- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC futures analysis: November 1st V2401 contract opening price: 6090, highest price: 6111, lowest price: 6055, position: 836498, settlement price: 6085, yesterday settlement: 6064, up: 21, daily trading volume: 818988 lots, precipitated capital: 3.572 billion, capital outflow: 87.88 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 10.31 |

Price 11.1 |

Rise and fall |

Remarks |

|

North China |

5770-5850 |

5780-5840 |

10/-10 |

Send to cash remittance |

|

East China |

5880-5950 |

5910-5970 |

30/20 |

Cash out of the warehouse |

|

South China |

5940-5980 |

5920-5960 |

-20/-20 |

Cash out of the warehouse |

|

Northeast China |

5700-5900 |

5700-5900 |

0/0 |

Send to cash remittance |

|

Central China |

5870-5890 |

5870-5890 |

0/0 |

Send to cash remittance |

|

Southwest |

5650-5800 |

5650-5800 |

0/0 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction price narrow adjustment, trading lukewarm. Compared with the valuation, the low-end price in North China rose 10 yuan / ton, the high-end price fell 10 yuan / ton, East China rose 20-30 yuan / ton, South China fell 20 yuan / ton, and Northeast, Central China and Southwest China were stable. Upstream PVC production enterprises mostly maintain stable ex-factory prices, individual enterprises to stimulate shipments slightly reduced by 30 yuan / ton. Futures are still running in a narrow range and slightly stronger, and the spot market offers in various regions are slightly adjusted, with little change as a whole, and quotations in some areas have risen slightly. The price and spot price market coexist, and some of the supply bases are weakening, including East China basis offer 01 contract-(130-150), South China 01 contract-(100), North 01 contract-(500), Southwest 01 contract-(300). Although the two quotations coexist, the transaction is generally poor in various regions, and the resistance to the high price transaction is greater, the inquiry on the point price is also lack of sufficient enthusiasm, and the downstream wait-and-see intention is obvious.

Futures point of view: PVC2401 contract night trading is still adjusted in a narrow range, intraday price volatility is small. After the start of morning trading, the futures price rose slightly, breaking through 6100, but the high point did not continue to break through in this position, and the afternoon price was still dominated by consolidation. 2401 contracts range from 6055 to 6111 throughout the day, with a spread of 56. 01. The contract reduced its positions by 21989 positions and has held 836497 positions so far. The 2405 contract closed at 6218, with 111198 positions.

PVC Future Forecast:

Futures: & the operation of nbsp; PVC2401 contract prices continues to adjust horizontally and narrowly, and the high range is within the range of 6100-6150 as we expected. The market still shows a state of substantial reduction, and since the recent departure of high positions, on the one hand, due to the relatively narrow adjustment of futures prices, speculative warehouse receipts are unable to show a better profit space no matter how short they are. on the other hand, the current incentives from fundamentals and policy aspects are insufficient, and the volatility of futures prices is also lack of sufficient direction. The technical level shows that the opening of the three tracks of the Bolin belt (13, 13, 2) is upward, and there is a trend of intersection between the KD lines at the daily level. We continue to maintain our previous judgment and continue to observe the performance in the range of 6100-6150.

Spot aspect: & the narrow adjustment of nbsp; futures price makes the spot market transaction light, terminal products enterprises in addition to rigid demand replenishment, there is no larger intention to sell goods, in addition to narrow consolidation of the market so that the spot market also lacks sufficient speculative demand, production enterprises and traders only maintain the basic delivery rhythm. At present, the basic variables of PVC are few, the supply side has been stable, and the small adjustment of operating rate can not shake the prices of the two cities. Weak and high inventory on the demand side has always been the consensus of the industry chain. Outer disk: international oil prices closed lower as concerns about possible supply disruptions caused by the Middle East conflict abated and data showed an increase in crude oil production by the Organization of Petroleum Exporting countries (OPEC) and the United States. On the whole, the trend of narrow adjustment in the spot market remains unchanged in the short term, waiting for new stimulus to emerge.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 10.31 |

Price 11.1 |

Rate of change |

|

V2401 collection |

6090 |

6100 |

10 |

|

|

Average spot price in East China |

5915 |

5940 |

25 |

|

|

Average spot price in South China |

5960 |

5940 |

-20 |

|

|

PVC2401 basis difference |

-175 |

-160 |

15 |

|

|

V2405 collection |

6201 |

6218 |

17 |

|

|

V2401-2405 closed |

-111 |

-118 |

-7 |

|

|

PP2401 collection |

7588 |

7614 |

26 |

|

|

Plastic L2401 collection |

8142 |

8160 |

18 |

|

|

V--PP basis difference |

-1498 |

-1514 |

-16 |

|

|

Vmure-L basis difference of plastics |

-2052 |

-2060 |

-8 |

|

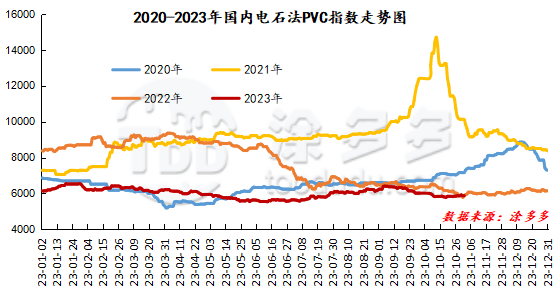

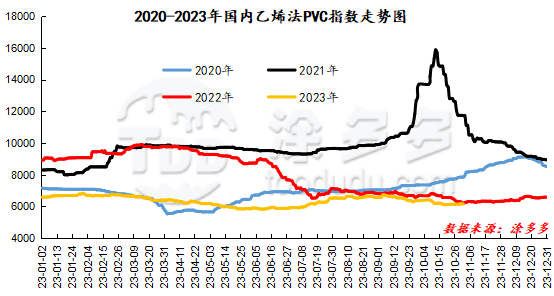

China PVC Index: according to Tuduoduo data, the spot index of China calcium Carbide PVC was 5877.86, up 3.05%, or 0.052%. The ethylene method PVC spot index was 6159.39, down 2.06%, with a range of 0.033%. The calcium carbide method index rose, the ethylene method index decreased, and the ethylene-calcium carbide index spread was 281.53.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

10.31 warehouse orders |

11.1 warehouse receipt quantity |

change |

|

Polyvinyl chloride |

China Reserve shares |

843 |

843 |

0 |

|

|

Guangzhou materials |

441 |

441 |

0 |

|

|

China Central Reserve Nanjing |

402 |

402 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

351 |

351 |

0 |

|

|

Zhenjiang Middle and far Sea |

351 |

351 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

2,417 |

2,417 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,343 |

1,343 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,350 |

1,350 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

9,474 |

9,474 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

1,844 |

1,844 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,162 |

3,162 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

274 |

274 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

30,276 |

30,276 |

0 |

|

Total |

|

30,276 |

30,276 |

0 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.

Original: Pei Zhongxue