- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

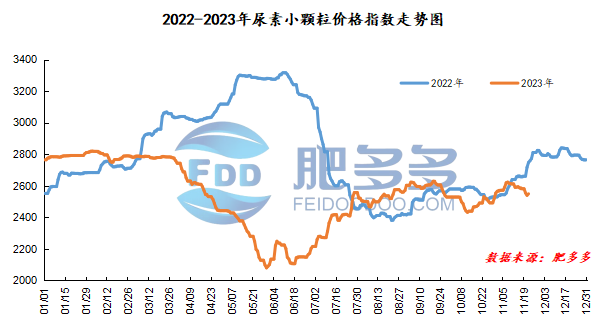

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on November 22 was 2,549.36, up 9.36 from yesterday, up 0.37% month-on-month, and down 7.23% year-on-year.

Urea futures market:

Today, the opening price of the Urea UR2401 contract is 2320, the highest price is 2346, the lowest price is 2285, the settlement price is 2317, and the closing price is 2333. The closing price is up 35 compared with the settlement price of the previous trading day, up 1.52% month-on-month. The daily fluctuation range is 2285-2346; the basis of the 01 contract in Shandong is 117; the 01 contract has reduced its position by 10261 lots today, and so far, it has held 246727 lots.

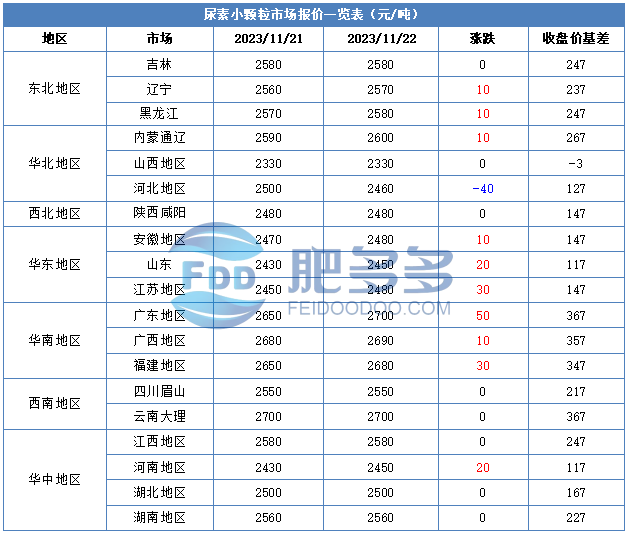

Spot market analysis:

Today, China's urea prices have stopped falling and rising. While new orders continue to be sold, companies tend to sort out their ex-factory quotations based on their own production and inventory conditions.

Specifically, prices in Northeast China have risen to 2,550 - 2,600 yuan/ton. Prices in North China rose to 2,330 - 2,610 yuan/ton. Prices in the northwest region are stable at 2,480 - 2,490 yuan/ton. Prices in Southwest China fell to 2,520 - 2,800 yuan/ton. Prices in East China rose to 2,430 - 2,490 yuan/ton. The price of small and medium-sized particles in Central China rose to 2,440 - 2,650 yuan/ton, and the price of large particles rose to 2,580 - 2,660 yuan/ton. Prices in South China rose to 2,660 - 2,710 yuan/ton.

Market outlook forecast:

In terms of enterprises, although enterprises have a large number of pending orders, some enterprises intend to accumulate stocks if they have maintenance plans in the future. This week, the increase in enterprises 'inventory increased by 21.43% month-on-month. On the supply side, supply is expected to reduce production. Maintenance losses of coal-to-urea have decreased, and maintenance losses of gas-to-urea have increased slightly. It is expected that the number of parking of gas-to-urea will increase at the end of the month. Specific attention needs to be paid to the parking dynamics of gas-to-head enterprises. In terms of the market, after the factory lowered its quotation at the beginning of the week, its willingness to deal at a low price has increased, and orders have been well received in the past two days. Currently, prices have rebounded and risen; the external market has been affected by low-price supplies in the early period, and market transactions continue to be weak. On the demand side, downstream purchasing sentiment is relatively cautious, and actual trading is mainly follow-up on demand. The market mentality is unstable, and the industry mentality is mostly cautious.

On the whole, companies are currently interested in class libraries, restricting collection at high prices, and downstream demand is gradually following up. However, the overall market mentality is relatively stable and procurement is cautious. It is expected that the urea market price will continue to fluctuate and consolidate in a short period of time.