- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC futures analysis: December 5th V2401 contract opening price: 5722, highest price: 5732, lowest price: 5653, position: 766130, settlement price: 5688, yesterday settlement: 5770, down: 82, daily trading volume: 785733 lots, precipitated capital: 3.041 billion, capital outflow: 22.19 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 12.4 |

Price 12.5 |

Rise and fall |

Remarks |

|

North China |

5580-5640 |

5530-5600 |

-50/-40 |

Send to cash remittance |

|

East China |

5600-5700 |

5550-5650 |

-50/-50 |

Cash out of the warehouse |

|

South China |

5700-5770 |

5620-5700 |

-80/-70 |

Cash out of the warehouse |

|

Northeast China |

5500-5700 |

5500-5650 |

0/-50 |

Send to cash remittance |

|

Central China |

5630-5650 |

5600-5620 |

-30/-30 |

Send to cash remittance |

|

Southwest |

5500-5650 |

5450-5600 |

-50/-50 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction prices continue to decline, market sentiment continues to run poorly. Compared with the valuation, it fell by 40-50 yuan / ton in North China, 50 yuan / ton in East China, 70-80 yuan / ton in South China, 50 yuan / ton in Northeast China, 30 yuan / ton in Central China and 50 yuan / ton in Southwest China. Upstream PVC production enterprise factory price reduction of 50-100 yuan / ton, yesterday did not reduce the quotation of enterprises fell sharply today. The spot market atmosphere is weak, after the futures price continues to appear low, the spot market trader offers lower than yesterday, the price center of gravity continues to move down, the transaction is mainly point price. The basis is slightly stronger, including East China Base offer 01 contract-(50-100-140), South China 01 contract-(0-20-70) good fans + 30, North 01 contract-(310-370), Southwest 01 contract-(200). On the whole, in the spot market, where the price is on the high side, there is no advantage in the spot market. Most of the goods are shipped at point prices, and the downstream replenishment purchasing enthusiasm has been improved.

Futures point of view: PVC2401 contract night trading opened slightly volatile, began to weaken and fall below the 5700 mark. After the start of morning trading, futures continued to fluctuate at low levels, and afternoon prices rose slightly but were not strong enough or even unable to exceed the night highs, and afternoon prices returned to weak lows. 2401 contracts range from 5653 to 5732 throughout the day, with a price spread of 79. 01 contracts with an increase of 886 positions and 766130 positions so far. The 2405 contract closed at 5867, with 334605 positions.

PVC Future Forecast:

Futures: & the operating low of the nbsp; PVC2401 contract price continues to refresh and approaches the low position before the main contract, and the operation of the futures price is relatively narrow but mainly low. In terms of transaction, the gap is 24.9% compared with 22.5% more. The technical level shows that the Bollinger belt (13, 13, 2) three tracks are obvious downward, the daily KD line and MACD line continue to show a dead fork trend, and the distance between the two lines expands. At present, it still shows a short trend, with the main Chinese futures contract floating green in large areas at midday, lithium carbonate down the limit, down 7%, the Container Index (European line), live pigs down more than 4%, and industrial silicon, stainless steel (SS) and Shanghai nickel down nearly 4%. Overall, in the short term, the operation of futures prices will continue to test the previous low of 5596 of the main company.

Spot aspect: First of all, the sentiment of Chinese commodities is slightly on the negative side, with most commodities falling mainly. After entering December, commodities began to gradually usher in the shift of positions and months. Under the current empty state, there is a greater pressure on bulls and speculative demand. The supply of PVC fundamentals is temporarily stable, and the start-up load of chlor-alkali plants in production enterprises is maintained in the early stage, but there is no additional demand except rigid demand on the demand side, and there is also less news about exports recently. It is difficult to support and stimulate. On the one hand, the contract is still dominated by short sellers, on the other hand, the corresponding spot market also shows obvious off-season characteristics. Therefore, although some industrial chains are faced with the queuing of production enterprises and the lack of inventory in the factory area, the greater demand shackles still make the operation of the two cities weak. International oil prices fell as traders took a wait-and-see attitude to OPEC's decision to cut production further in the first quarter of next year. In addition, fears of falling oil demand are also a drag on oil prices. On the whole, the low and weak operation of the PVC spot market continues in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 12.4 |

Price 12.5 |

Rate of change |

|

V2401 collection |

5719 |

5671 |

-48 |

|

|

Average spot price in East China |

5650 |

5600 |

-50 |

|

|

Average spot price in South China |

5735 |

5660 |

-75 |

|

|

PVC2401 basis difference |

-69 |

-71 |

-2 |

|

|

V2405 collection |

5906 |

5867 |

-39 |

|

|

V2401-2405 closed |

-187 |

-196 |

-9 |

|

|

PP2401 collection |

7360 |

7381 |

21 |

|

|

Plastic L2401 collection |

7856 |

7894 |

38 |

|

|

V--PP basis difference |

-1641 |

-1710 |

-69 |

|

|

Vmure-L basis difference of plastics |

-2137 |

-2223 |

-86 |

|

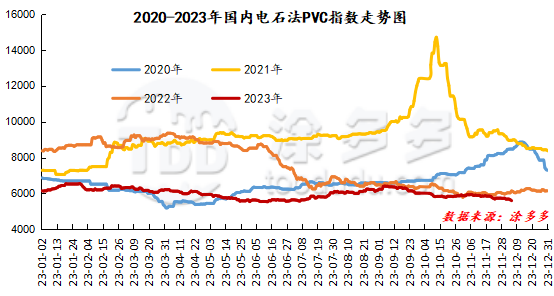

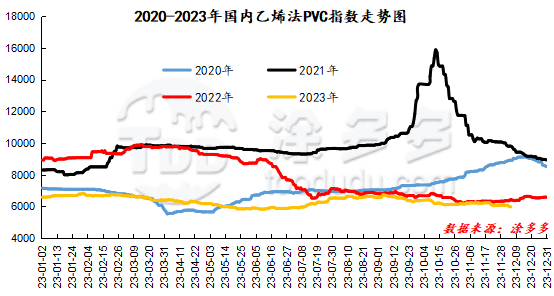

China PVC Index: according to Tuduoduo data, China calcium Carbide PVC spot Index fell 50.48, or 0.894%, to 5598.97 on December 5. The ethylene PVC spot index was 5979.98, down 9.23, or 0.154%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 381.01.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

12.4 warehouse orders |

12.5 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

1,423 |

1,423 |

0 |

|

|

Guangzhou materials |

441 |

441 |

0 |

|

|

China Central Reserve Nanjing |

982 |

982 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

549 |

549 |

0 |

|

|

Zhenjiang Middle and far Sea |

549 |

549 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

3,356 |

3,356 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,843 |

1,843 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

2,809 |

2,809 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

13,846 |

14,528 |

682 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

2,944 |

2,944 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

180 |

180 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,142 |

3,142 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

307 |

307 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

39,497 |

40,179 |

682 |

|

Total |

|

39,497 |

40,179 |

682 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.