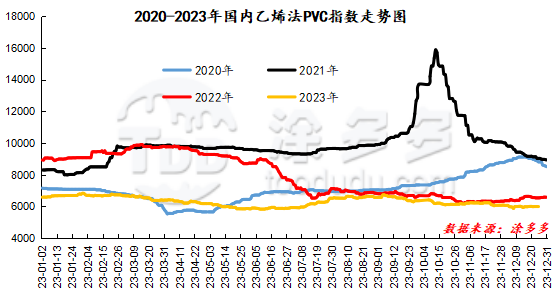

China PVC Index: according to Tudou data, the China calcium Carbide PVC spot Index rose 21.71, or 0.378%, to 5769.96 on December 25. The ethylene PVC spot index was 5995.6, down 1.23, with a range of 0.021%. The calcium carbide index rose, the ethylene index decreased, and the ethylene-calcium carbide index spread was 225.64.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

12.22 warehouse orders |

12.25 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

2,245 |

2,245 |

0 |

|

|

Guangzhou materials |

963 |

963 |

0 |

|

|

China Central Reserve Nanjing |

1,282 |

1,282 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

584 |

584 |

0 |

|

|

Zhenjiang Middle and far Sea |

584 |

584 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

4,806 |

4,806 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

2,813 |

2,813 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

3,607 |

3,607 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

18,994 |

19,494 |

500 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

3,495 |

3,495 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

470 |

470 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,322 |

3,322 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

687 |

687 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

50,121 |

50,621 |

500 |

|

Total |

|

50,121 |

50,621 |

500 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.