- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

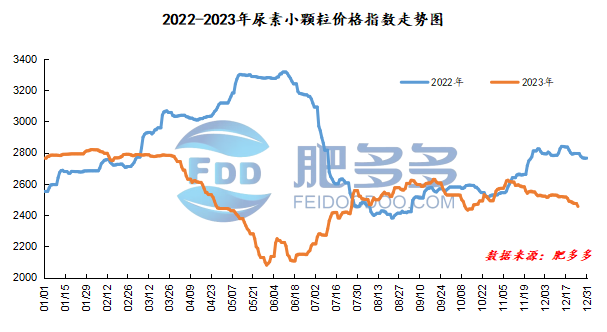

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on December 25 was 2,455.59, a decrease of 18.95 from last Friday, a month-on-month decrease of 0.77% and a year-on-year decrease of 12.14%.

Urea futures market:

Today, the opening price of the Urea UR405 contract is 2119, the highest price is 2119, the lowest price is 2074, the settlement price is 2092, and the closing price is 2079. The closing price is 87 lower than the settlement price of the previous trading day, down 4.02% month-on-month. The fluctuation range of the whole day is 2074-2119; the basis of the 05 contract in Shandong is 301; the 05 contract has increased its position by 26218 lots today, and the position held so far is 184,100 lots.

Spot market analysis:

Today, the price of urea in China's market has been significantly lowered, and companies in various regions have obvious willingness to accept orders. Quotes have generally declined, with reductions ranging from 10 to 50 yuan/ton.

Specifically, prices in Northeast China fell to 2,450 - 2,510 yuan/ton. Prices in North China fell to 2,220 - 2,510 yuan/ton. Prices in the northwest region are stable at 2,410 - 2,420 yuan/ton. Prices in Southwest China are stable at 2,450 - 2,800 yuan/ton. Prices in East China fell to 2,350 - 2,410 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,340 - 2,580 yuan/ton, and the price of large particles fell to 2,410 - 2,500 yuan/ton. Prices in South China fell to 2,510 - 2,550 yuan/ton.

Market outlook forecast:

In terms of factories, the factory is supported by a small number of pending orders, which are gradually reduced. Some mainstream regional enterprises are taking orders, and the price reduction is obvious, but the actual volume of orders is limited. In terms of the market, after a round of price reductions, market transactions have improved, but the actual enthusiasm for downstream procurement has not been significantly improved, and the current market atmosphere is still flat. On the supply side, recent high-profile companies have stopped their operations one after another, and the market supply has continued to shrink. Although there is a certain positive support on the supply side, it has not affected the slow pace of entry into the market for procurement, and a small amount has been followed up downstream. On the demand side, the overall demand is relatively limited, and downstream factories follow up in a small number, and their mentality is still cautious.

On the whole, the current urea market price lacks obvious upward factors, and the downstream wait-and-see attitude remains unchanged. It is expected that the urea market price will continue to maintain a stable and downward consolidation in the short term.