- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

1. Carbon black market analysis

Today, China's carbon black market is operating smoothly. As of now, the mainstream price of N330 in the carbon black market is 8,200 - 9,200 yuan/ton.

Cost: Today, China's high-temperature coal tar market is on the sidelines. Coal tar prices have created a certain bottom-up phenomenon. Downstream deep processing companies have resumed work one after another, their intention to purchase goods has increased significantly, and the overall market atmosphere has warmed up. However, the loss situation of deep processing companies is difficult to change, and the coal tar market has insufficient momentum to rebound. Currently, the cost of carbon black support is still weak.

Supply: Today, some carbon black companies have maintained a high starting level, while most other carbon black companies have relatively stable starting loads.

On the demand side: The price of carbon black raw materials has declined, the cost of tire production has decreased, the downstream market has a bearish attitude towards prices, and traders have reduced their enthusiasm for purchasing without being out of stock.

2. Carbon black market price

|

Carbon black market price on November 20 |

|||||

|

specifications |

market |

November 17 |

November 20 |

rise and fall |

units |

|

N330 |

Shanxi |

8200-8600 |

8200-8600 |

0 |

Yuan/ton |

|

Hebei |

8900-9200 |

8900-9200 |

0 |

Yuan/ton |

|

|

Guangzhou |

8700-9000 |

8700-9000 |

0 |

Yuan/ton |

|

|

Shandong |

8400-8800 |

8400-8800 |

0 |

Yuan/ton |

|

|

Zhejiang |

8600-8900 |

8600-8900 |

0 |

Yuan/ton |

|

|

Henan |

8900-9200 |

8900-9200 |

0 |

Yuan/ton |

|

|

N220 |

Shanxi |

9500-9800 |

9500-9800 |

0 |

Yuan/ton |

|

Hebei |

10400-10700 |

10400-10700 |

0 |

Yuan/ton |

|

|

Guangzhou |

9800-10100 |

9800-10100 |

0 |

Yuan/ton |

|

|

Shandong |

9600-9900 |

9600-9900 |

0 |

Yuan/ton |

|

|

Zhejiang |

9700-10000 |

9700-10000 |

0 |

Yuan/ton |

|

|

Henan |

10400-10700 |

10400-10700 |

0 |

Yuan/ton |

|

|

N550 |

Shanxi |

8600-9000 |

8600-9000 |

0 |

Yuan/ton |

|

Hebei |

9100-9400 |

9100-9400 |

0 |

Yuan/ton |

|

|

Guangzhou |

9000-9300 |

9000-9300 |

0 |

Yuan/ton |

|

|

Shandong |

8700-9100 |

8700-9100 |

0 |

Yuan/ton |

|

|

Zhejiang |

8900-9200 |

8900-9200 |

0 |

Yuan/ton |

|

|

Henan |

9100-9400 |

9100-9400 |

0 |

Yuan/ton |

|

|

N660 |

Shanxi |

8200-8600 |

8200-8600 |

0 |

Yuan/ton |

|

Hebei |

8900-9200 |

8900-9200 |

0 |

Yuan/ton |

|

|

Guangzhou |

8700-9000 |

8700-9000 |

0 |

Yuan/ton |

|

|

Shandong |

8400-8800 |

8400-8800 |

0 |

Yuan/ton |

|

|

Zhejiang |

8600-8900 |

8600-8900 |

0 |

Yuan/ton |

|

|

Henan |

8900-9200 |

8900-9200 |

0 |

Yuan/ton |

|

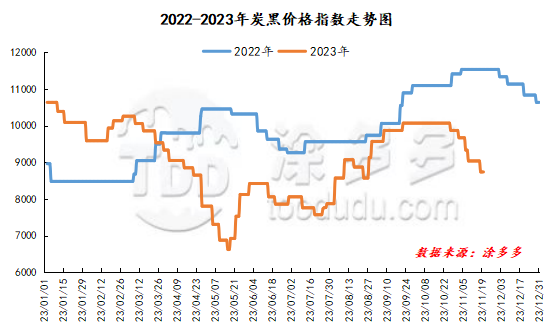

3. Carbon black index analysis

According to Tdd-global's data, the carbon black price index on November 20 was 8,738.25, which was the same as the previous working day.

4. market outlook

In the short term, the raw coal tar market is operating in turmoil, and its support for carbon black costs is weak; the demand in the downstream tire and rubber industries has not improved significantly, and the performance of companies in receiving goods has been flat. The market wait-and-see atmosphere is strong. It is expected that the carbon black market will be weak in the short term.