- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC futures analysis: November 7 V2401 contract opening price: 6180, highest price: 6180, lowest price: 6102, position: 791200, settlement price: 6139, yesterday settlement: 6169, down: 30, daily trading volume: 900065 lots, precipitated capital: 3.384 billion, capital outflow: 36.45 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 11.6 |

Price 11.7 |

Rise and fall |

Remarks |

|

North China |

5850-5900 |

5830-5870 |

-20/-30 |

Send to cash remittance |

|

East China |

5990-6050 |

5950-5980 |

-40/-70 |

Cash out of the warehouse |

|

South China |

5980-6020 |

5950-6020 |

-30/0 |

Cash out of the warehouse |

|

Northeast China |

5750-5950 |

5750-5950 |

0/0 |

Send to cash remittance |

|

Central China |

5900-5920 |

5880-5900 |

-20/-20 |

Send to cash remittance |

|

Southwest |

5750-5900 |

5750-5900 |

0/0 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction prices narrow adjustment, some areas showed a decline. Compared with the valuation, it fell by 20-30 yuan / ton in North China, 40-70 yuan / ton in East China, 30 yuan / ton in South China, stable in Northeast China, 20 yuan / ton in Central China and stable in Southwest China. Upstream PVC production enterprises factory price part of the reduction of 20-50 yuan / ton, stable prices in some areas wait and see to digest inventory. The operation of the futures market is weaker, the price of the spot market in the morning is lower than that of yesterday, and the downward range is more obvious in the afternoon. There is almost no transaction on the high side of the offer, and the basis does not change much. Among them, the base difference offer 01 contract in East China-(150-200), South China 01 contract-(100-150), North 01 contract-(500-550), Southwest 01 contract-(300). On the whole, there is still resistance in the spot market transaction, the supply is not digested smoothly, the actual transaction is mainly low price, part of the real price has a small negotiation, the overall spot market trading is limited.

From the futures point of view: PVC2401 contracts open high and low at night, and there is greater pressure on the high price of the futures. Early prices also fluctuated in a narrow range on the basis of night trading, the direction of volatility narrowed, and prices weakened again in late afternoon trading. 2401 contracts range from 6102 to 6180 throughout the day, with a spread of 78. 01. The contract increased its position by 536 hands, and so far it has held 791200 positions. The 2405 contract closed at 6247, with 125406 positions.

PVC Future Forecast:

Futures: There were two slight signs of weakening in the night trading and late afternoon trading of PVC2401 contract prices. Trading volume was 24.4% higher than short opening 21.7%, but the corresponding Duoping increased, of which Duoping 26.1% vs. empty 22.4%. In the market with continuous slightly stronger operation, the operating pressure level of futures was obvious at 6200, which also led to short-term long-term closing of hot money. Therefore, today's market shows the state of increasing the position first and then closing the position. The technical level shows that the third track of the Bolin belt (13,13,2) narrows obviously. The upside of futures prices may have come to an end. The current macro guidance is not strong, in the short term, the operation of the futures price to observe the performance near the rail support level 6080.

Spot aspect: & the weakening of the narrow range of nbsp; futures prices at the end of the day has increased the activity of spot price enquiries in the spot market, and the regional basis has recently expanded, but the actual transaction is not ideal. Chlor-alkali production enterprises still tend to the current spot digestion inventory, and the recent reduction in caustic soda profits is obvious, some enterprises have the psychology of PVC. Downstream products enterprises in the mainstream consumer areas are feedback on the current underemployment, especially pipe enterprises, due to poor real estate demand, resulting in fewer orders for products enterprises, so as the main PVC downstream consumer industry demand for raw materials is not good, which is also the fundamental reason that restricts the current two cities of PVC. However, under the recent changes in futures prices, when the upside has not effectively exceeded 6200, the recent slightly biased futures price operation also gives certain hedging opportunities to the spot market. On the whole, the operation of the spot market may be slightly weak in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 11.6 |

Price 11.7 |

Rate of change |

|

V2401 collection |

6180 |

6110 |

-70 |

|

|

Average spot price in East China |

6020 |

5965 |

-55 |

|

|

Average spot price in South China |

6000 |

5985 |

-15 |

|

|

PVC2401 basis difference |

-160 |

-145 |

15 |

|

|

V2405 collection |

6297 |

6247 |

-50 |

|

|

V2401-2405 closed |

-117 |

-137 |

-20 |

|

|

PP2401 collection |

7729 |

7694 |

-35 |

|

|

Plastic L2401 collection |

8229 |

8181 |

-48 |

|

|

V--PP basis difference |

-1549 |

-1584 |

-35 |

|

|

Vmure-L basis difference of plastics |

-2049 |

-2071 |

-22 |

|

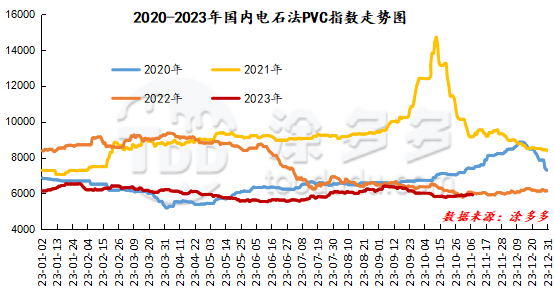

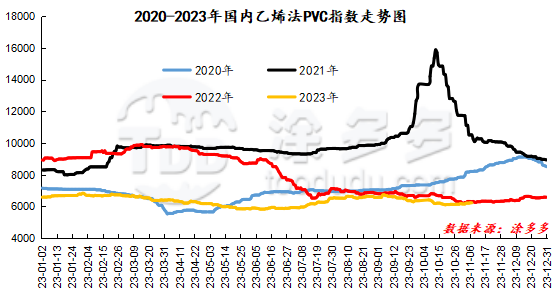

China PVC Index: according to Tuduoduo data, the spot index of China calcium Carbide PVC fell 27.36 or 0.46% to 5976.18 on Nov. 7. The ethylene method PVC spot index was 6231.05, down 2.31, the range was 0.037%, the calcium carbide method index decreased, the ethylene method index dropped, and the ethylene-calcium carbide index spread was 314.27.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

11.6 warehouse orders |

11.7 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

843 |

1,143 |

300 |

|

|

Guangzhou materials |

441 |

441 |

0 |

|

|

China Central Reserve Nanjing |

402 |

702 |

300 |

|

Polyvinyl chloride |

Cosco sea logistics |

351 |

351 |

0 |

|

|

Zhenjiang Middle and far Sea |

351 |

351 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

2,417 |

2,937 |

520 |

|

Polyvinyl chloride |

Peak supply chain |

1,343 |

1,343 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,350 |

1,350 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

10,444 |

10,607 |

163 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

2,584 |

2,584 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,162 |

3,162 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

274 |

274 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

31,986 |

32,969 |

983 |

|

Total |

|

31,986 |

32,969 |

983 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.