- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

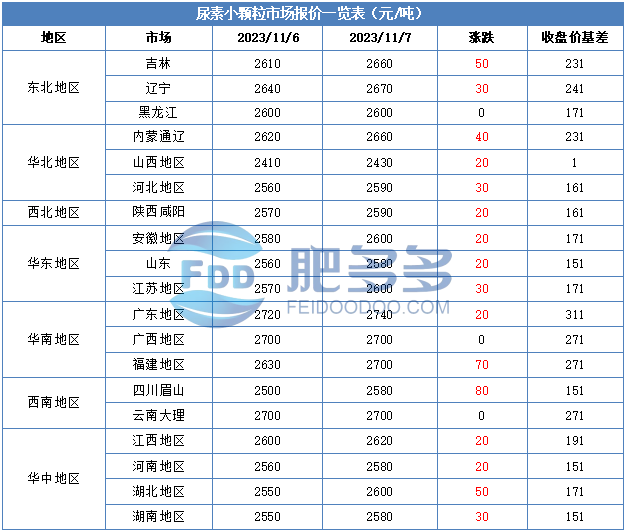

China Urea Price Index:

According to calculations from Feiduo data, the urea small pellet price index on November 7 was 2,619.68, up 28.18 from yesterday, up 1.09% month-on-month, and up 2.59% year-on-year.

Urea futures market:

Today, the opening price of the Urea UR2401 contract is 2423, the highest price is 2485, the lowest price is 2406, the settlement price is 2448, and the closing price is 2429. The closing price is up 31 compared with the settlement price of the previous trading day, up 1.29% month-on-month. The fluctuation range of the whole day is 2406-2485; the basis of the 01 contract in Shandong is 151; the 01 contract has reduced its position by 21318 lots today, and so far, it has held 367650 lots.

Spot market analysis:

Today, China's urea prices continue to rise, and the increase has not yet slowed down. Currently, with the support of waiting, companies are less willing to transfer profits, and prices have been increased and consolidated.

Specifically, prices in Northeast China rose to 2,590 - 2,680 yuan/ton. Prices in North China rose to 2,430 - 2,680 yuan/ton. Prices in the northwest region rose to 2,590 - 2,600 yuan/ton. Prices in Southwest China are stable at 2,550 - 2,800 yuan/ton. Prices in East China rose to 2,560 - 2,610 yuan/ton. The price of small and medium-sized particles in Central China rose to 2,560 - 2,730 yuan/ton, and the price of large particles rose to 2,570 - 2,730 yuan/ton. Prices in South China rose to 2,680 - 2,750 yuan/ton.

Market outlook forecast:

On the supply side, there are currently an increase in factory equipment maintenance failures, Nissan has dropped, and corporate inventories continue to operate at a low level. In addition, Shanxi Jincheng's environmental protection and production restriction policy and natural gas restrictions starting this month have become two strong influencing factors on the supply side, which have a greater impact on the current supply. In terms of manufacturers, most manufacturers have no intention of transferring profits supported by advance orders in the early stage. The quotations are operating firmly, with stable and small increases. On the market side, with the recent rise in futures prices, the market atmosphere has improved significantly. The positive situation has simultaneously affected the spot market, and the market inquiry atmosphere has been active. On the demand side, downstream traders are actively following up on purchases. In addition, short storage companies have entered the inspection period this month, and there is still a gap in reserve supplies and have to enter the market to purchase. The market needs still exist; the operating rate of industrial demand compound fertilizers remains low, but with the gradual start of compound fertilizer companies in the Northeast market, it is expected that the operating rate of the compound fertilizer industry will gradually increase and the demand for urea will increase.

On the whole, the market price is currently at a high level, transactions have slowed down, and manufacturers 'transactions have been slightly deadlocked. However, manufacturers are bullish with the support of waiting to go, and it is expected that there will still be room for upward adjustment in the urea market price in the short term.