- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

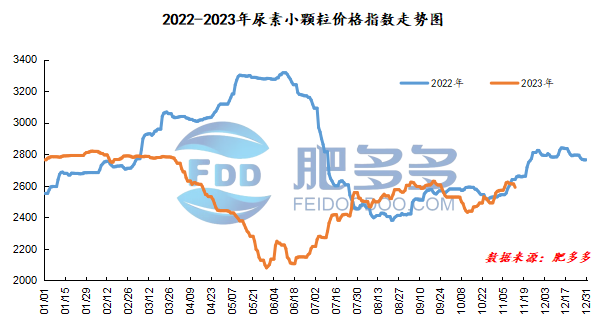

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on November 13 was 2,590.59, down 21.36 from last Friday, down 0.82% month-on-month, and down 1.87% year-on-year.

Urea futures market:

Today, the opening price of the Urea UR2401 contract is 2345, the highest price is 2395, the lowest price is 2341, the settlement price is 2369, and the closing price is 2364. The closing price is down 21 compared with the settlement price of the previous trading day, down 0.88% month-on-month. The fluctuation range of the whole day is 2341-2395; the basis of the 01 contract in Shandong is 116; the 01 contract has reduced its position by 3934 lots today, and so far, it has held 307172 lots.

Spot market analysis:

Today, China's urea prices weakened downward, and the market trading atmosphere weakened. Most factories slightly lowered their ex-factory quotations, but the reduction was limited with the support of cost and readiness.

Specifically, prices in Northeast China fell to 2,590 - 2,660 yuan/ton. Prices in North China fell to 2,350 - 2,680 yuan/ton. Prices in the northwest region have stabilized at 2,610 - 2,620 yuan/ton. Prices in Southwest China are stable at 2,550 - 2,800 yuan/ton. Prices in East China fell to 2,460 - 2,520 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,500 - 2,660 yuan/ton, and the price of large particles fell to 2,610 - 2,730 yuan/ton. Prices in South China have stabilized at 2,680 - 2,760 yuan/ton.

Market outlook forecast:

On the supply side, some enterprises temporarily parked their installations, coupled with environmental protection and production restrictions in Jincheng, Shanxi, have led to a slight decrease in the operating rate. However, Nissan remains high. In terms of inventory, corporate inventories remain low, social inventories are not high, and supply and demand remain relatively tight. In terms of manufacturers, most urea manufacturers have relatively sufficient advance orders, and there is no pressure to collect orders. Supported by low inventories, the factory quotation has not been significantly adjusted yet, but the focus of transactions has shifted down within a narrow range. In terms of the market, traders are more cautious and are not willing to pick goods. In addition, export expectations have also weakened, and the market trading atmosphere is weak. On the demand side, weak reserves and industrial demand still exists. Affected by the news, operators have a wait-and-see mentality. In terms of industrial demand, the start-up of compound fertilizers has increased slightly, and the demand for urea has increased; in terms of agricultural demand, short storage companies have entered the inspection period this month, and the demand for replenishment still exists.

On the whole, the current market support is weak, downstream needs to follow up slowly, and there is still room for price reduction. It is expected that the urea market price will be mainly weak and downward in the short term.