- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

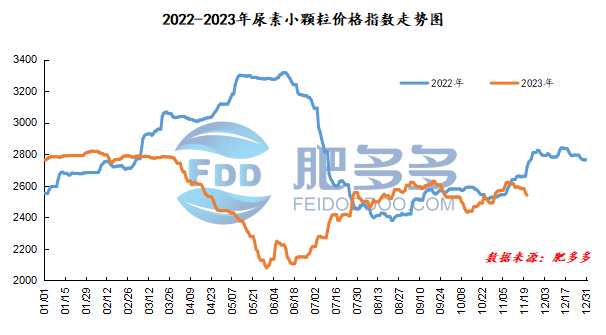

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on November 21 was 2,540.00, down 14.68 from yesterday, down 0.57% month-on-month, and down 6.52% year-on-year.

Urea futures market:

Today, the opening price of the Urea UR2401 contract is 2291, the highest price is 2323, the lowest price is 2264, the settlement price is 2298, and the closing price is 2301. The closing price is 25% higher than the settlement price of the previous trading day, and the month-on-month increase is 1.10%. The fluctuation range of the whole day is 2264-2323; the basis of the 01 contract in Shandong is 129; the 01 contract has increased its position by 1434 lots today, and so far, it has held 256988 lots.

Spot market analysis:

Today, China's urea prices show regional growth, with prices rising and falling in various places being consolidated. Low market prices in the early stage have brought about a slight increase in demand. Market inquiries are better, low-end transactions have increased, and companies are holding prices.

Specifically, prices in Northeast China fell to 2,540 - 2,590 yuan/ton. Prices in North China fell to 2,330 - 2,600 yuan/ton. Prices in Northwest China fell to 2,480 - 2,490 yuan/ton. Prices in Southwest China are stable at 2,550 - 2,800 yuan/ton. Prices in East China rose to 2,410 - 2,470 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,420 - 2,640 yuan/ton, and the price of large particles fell to 2,560 - 2,660 yuan/ton. Prices in South China fell to 2,630 - 2,690 yuan/ton.

Market outlook forecast:

In terms of enterprises, manufacturers are supported by orders to be issued in the early stage and are willing to hold prices. However, when market transactions are slightly sluggish, companies often adjust their ex-factory prices based on their own levels. Currently, market prices are mixed, and most of them are regional. In terms of supply, although some units are currently temporarily suspended for maintenance, the overall operating rate in the market still maintains a high level. In the later period, there will still be parking companies, and the operating rate is expected to decline. The specific operating rate still needs to pay attention to the parking situation of enterprises. In terms of the market, the market is expected to increase in overall prices with the support of policies to ensure supply and stabilize prices. In terms of demand, we are currently in the off-season for agricultural demand, and most of the market is mainly based on reserves. Most operators replenish stocks on dips. Market delivery in some areas is better, and reserve demand is relatively scattered; in terms of industrial demand, demand for compound fertilizers has increased, and new winter reserve fertilizers have been followed up one after another, and preliminary orders are also in the process of being shipped one after another. The demand for urea has increased, and prices have formed support.

On the whole, the market operation is relatively stable in the short term, lacking effective positive support, and it is difficult for prices to continue to rise. It is expected that the urea market price will be weak and consolidated in the short term.