- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

1. Carbon black market analysis

Today, the price of carbon black in China has risen within a narrow range supported by cost. As of now, the mainstream price of N330 in the carbon black market is 8,400 - 9,400 yuan/ton.

Cost: Today, China's high-temperature coal tar market prices are operating smoothly. As the price of coal fed into the furnace continues to rise, the losses of coke companies have expanded, the overall enthusiasm for production has weakened, and the supply of coal tar is tight, temporarily supporting the coal tar market to maintain prices and provide certain support for the cost of carbon black.

Supply: The carbon black industry's inventory digestion is obvious, and some models of carbon black have experienced slow delivery and difficult ordering.

On the demand side: Due to the reduction in the burden of individual companies, the overall capacity utilization rate of all-steel tire enterprises has declined slightly, while the capacity utilization rate of semi-steel tire enterprises has continued to be stable.

2. Carbon black market price

|

Carbon black market price on November 27 |

|||||

|

specifications |

market |

November 24 |

November 27 |

rise and fall |

units |

|

N330 |

Shanxi |

8200-8600 |

8400-8800 |

200/200 |

Yuan/ton |

|

Hebei |

8900-9200 |

9100-9400 |

200/200 |

Yuan/ton |

|

|

Guangzhou |

8700-9000 |

8900-9200 |

200/200 |

Yuan/ton |

|

|

Shandong |

8400-8800 |

8600-9000 |

200/200 |

Yuan/ton |

|

|

Zhejiang |

8600-8900 |

8800-9100 |

200/200 |

Yuan/ton |

|

|

Henan |

8900-9200 |

9100-9400 |

200/200 |

Yuan/ton |

|

|

N220 |

Shanxi |

9500-9800 |

9700-10000 |

200/200 |

Yuan/ton |

|

Hebei |

10400-10700 |

10600-10900 |

200/200 |

Yuan/ton |

|

|

Guangzhou |

9800-10100 |

10000-10300 |

200/200 |

Yuan/ton |

|

|

Shandong |

9600-9900 |

9800-10100 |

200/200 |

Yuan/ton |

|

|

Zhejiang |

9700-10000 |

9900-10200 |

200/200 |

Yuan/ton |

|

|

Henan |

10400-10700 |

10600-10900 |

200/200 |

Yuan/ton |

|

|

N550 |

Shanxi |

8600-9000 |

8800-9200 |

200/200 |

Yuan/ton |

|

Hebei |

9100-9400 |

9300-9600 |

200/200 |

Yuan/ton |

|

|

Guangzhou |

9000-9300 |

9200-9500 |

200/200 |

Yuan/ton |

|

|

Shandong |

8700-9100 |

8900-9300 |

200/200 |

Yuan/ton |

|

|

Zhejiang |

8900-9200 |

9100-9400 |

200/200 |

Yuan/ton |

|

|

Henan |

9100-9400 |

9300-9600 |

200/200 |

Yuan/ton |

|

|

N660 |

Shanxi |

8200-8600 |

8400-8800 |

200/200 |

Yuan/ton |

|

Hebei |

8900-9200 |

9100-9400 |

200/200 |

Yuan/ton |

|

|

Guangzhou |

8700-9000 |

8900-9200 |

200/200 |

Yuan/ton |

|

|

Shandong |

8400-8800 |

8600-9000 |

200/200 |

Yuan/ton |

|

|

Zhejiang |

8600-8900 |

8800-9100 |

200/200 |

Yuan/ton |

|

|

Henan |

8900-9200 |

9100-9400 |

200/200 |

Yuan/ton |

|

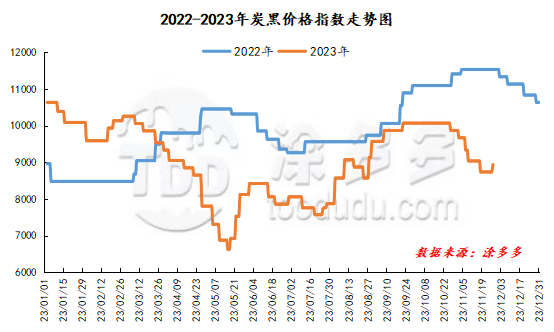

3. Carbon black index analysis

According to Tdd-global's data, the carbon black price index on November 27 was 8,938.25, an increase of 200 yuan/ton from the previous working day, or an increase of 2.29%.

4. market outlook

In the short term, the market price of raw coal tar has a slight room for increase, which supports or strengthens the cost of carbon black; in the case of a sluggish market, the terminal tire industry has to take more goods into the market to maintain demand, and the on-site trading atmosphere is relatively cold. It is expected that the carbon black market will operate smoothly in the short term.