- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC futures analysis: November 22nd V2401 contract opening price: 5920, highest price: 5947, lowest price: 5874, position: 814395, settlement price: 5914, yesterday settlement: 5967, down: 53, daily trading volume: 716773 lots, precipitated capital: 3.367 billion, capital inflow: 8.47 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 11.21 |

Price 11.22 |

Rise and fall |

Remarks |

|

North China |

5650-5720 |

5630-5690 |

-20/-30 |

Send to cash remittance |

|

East China |

5750-5870 |

5720-5820 |

-30/-50 |

Cash out of the warehouse |

|

South China |

5780-5880 |

5710-5830 |

-70/-50 |

Cash out of the warehouse |

|

Northeast China |

5650-5820 |

5600-5770 |

-50/-50 |

Send to cash remittance |

|

Central China |

5760-5780 |

5730-5750 |

-30/-30 |

Send to cash remittance |

|

Southwest |

5650-5750 |

5600-5700 |

-50/-50 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction prices are mainly low and narrow finishing, some areas are still down. Compared with the valuation, it fell by 20-30 yuan / ton in North China, 30-50 yuan / ton in East China, 50-70 yuan / ton in South China, 50 yuan / ton in Northeast China, 30 yuan / ton in Central China and 50 yuan / ton in Southwest China. The ex-factory price of the upstream PVC production enterprises continues to be reduced by 30-50 yuan / ton, including the price quoted by the remote warehouse in East and South China, the futures price is weak and low, the offer mentality of the spot market merchants is not good, it is difficult to close the offer, and the price advantage of the basis offer is more obvious after the futures price goes down. among them, the base difference offer 01 contract in East China and 01 contract in South China North 01 contract-(470-530), southwest 01 contract-(300), the overall basis does not change much. But the downstream procurement enthusiasm is not high, some traders base quotation gradually moved to 05 contract, the overall market transaction point price is mainly, hanging order price is low, the spot market trading atmosphere is weak.

Futures point of view: PVC2401 contract night opening price narrow range low finishing, intraday volatility direction is unknown. After the start of morning trading, futures prices weakened slightly, but the overall decline was small. It continued to run low in the afternoon, and the price rose slightly in late trading. 2401 contracts range from 5874 to 5947 throughout the day, with a spread of 73. 01 contracts with an increase of 3285 positions and 814395 positions so far. The 2405 contract closed at 6100, with 187528 positions.

PVC Future Forecast:

Futures: PVC2401 contract low continued to break the track down, futures market refreshed the recent low and fell below the 5900 mark, the lowest point approaching the pre-October low. The trend of the futures price is in the second target range of the test as we expected. The technical level shows that the opening of the third rail of the Bolin belt (13,13,2) continues to expand, the middle and lower rails turn down obviously, and the KD line and MACD line at the daily level tend to expand. The price of the whole month is in line with our previous view of the month, and the judgment that there will still be a deep decline in the second ten days after the upsurge of 6200 in the first ten days of the month has been verified. In the short term, the operation of the futures market is still dominated by short sellers, the operation of futures prices or continue to test the low range, continue to observe the performance of the range of 5800-5900.

Spot: from the perspective of cultural index, the trend of PVC futures is more in line with this trend, in the overall commodity sentiment is more consistent, it is difficult for a single product to get out of a separate market. PVC also follows the overall commodity index to show some weakness. Most of the main Chinese futures contracts fell at midday. Lithium carbonate sealed the limit, down 6.98%, Shanghai nickel fell more than 3%, pulp, liquefied petroleum gas (LPG), glass, rubber, caustic soda, butadiene rubber (BR), 20 rubber (NR), PTA, Shanghai zinc fell more than 2%. And PVC spot market, weak fundamentals have always been unable to support the two market prices, although Formosa plastic prices upward but can not form a pull, the other variables are few, the PVC spot market is obviously restricted by demand. On the whole, the price operation of the spot market is still under pressure in the short term, and it is still dominated by low weakness.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 11.21 |

Price 11.22 |

Rate of change |

|

V2401 collection |

5915 |

5906 |

-9 |

|

|

Average spot price in East China |

5810 |

5770 |

-40 |

|

|

Average spot price in South China |

5830 |

5770 |

-60 |

|

|

PVC2401 basis difference |

-105 |

-136 |

-31 |

|

|

V2405 collection |

6108 |

6100 |

-8 |

|

|

V2401-2405 closed |

-193 |

-194 |

-1 |

|

|

PP2401 collection |

7516 |

7503 |

-13 |

|

|

Plastic L2401 collection |

7966 |

7928 |

-38 |

|

|

V--PP basis difference |

-1601 |

-1597 |

4 |

|

|

Vmure-L basis difference of plastics |

-2051 |

-2022 |

29 |

|

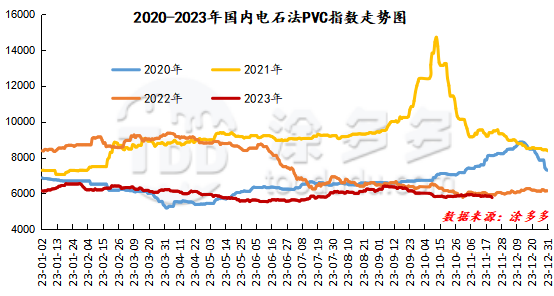

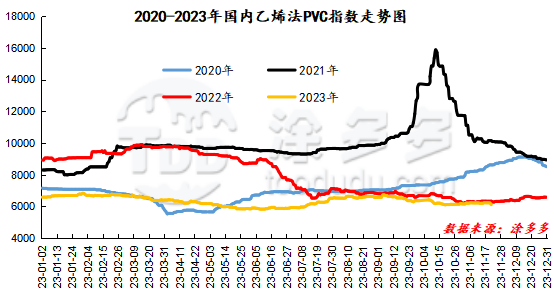

China PVC Index: according to Tuduoduo data, the spot index of China calcium Carbide PVC was 5727.57, down 41.59, or 0.721%. The ethylene PVC spot index was 6097.68, down 18.02, or 0.295%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 370.11.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

11.21 warehouse receipts |

11.22 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

1,383 |

1,423 |

40 |

|

|

Guangzhou materials |

441 |

441 |

0 |

|

|

China Central Reserve Nanjing |

942 |

982 |

40 |

|

Polyvinyl chloride |

Cosco sea logistics |

417 |

417 |

0 |

|

|

Zhenjiang Middle and far Sea |

417 |

417 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

3,256 |

3,256 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,843 |

1,843 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

2,690 |

2,760 |

70 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

12,922 |

12,922 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

2,944 |

2,944 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

180 |

180 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,142 |

3,142 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

307 |

307 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

38,182 |

38,292 |

110 |

|

Total |

|

38,182 |

38,292 |

110 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.