- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

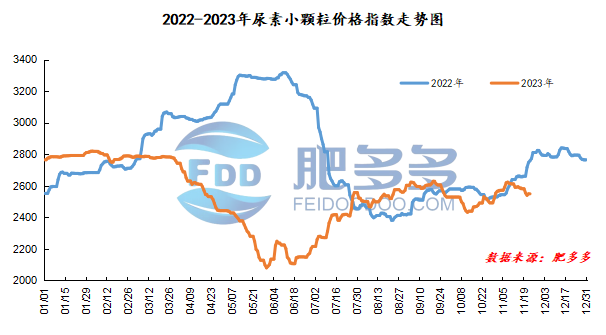

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on November 23 was 2,553.45, up 4.09 from yesterday, up 0.16% month-on-month, and down 7.45% year-on-year.

Urea futures market:

Today, the opening price of the Urea UR2401 contract is 2332, the highest price is 2332, the lowest price is 2291, the settlement price is 2313, and the closing price is 2309. The closing price is down 8 compared with the settlement price of the previous trading day, down 0.35% month-on-month. The fluctuation range of the whole day is 2291-2332; the basis of the 01 contract in Shandong is 151; the 01 contract has reduced its position by 11727 lots today, and so far, it has held 235000 lots.

Spot market analysis:

Today, China's urea prices are stable and slightly adjusted. In the early stage, new orders in the market were well received. Manufacturers 'prices have gone up. Mainstream companies have sufficient orders and no pressure on sales. At present, new orders in the market are slowing down, and prices are under pressure, so more consolidation and operation are being carried out.

Specifically, prices in Northeast China have stabilized at 2,550 - 2,600 yuan/ton. Prices in North China rose to 2,340 - 2,610 yuan/ton. Prices in Northwest China rose to 2,510 - 2,520 yuan/ton. Prices in Southwest China are stable at 2,520 - 2,800 yuan/ton. Prices in East China rose to 2,440 - 2,500 yuan/ton. The price of small and medium-sized particles in Central China has risen to 2,450 - 2,650 yuan/ton, and the price of large particles has stabilized at 2,580 - 2,660 yuan/ton. Prices in South China rose to 2,670 - 2,710 yuan/ton.

Market outlook forecast:

In terms of factories, most manufacturers have good orders and are currently well received. According to statistics, the number of days companies have received orders in advance so far is about 6.82 days. Without obvious sales pressure, factory quotations are mostly firm. In terms of supply, gas head companies are facing maintenance expectations. Some gas head companies in Northwest, Southwest, and Inner Mongolia have maintenance expectations at the end of this month and next month, and supply may continue to decline. Currently, the industry's average daily output is about 178,200 tons, and the operating rate is about 80.08%. Nissan starts continue to remain high. In terms of the market, the trading atmosphere on the floor is gradually improving, and the transaction of new orders from factories is also showing signs of improvement. Orders have been closed well in the past two days. In order to control orders receiving, prices are currently recovering and rising. On the demand side, downstream and traders have appropriately followed up on purchases, and market activity has increased. However, with the current rebound in prices, downstream enthusiasm for receiving goods has declined, and we will wait and see for the moment.

On the whole, although the downstream willingness to buy in the urea market is not high, there is still room for a slight increase in prices under the expectation of production reduction in gas-head equipment. It is expected that the urea market price will continue to continue a slight upward consolidation in the short term.