- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

1. Anthracene Oil Market Analysis

This week, China's anthracene oil market prices fluctuated downward. As of now, the market price in Shandong is 4,750 - 4,800 yuan/ton. This week, the decline in raw coal tar has widened, and the cost side is strong, which is negative for the market; the focus of real orders in the carbon black market has shifted downward, and the pressure on raw materials has been obvious, and the receipt volume has dropped significantly; this week, oil prices have continued to decline, and anthracene oil hydrogenation companies have been more cautious in receiving goods; The buying atmosphere in the downstream market is sluggish, with low purchases being the main choice, and the implementation of real orders on the market has been slow. Negative factors dominate the market. Although cost prices have declined, the loss situation of anthracene oil companies is difficult to change, and the anthracene oil market is expected to operate weakly in the short term.

2. Comparison of market prices of anthracene oil

|

Comparison of anthracene oil market prices this week |

||||

|

market |

November 2 |

November 9 |

Weekly ups and downs |

units |

|

Shandong |

5000-5100 |

4750-4800 |

-250/-300 |

Yuan/ton |

|

Henan |

4700-4750 |

4700-4750 |

0 |

Yuan/ton |

|

Shanxi |

4650-4700 |

4600-4700 |

-50/0 |

Yuan/ton |

|

Ningxia |

4500-4600 |

4400-4500 |

-100/-100 |

Yuan/ton |

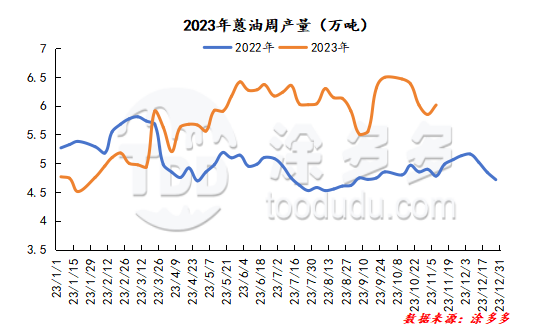

3. Weekly output of anthracene oil

This week, the decline in coal tar widened, the production pressure of anthracene oil companies decreased, the company's loss situation eased, and the operating rate increased slightly. The weekly output of anthracene oil increased compared with last week. This week's output was 60.12 million tons, an increase from last week. 1.63 million tons.

4. Deep processing operating rate

The effective production capacity this week is about 23.6 million tons, of which 300,000 tons in North China, 300,000 tons in Northwest China, and 150,000 tons in Southwest China have completed maintenance. Some enterprises in other regions have also stopped maintenance, driving the operating rate of deep processing to increase slightly this week. At present, the operating rate of deep processing enterprises is 46.51%, up 5.3% from last week.