- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

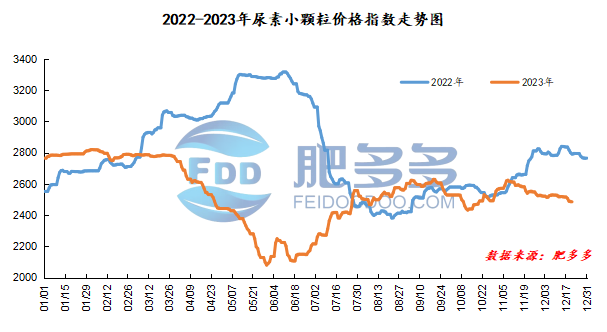

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on December 21 was 2,479.55, a decrease of 5.91 from yesterday, a month-on-month decrease of 0.24% and a year-on-year decrease of 11.17%.

Urea futures market:

Today, the opening price of the Urea UR405 contract is 2158, the highest price is 2175, the lowest price is 2130, the settlement price is 2154, and the closing price is 2160. The closing price is 4.4% lower than the settlement price of the previous trading day, down 0.18% month-on-month. The fluctuation range of the whole day is 2130-2175; the basis of the 05 contract in Shandong is 280; the 05 contract has increased its position by 1525 lots today, and so far, it has held 155,400 lots.

Spot market analysis:

Today, China's urea market prices continue to be weak and downward, companies have received average orders, market transactions are weak, and downstream mentality continues to be cautious.

Specifically, prices in Northeast China fell to 2,470 - 2,510 yuan/ton. Prices in North China fell to 2,260 - 2,510 yuan/ton. Prices in the northwest region are stable at 2,410 - 2,420 yuan/ton. Prices in Southwest China are stable at 2,450 - 2,800 yuan/ton. Prices in East China fell to 2,410 - 2,470 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,380 - 2,600 yuan/ton, and the price of large particles fell to 2,440 - 2,600 yuan/ton. Prices in South China fell to 2,530 - 2,620 yuan/ton.

Market outlook forecast:

In terms of factories, manufacturers currently have few orders, insufficient follow-up on new orders, and prices continue to be consolidated downward. In terms of the market, market purchasing enthusiasm continues to be weak, trading is flat, and transaction prices have dropped. On the supply side, installations were stopped one after another this week, and the daily output dropped. However, the company's order acquisition situation was poor. In addition, transportation in some areas was affected by rain and snow, and the company's inventory was slightly accumulated. On the demand side, downstream replenishment continues to continue to purchase small quantities on dips, and the demand side is still slow to start. In terms of printing and labeling, India today released a new round of urea import tenders. This round of bidding ends on January 4, 2024 and is valid until January 15, 2024. The latest shipping date is February 29, 2024. Based on the current Chinese urea market The price is higher than the international market price and supported by China's policy of ensuring supply and stabilizing prices, it is expected that this printing and labeling will not be a key benefit.

On the whole, the current urea market mentality is pessimistic, downstream follow-up is insufficient, and the market has no obvious positive support. It is expected that there will still be room for downward pressure in the urea market price in the short term.