- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

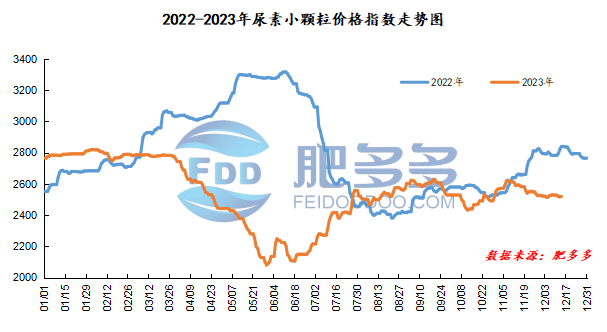

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on December 14 was 2,518.32, a decrease of 0.91 from yesterday, a month-on-month decrease of 0.04% and a year-on-year decrease of 11.34%.

Urea futures market:

Today, the opening price of the Urea UR405 contract is 2272, the highest price is 2284, the lowest price is 2213, the settlement price is 2239, and the closing price is 2219. The closing price is down 51 compared with the settlement price of the previous trading day, down 2.25% month-on-month. The fluctuation range of the whole day is 2213-2284; the basis of the 05 contract in Shandong is 261; the 05 contract has increased its position by 2138 lots today, with 140,400 lots held so far.

Spot market analysis:

Today, China's urea prices fell slightly, with a small overall change. The prices of most manufacturers were stable and the market was temporarily firm.

Specifically, prices in Northeast China have stabilized at 2,500 - 2,530 yuan/ton. Prices in North China fell to 2,310 - 2,540 yuan/ton. Prices in the northwest region are stable at 2,460 - 2,470 yuan/ton. Prices in Southwest China are stable at 2,480 - 2,800 yuan/ton. Prices in East China rose to 2,450 - 2,510 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,440 - 2,650 yuan/ton, and the price of large particles fell to 2,540 - 2,660 yuan/ton. Prices in South China are stable at 2,590 - 2,640 yuan/ton.

Market outlook forecast:

In terms of factories, after a round of slight price increases yesterday, the factory's orders were not satisfactory. The current prices are mostly stable. The quotations of a small number of manufacturers continue to increase, and some manufacturers 'prices are tested and accepted orders. The overall company's orders are lower than last week. There has been a decline. In terms of the market, due to the impact of rain and snow this week, transportation and shipment are not smooth, and the market is not enthusiastic about purchasing. Currently, most of them are mainly wait-and-see. In terms of supply, the number of urea plant overhauls this week has decreased compared with last week. The overall operating rate and daily production have increased slightly. The current market supply is relatively sufficient. On the demand side, downstream purchases are mostly on dips and mostly on the wait-and-see basis. Under the influence of the increase in corporate inventories, companies are more cautious in replenishing stocks.

On the whole, the wait-and-see attitude of urea industry operators remains unabated. They are replenishing stocks at bargain prices, and it is difficult to deal at high prices. It is expected that urea market prices will continue to remain stable in the short term.